CALIFORNIA STANDARD PRACTICE MANUAL

ECONOMIC ANALYSIS OF DEMAND-SIDE

PROGRAMS AND PROJECTS

OCTOBER 2001

1

Table of Contents

Page

Chapter 1 .............................................................................................................................. 1

Basic Methodology ............................................................................................................... 1

Background....................................................................................................................... 1

Demand-Side Management Categories and Program Definitions.......................................2

Basic Methods .................................................................................................................. 4

Balancing the Tests ........................................................................................................... 6

Limitations: Externality Values and Policy Rules.............................................................. 6

Externality Values............................................................................................................. 7

Policy Rules......................................................................................................................7

Chapter 2 .............................................................................................................................. 8

Participant Test ..................................................................................................................... 8

Definition.......................................................................................................................... 8

Benefits and Costs............................................................................................................. 8

How the Results Can be Expressed....................................................................................9

Strengths of the Participant Test........................................................................................ 9

Weaknesses of the Participant Test.................................................................................. 10

Formulae......................................................................................................................... 10

Chapter 3 ............................................................................................................................ 13

The Ratepayer Impact Measure Test ................................................................................... 13

Definition........................................................................................................................ 13

Benefits and Costs........................................................................................................... 13

How the Results can be Expressed .................................................................................. 13

Strengths of the Ratepayer Impact Measure (RIM) Test .................................................. 14

Weaknesses of the Ratepayer Impact Measure (RIM) Test .............................................. 15

Chapter 4 ............................................................................................................................ 18

Total Resource Cost Test .................................................................................................... 18

Definition........................................................................................................................ 18

How the Results Can be Expressed.................................................................................. 19

Strengths of the Total Resource Cost Test ....................................................................... 21

Weakness of the Total Resource Cost Test ...................................................................... 21

Formulas......................................................................................................................... 21

Chapter 5 ............................................................................................................................ 23

Program Administrator Cost Test........................................................................................ 23

Definition........................................................................................................................ 23

Benefits and Costs........................................................................................................... 23

How the Results Can be Expressed.................................................................................. 23

Strengths of the Program Administrator Cost Test........................................................... 24

Weaknesses of the Program Administrator Cost Test....................................................... 24

Formulas......................................................................................................................... 24

Appendix A ........................................................................................................................ 26

Inputs to Equations and Documentation .............................................................................. 26

Appendix B......................................................................................................................... 28

2

Summary of Equations and Glossary of Symbols ................................................................ 28

Basic Equations............................................................................................................... 28

Participant Test ........................................................................................................... 28

Ratepayer Impact Measure Test................................................................................... 28

Total Resource Cost Test............................................................................................. 28

Program Administrator Cost Test ................................................................................ 28

Benefits and Costs........................................................................................................... 29

Participant Test ........................................................................................................... 29

Ratepayer Impact Measure Test................................................................................... 29

Total Resource Cost Test............................................................................................. 29

Program Administrator Cost Test ................................................................................ 30

Glossary of Symbols ....................................................................................................... 30

Appendix C......................................................................................................................... 33

Derivation of Rim Lifecycle Revenue Impact Formula........................................................ 33

Rate Impact Measure....................................................................................................... 33

1

Chapter 1

Basic Methodology

Background

Since the 1970s, conservation and load management programs have been promoted by the

California Public Utilities Commission (CPUC) and the California Energy Commission

(CEC) as alternatives to power plant construction and gas supply options. Conservation and

load management (C&LM) programs have been implemented in California by the major

utilities through the use of ratepayer money and by the CEC pursuant to the CEC legislative

mandate to establish energy efficiency standards for new buildings and appliances.

While cost-effectiveness procedures for the CEC standards are outlined in the Public

Resources Code, no such official guidelines existed for utility-sponsored programs. With the

publication of the Standard Practice for Cost-Benefit Analysis of Conservation and Load

Management Programs in February 1983, this void was substantially filled. With the

informal "adoption" one year later of an appendix that identified cost-effectiveness

procedures for an "All Ratepayers" test, C&LM program cost effectiveness consisted of the

application of a series of tests representing a variety of perspectives-participants, non-

participants, all ratepayers, society, and the utility.

