1

ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to Nonresidents of Ohio –Issued

August 2007; Revised March 2009; Revised October 2011; Revised December 2013;

Revised January 2014; Revised February 2016; Revised June 2017; Revised October 2018.

(Archived)

This archived Information Release has been superseded by a later release. It is archived here for historical/reference purposes ONLY.

For the most current Information Releases, please refer to the main "Information Releases - Current Releases" index.

The purpose of this information release is to explain the application of Ohio sales and use tax to sales of motor vehicles by

Ohio motor vehicle dealers to nonresidents of Ohio (“Nonresidents”). This revision addresses Michigan’s trade-in

allowance for motor vehicles.

This change to Michigan’s law increases the phase-in of the trade-in allowance from $500

annually to $1000 annually until there is no limitation on the trade-in value beginning January 1, 2029. Therefore, effective

for sales beginning on or after January 1, 2019, an Ohio motor vehicle dealer selling to a Michigan resident should calculate

the tax due based on the specifically stated or modified trade-in allowance that is authorized to be collected in Michigan.

Additionally, beginning on January 18, 2018, unlike the modified trade in allowances on other motor vehicles discussed

above, Michigan allows an owner trading in a recreational vehicle, as defined under Michigan law, to utilize the full trade-

in allowance on the purchase of a new recreational vehicle from a vehicle dealer. In Michigan and Ohio, recreational

vehicles include items such as motor homes and travel trailers.

R.C. 5739.029 allows the imposition of Ohio sales tax on the purchase of motor vehicles by Nonresidents in certain cases.

That provision applies only to sales of motor vehicles to Nonresidents made on and after August 1, 2007. Leases to

Nonresidents continue to not be subject to sales tax.

To What Transactions Does R.C. 5739.029 Apply?

R.C. 5739.029 applies to all sales of motor vehicles by an Ohio motor vehicle dealer to a Nonresident who removes the

vehicle from Ohio to be titled, registered or used outside Ohio, whether in another state or in a foreign nation. This provision

does not affect the application of sales tax to motor vehicle purchases by Ohio residents. An Ohio resident must pay the

sales tax on a motor vehicle that will be titled in and used in Ohio. In addition, residents of most other states

1

will continue

to be exempt from Ohio sales tax on the purchase of motor vehicles in Ohio.

Currently, motor vehicle dealers are only required to collect sales tax on sales of motor vehicles to Nonresidents who will

remove the vehicle to one of these seven states--Arizona, California, Florida, Indiana

2

, Massachusetts, Michigan and South

Carolina.

How Is the Sales Tax Calculated?

The amount of sales tax to collect on sales of motor vehicles to Nonresidents who will remove the vehicle purchased to any

of the above seven states to be titled, registered or used is the lesser of the:

• Sales tax due to Ohio; or

• Amount of sales tax the Nonresident would pay in the state of titling, registration or use.

A trade-in allowance reduces the price of a new or used vehicle to Nonresident purchasers if allowed by the state to which

the vehicle will be removed. Rebates or other cash back offers paid by someone other than a dealer do not reduce the tax

base, except in South Carolina.

Here’s how to determine the tax due from Nonresidents who will remove the motor vehicle to one of the seven listed states:

1

R.C. 5739.029(G)(2) defines the term “state” for purposes of this statute to include states, districts, commonwealths, or territories of the United

States, such as the District of Columbia, U. S. Virgin Islands, Puerto Rico, and any province of Canada.

2

Note: Indiana provides an exemption for purchases of recreational vehicles and trailers with a load capacity of at least 2200 pounds by nonresidents

who remove the vehicle for titling outside Indiana. Therefore, sales of these types of vehicles by Ohio dealers to Nonresidents who will remove the

recreational vehicle or trailer to Indiana for titling, registration or use are not subject to Ohio sales tax.

2

1. Calculate the Ohio price of the vehicle under Ohio law, i.e., as you would for a sale to an Ohio resident, taking

into account the trade-in deduction if a new vehicle is purchased. The sales tax rate to apply to the Ohio price

is 6.0%.

2. Calculate the price in the applicable state taking into account the adjustments in the chart below, such as a trade-

in allowance, if permitted by the state, and apply the sales tax rate of the appropriate state listed in the chart

below. Please note that the sales tax rates listed in the chart below may be subject to change.

3. The lesser of the two amounts must be collected as the sales tax due from the customer.

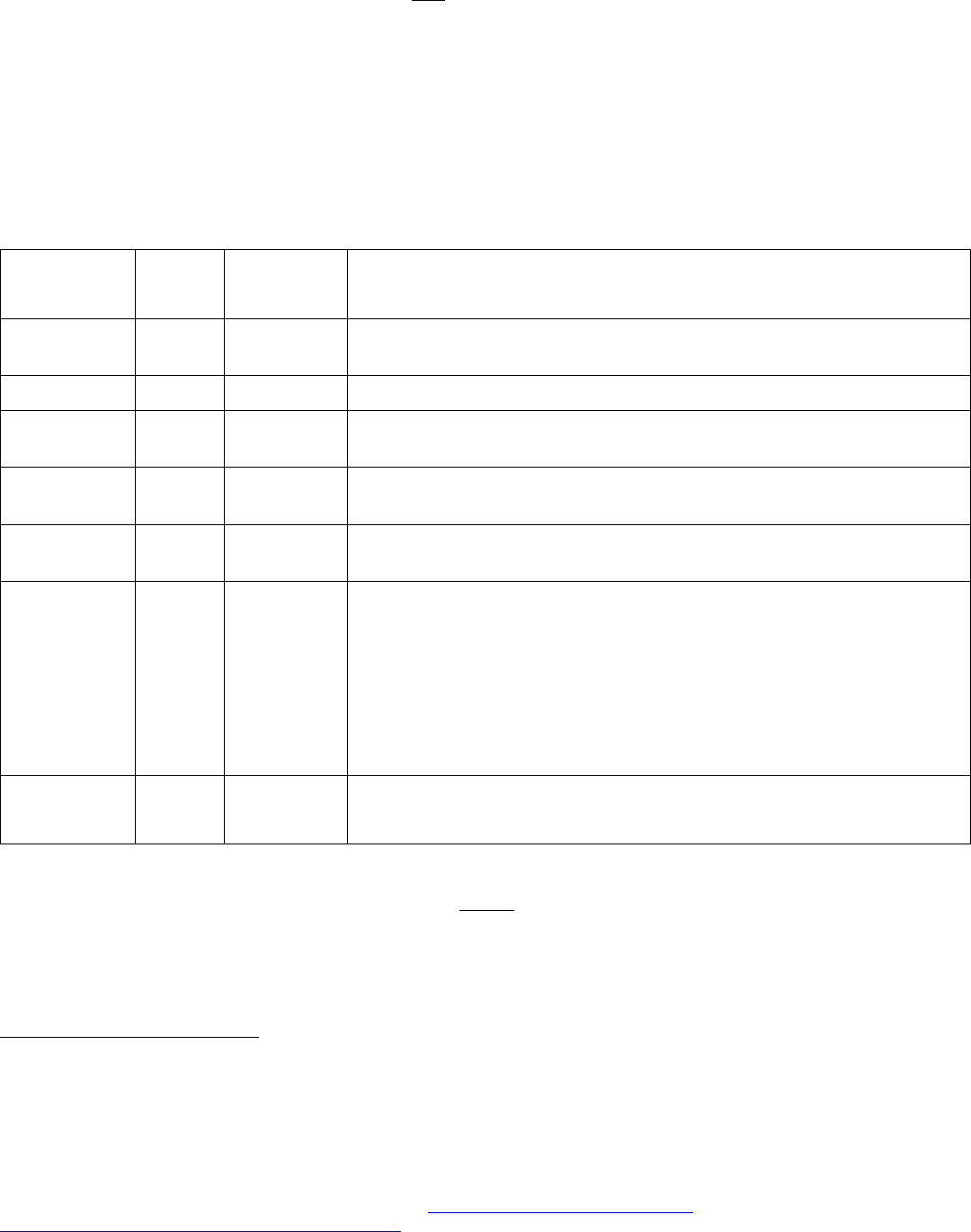

The following is the list of the states, applicable tax rate, and the adjustments required to determine the proper amount of

sales tax to collect:

State

Sales

Tax

Rate

Trade-In

Allowance

Special Provisions

Arizona

5.60%

3

Yes –New

and Used

California

7.5%

4

No

Florida

6.00%

Yes- New

and Used

Indiana

7.00%

Yes-New

and Used

Nonresident exemption for RVs and trailers with a load capacity of at least

2200 pounds

Massachusetts

6.25%

Yes-New

and Used

Michigan

6.00%

Yes – New

and Used

5

Initially, in 2013, up to $2,000 of the value of the motor vehicle being

traded-in could be used to reduce the price. That trade-in amount increases

annually by $500 beginning on January 1, 2015. However, beginning on

January 1, 2019, the trade-in amount is $5,000. Additionally, beginning on

January 1, 2020, that trade-in amount increases from $500 annually to

$1,000 annually until the amount of $14,000 is exceeded in 2029.

Beginning in 2029, there is no limitation on the trade-in that would reduce

the price.

South

Carolina

5.00%

6

Yes-New

and Used

Tax Cap

7

of $500.00 (Effective for sales on or after July 1, 2017)

Tax Cap of $300.00 (Effective for sales prior to July 1, 2017)

Sales to Nonresidents who remove the vehicle to any other state (including, on or after September 23, 2008, any province

of Canada) not listed above for titling, registration or use are not subject to Ohio sales tax, provided the proper affidavit is

completed by the purchaser and filed with the Clerk of Courts when application for title is made. The purchaser must

complete Form STEC-NR, Affidavit Regarding Sale of a Motor Vehicle, Off-Highway, Motorcycle, or All-Purpose Vehicle

to an Out-of-State Resident.

8

The affidavit requires the date of sale which is the date the customer pays for the vehicle, or

takes delivery, whichever comes first, the amount of sales tax collected on the sale, if any, and the trade-in amount.

3

The Arizona rate change was effective June 1, 2013.

4

The California rate change was effective January 1, 2013.

5

The Michigan trade-in allowance originally only applied to sales made by motor vehicle dealers licensed by the State of Michigan. However, in

January of 2016, the trade-in allowance became available to out-of-state dealers. The provision also had a retroactive application.

6

South Carolina raised the general sales tax rate to 6% effective June 1, 2007; however, the one-percent increase does not apply to maximum tax

purchases such as motor vehicles. S.C. Code § 12-36-1130.

7

Effective July 1, 2017, sales to Nonresidents who remove the vehicle to South Carolina for titling, registration or use, will remit no more than $500,

the maximum sales tax due on the purchase of a motor vehicle in that state.

8

Available on the Department of Taxation’s (“ODT”) Web site at http://tax.ohio.gov/documents/forms/fill-

in/sales_and_use/exemption_certificates/ST_STEC_NR_FI.pdf.

3

If the sale is to a Nonresident who will remove the vehicle purchased to any foreign country (except, on or after September

23, 2008, Canada) for titling, registration or use, the Ohio sales tax should be collected at six percent (6%) of the price of

the vehicle.

A sale to a Nonresident who will remove the vehicle purchased to one of the seven states where sales tax must be collected

may still qualify for exemption from the sales tax if a valid Ohio exemption exists. For example, a trucking company from

Michigan may claim an exemption for tangible personal property used in highway transportation for hire if they are carrying

goods belonging to others and hold a permit or certificate issued by the United States authorizing the holder to engage in

transportation of tangible personal property belonging to others for consideration over or on highways. If an exemption

applies, the purchaser must complete Form STEC-MV, Sales and Use Tax Certificate of Exemption Regarding Sale of a

Motor Vehicle, Off-Highway Motorcycle, or All-Purpose Vehicle.

9

Exemptions allowed in other states but not in Ohio do

not exempt the sale from Ohio sales tax.