The Standard Practice Manual was revised again in 1987-88. The primary changes (relative

to the 1983 version), were: (1) the renaming of the “Non-Participant Test” to the “Ratepayer

Impact Test“; (2) renaming the All-Ratepayer Test” to the “Total Resource Cost Test.”; (3)

treating the “Societal Test” as a variant of the “Total Resource Cost Test;” and, (4) an

expanded explanation of “demand-side” activities that should be subjected to standard

procedures of benefit-cost analysis.

Further changes to the manual captured in this (2001) version were prompted by the

cumulative effects of changes in the electric and natural gas industries and a variety of

changes in California statute related to these changes. As part of the major electric industry

restructuring legislation of 1996 (AB1890), for example, a public goods charge was

established that ensured minimum funding levels for “cost effective conservation and energy

efficiency” for the 1998-2002 period, and then (in 2000) extended through the year 2011.

Additional legislation in 2000 (AB1002) established a natural gas surcharge for similar

purposes. Later in that year, the Energy Security and Reliability Act of 2000 (AB970)

directed the California Public Utilities Commission to establish, by the Spring of 2001, a

distribution charge to provide revenues for a self generation program and a directive to

consider changes to cost-effectiveness methods to better account for reliability concerns.

In the Spring of 2001, a new state agency — the Consumer Power and Conservation

Financing Authority — was created. This agency is expected to provide additional revenues

in the form of state revenue bonds that could supplement the amount and type of public

financial resources to finance energy efficiency and self generation activities.

2

The modifications to the Standard Practice Manual reflect these more recent developments in

several ways. First, the “Utility Cost Test” is renamed the “Program Administrator Test” to

include the assessment of programs managed by other agencies. Second, a definition of self

generation as a type of “demand-side” activity is included. Third, the description of the

various potential elements of “externalities” in the Societal version of the TRC test is

expanded. Finally the limitations section outlines the scope of this manual and elaborates

upon the processes traditionally instituted by implementing agencies to adopt values for these

externalities and to adopt the the policy rules that accompany this manual.

Demand-Side Management Categories and Program

Definitions

One important aspect of establishing standardized procedures for cost-effectiveness

evaluations is the development and use of consistent definitions of categories, programs, and

program elements.

This manual employs the use of general program categories that distinguish between

different types of demand-side management programs, conservation, load management, fuel

substitution, load building and self-generation. Conservation programs reduce electricity

and/or natural gas consumption during all or significant portions of the year. ‘Conservation’

in this context includes all ‘energy efficiency improvements’. An energy efficiency

improvement can be defined as reduced energy use for a comparable level of service,

resulting from the installation of an energy efficiency measure or the adoption of an energy

efficiency practice. Level of service may be expressed in such ways as the volume of a

refrigerator, temperature levels, production output of a manufacturing facility, or lighting

level per square foot. Load management programs may either reduce electricity peak

demand or shift demand from on peak to non-peak periods.

Fuel substitution and load building programs share the common feature of increasing annual

consumption of either electricity or natural gas relative to what would have happened in the

absence of the program. This effect is accomplished in significantly different ways, by

inducing the choice of one fuel over another (fuel substitution), or by increasing sales of

electricity, gas, or electricity and gas (load building). Self generation refers to distributed

generation (DG) installed on the customer’s side of the electric utility meter, which serves

some or all of the customer's electric load, that otherwise would have been provided by the

central electric grid.

In some cases, self generation products are applied in a combined heat and power manner, in

which case the heat produced by the self generation product is used on site to provide some

or all of the customer’s thermal needs. Self generation technologies include, but are not

limited to, photovoltaics, wind turbines, fuel cells, microturbines, small gas-fired turbines,

and gas-fired internal combustion engines.

Fuel substitution and load building programs were relatively new to demand-side

management in California in the late 1980s, born out of the convergence of several factors

3

that translated into average rates that substantially exceeded marginal costs. Proposals by

utilities to implement programs that increase sales had prompted the need for additional

procedures for estimating program cost effectiveness. These procedures maybe applicable in

a new context. AB 970 amended the Public Utilities Code and provided the motivation to

develop a cost-effectiveness method that can be used on a common basis to evaluate all

programs that will remove electric load from the centralized grid, including energy

efficiency, load control/demand-responsiveness programs and self-generation. Hence, self-

generation was also added to the list of demand side management programs for cost-

effectiveness evaluation. In some cases, self-generation programs installed with incremental

load are also included since the definition of self-generation is not necessarily confined to

projects that reduce electric load on the grid. For example, suppose an industrial customer

installs a new facility with a peak consumption of 1.5 MW, with an integrated on-site

1.0 MW gas fired DG unit. The combined impact of the new facility is load building since

the new facility can draw up to 0.5 MW from the grid, even when the DG unit is running.

The proper characterization of each type of demand-side management program is essential to

ensure the proper treatment of inputs and the appropriate interpretation of cost-effectiveness

results.

Categorizing programs is important because in many cases the same specific device can be

and should be evaluated in more than one category. For example, the promotion of an electric

heat pump can and should be treated as part of a conservation program if the device is

installed in lieu of a less efficient electric resistance heater. If the incentive induces the

installation of an electric heat pump instead of gas space heating, however, the program

needs to be considered and evaluated as a fuel substitution program. Similarly, natural gas-

fired self-generation, as well as self-generation units using other non-renewable fossil fuels,

must be treated as fuel-substitution. In common with other types of fuel-substitution, any

costs of gas transmission and distribution, and environmental externalities, must be

accounted for. In addition, cost-effectiveness analyses of self-generation should account for

utility interconnection costs. Similarly, a thermal energy storage device should be treated as a

load management program when the predominant effect is to shift load. If the acceptance of a

utility incentive by the customer to, install the energy storage device is a decisive aspect of

the customer's decision to remain an electric utility customer (i.e., to reject or defer the

option of installing a gas-fired cogeneration system), then the predominant effect of the

thermal energy storage device has been to substitute electricity service for the natural gas

service that would have occurred in the absence of the program.

In addition to Fuel Substitution and Load Building Programs, recent utility program

proposals have included reference to "load retention," "sales retention," "market retention,"

or "customer retention" programs. In most cases, the effect of such programs is identical to

either a Fuel Substitution or a Load Building program — sales of one fuel are increased

relative to sales without the program. A case may be made, however, for defining a separate

category of program called "load retention." One unambiguous example of a load retention

program is the situation where a program keeps a customer from relocating to another utility

service area. However, computationally the equations and guidelines included in this manual

to accommodate Fuel Substitution and Load Building programs can also handle this special

situation as well.

4

Basic Methods

This manual identifies the cost and benefit components and cost-effectiveness calculation

procedures from four major perspectives: Participant, Ratepayer Impact Measure (RIM),

Program Administrator Cost (PAC), and Total Resource Cost (TRC). A fifth perspective, the

Societal, is treated as a variation on the Total Resource Cost test. The results of each

perspective can be expressed in a variety of ways, but in all cases it is necessary to calculate

the net present value of program impacts over the lifecycle of those impacts.

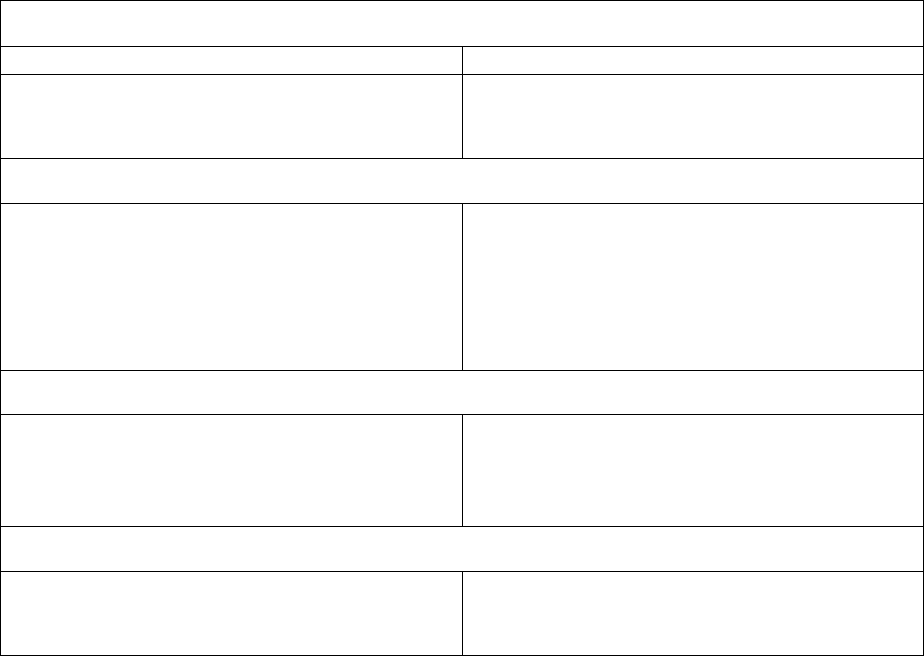

Table I summarizes the cost-effectiveness tests addressed in this manual. For each of the