Examples

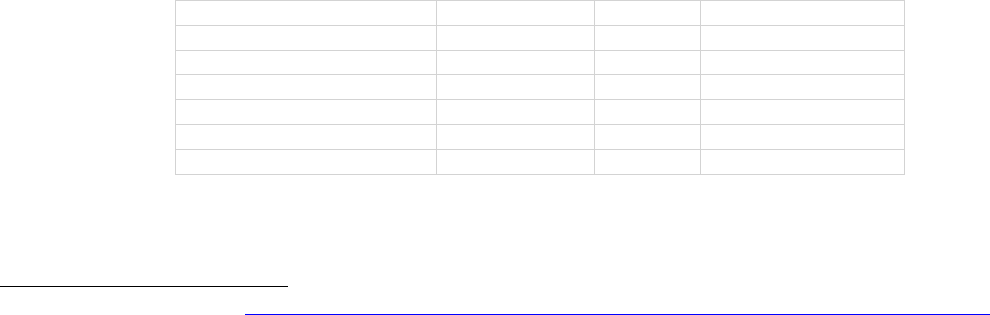

Example 1: An Indiana resident purchases a new vehicle from an Ohio dealer. There is no trade-in involved in the

transaction.

Ohio Calculation

Indiana Calculation

Purchase Price

$23,000.00

$23,000.00

Tax Rate

6.00%

7.00%

Calculated Tax

$1,380.00

$1,610.00

Tax to be Remitted to Ohio

$1,380.00

Example 2: A Florida resident purchases a new vehicle from an Ohio dealer. The customer has a trade-in.

Ohio Calculation

Florida Calculation

Purchase Price

$25,000.00

$25,000.00

Trade-In Allowance

$7,500.00

$7,500.00

Tax Base

$17,500.00

$17,500.00

Tax Rate

6.00%

6.00%

Calculated Tax

$1,050.00

$1,050.00

Tax to be Remitted to Ohio

$1,050.00

Example 3: A Michigan resident purchases a new vehicle from an Ohio dealer. The customer has a trade-in. Michigan’s

trade-in allowance is limited to $4,000 in 2018

10

($5,000 in 2019 and $6,000 in 2020) to an Ohio motor vehicle dealer’s sale

to a Michigan resident.

Ohio Calculation

Michigan Calculation

Purchase Price

$28,000.00

$28,000.00

Trade-In Allowance

$7,500.00

$4,000.00

Tax Base

$20,500.00

$24,000.00

Tax Rate

6.00%

6.00%

Calculated Tax

$1,230.00

$1,440.00

Tax to be Remitted to Ohio

$1,230.00

9

Available on ODT’s Web site at http://tax.ohio.gov/documents/forms/fill-in/sales_and_use/exemption_certificates/ST_STEC_MV_FI.pdf.

10

Initially, in 2013, up to $2,000 of the value of the motor vehicle being traded-in could be used to reduce the price. That trade-in amount increases

annually by $500 beginning on January 1, 2015. However, beginning on January 1, 2019, the trade-in amount is $5,000. Additionally, beginning on

January 1, 2020, that trade-in amount increases from $500 annually to $1,000 annually, until the amount of $14,000 is exceeded in 2029. Beginning

in 2029, there is no limitation on the trade-in that would reduce the price.

4

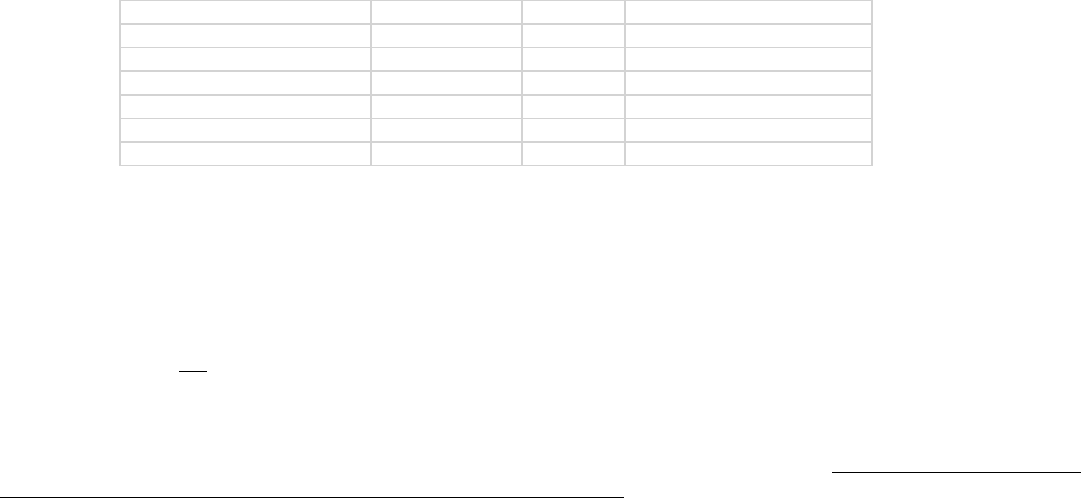

Example 4: A California resident purchases a new vehicle from an Ohio dealer. There is no trade-in involved in the

transaction.

Ohio Calculation

California Calculation

Purchase Price

$33,000.00

$33,000.00

Tax Rate

6.00%

7.50%

Calculated Tax

$1,980.00

$2,475.00

Tax to be Remitted to Ohio

$1,980.00

Note on Examples 1, 3 and 4. In these examples, the dealer will report and pay to Ohio a sales tax amount less than due in

the resident state. Upon return to his or her home state, the purchaser may owe additional sales or use tax to that state. The

Ohio dealer, at the request of the customer, may collect the full amount of sales tax due to both states for the transaction.

The bill of sale should separately list the sales tax amounts for the two states. When completing the application for an Ohio

title and the nonresident affidavit, the dealer should include only the Ohio sales tax collected and should remit that amount,

less discount, to the Clerk of Courts. Sales tax a dealer collects for another state must be remitted by the dealer to the

appropriate state according to that state’s law.

Example 5: An Indiana resident purchases a used vehicle from an Ohio dealer. The customer has a trade-in.

Ohio Calculation

Indiana Calculation

Purchase Price

$17,000.00

$17,000.00

Trade-In Allowance

$3,500.00

$3,500.00

Tax Base

$17,000.00

$13,500.00

Tax Rate

6.00%

7.00%

Calculated Tax

$1,020.00

$945.00

Tax to be Remitted to Ohio

$945.00

Example 6: A South Carolina resident purchases a new vehicle from an Ohio dealer after June 30, 2017. The customer has

a trade-in. South Carolina has a $500.00 cap on sales tax on the purchase of a motor vehicle.

Ohio Calculation

South Carolina Calculation

Purchase Price

$24,000.00

$24,000.00

Trade-In Allowance

$4,500.00

$4,500.00

Tax Base

$19,500.00

$19,500.00

Tax Rate

6.00%

5.00%

Calculated Tax

$1,170.00

$975.00

Tax to be Remitted to Ohio

$500.00

How Is the Tax Reported and Remitted to the Ohio?

The dealer must remit the sales tax to the Clerk of Courts at the time it applies for the Nonresident title.

What Impact Does This Have on Motor Vehicle Sales to Ohio Residents?

R.C. 5739.029 does not apply to any motor vehicle sale to an Ohio resident.

If an Ohio resident purchases a motor vehicle from an Ohio motor vehicle dealer and takes possession of the vehicle in

Ohio, the dealer must collect sales tax and remit it to the Clerk of Courts at the time the dealer obtains the title for the

vehicle. The Ohio sales tax must be paid based upon the purchaser’s county of residence. The purchaser’s subsequent

removal of the vehicle from Ohio does not affect the Ohio tax liability.

If an Ohio resident purchases a motor vehicle from an Ohio dealer and instructs the dealer to deliver the vehicle to a location

outside Ohio where the vehicle will subsequently be titled, registered or used, the dealer should complete a notarized Form

STEC IC, Statement Regarding Sale of a Motor Vehicle, Off-Highway Motorcycle, or All-Purpose Vehicle in Interstate

5

Commerce,

11

and present it to the Clerk of Courts. The dealer may then obtain an Ohio title without collection or payment

of the Ohio sales tax, as the sale will be a sale in interstate commerce.

Questions?

If you have any questions regarding this matter, please call 1-888-405-4039.

OHIO RELAY SERVICES FOR THE

HEARING OR SPEECH IMPAIRED

Phone: 1-800-750-0750

11

Available on ODT’s Web site at http://tax.ohio.gov/documents/forms/sales_and_use/exemption_certificates/ST_STEC_IC_FI.pdf.