perspectives, the table shows the appropriate means of expressing test results. The primary

unit of measurement refers to the way of expressing test results that are considered by the

staffs of the two Commissions as the most useful for summarizing and comparing demand-

side management (DSM) program cost-effectiveness. Secondary indicators of cost-

effectiveness represent supplemental means of expressing test results that are likely to be of

particular value for certain types of proceedings, reports, or programs.

This manual does not specify how the cost-effectiveness test results are to be displayed or the

level at which cost-effectiveness is to be calculated (e.g., groups of programs, individual

programs, and program elements for all or some programs). It is reasonable to expect

different levels and types of results for different regulatory proceedings or for different

phases of the process used to establish proposed program-funding levels. For example, for

summary tables in general rate case proceedings at the CPUC, the most appropriate tests may

be the RIM lifecycle revenue impact, Total Resource Cost, and Program Administrator Cost

test results for programs or groups of programs. The analysis and review of program

proposals for the same proceeding may include Participant test results and various additional

indicators of cost-effectiveness from all tests for each individual program element. In the

case of cost-effectiveness evaluations conducted in the context of integrated long-term

resource planning activities, such detailed examination of multiple indications of costs and

benefits may be impractical.

5

Table I

Cost-Effectiveness Tests

Participant

Primary

Secondary

Net present value (all participants)

Discounted payback (years)

Benefit-cost ratio

Net present value (average participant)

Ratepayer Impact Measure

Lifecycle revenue impact per Unit of

energy (kWh or therm) or demand

customer (kW)

Net present value

Lifecycle revenue impact per unit

Annual revenue impact (by year, per

kWh, kW, therm, or customer)

First-year revenue impact (per kWh, kW,

therm, or customer)

Benefit-cost ratio

Total Resource Cost

Net present value (NPV)

Benefit-cost ratio (BCR)

Levelized cost (cents or dollars per unit

of energy or demand)

Societal (NPV, BCR)

Program Administrator Cost

Net present value

Benefit-cost ratio

Levelized cost (cents or dollars per unit

of energy or demand)

Rather than identify the precise requirements for reporting cost-effectiveness results for all

types of proceedings or reports, the approach taken in this manual is to (a) specify the

components of benefits and costs for each of the major tests, (b) identify the equations to be

used to express the results in acceptable ways; and (c) indicate the relative value of the

different units of measurement by designating primary and secondary test results for each

test.

It should be noted that for some types of demand-side management programs, meaningful

cost-effectiveness analyses cannot be performed using the tests in this manual. The following

guidelines are offered to clarify the appropriated "match" of different types of programs and

tests:

1. For generalized information programs (e.g., when customers are provided generic

information on means of reducing utility bills without the benefit of on-site

evaluations or customer billing data), cost-effectiveness tests are not expected

because of the extreme difficulty in establishing meaningful estimates of load

impacts.

6

2. For any program where more than one fuel is affected, the preferred unit of

measurement for the RIM test is the lifecycle revenue impacts per customer, with gas

and electric components reported separately for each fuel type and for combined

fuels.

3. For load building programs, only the RIM tests are expected to be applied. The Total

Resource Cost and Program Administrator Cost tests are intended to identify cost-

effectiveness relative to other resource options. It is inappropriate to consider

increased load as an alternative to other supply options.

4. Levelized costs may be appropriate as a supplementary indicator of cost per unit for

electric conservation and load management programs relative to generation options

and gas conservation programs relative to gas supply options, but the levelized cost

test is not applicable to fuel substitution programs (since they combine gas and

electric effects) or load building programs (which increase sales).

The delineation of the various means of expressing test results in Table 1 is not meant to

discourage the continued development of additional variations for expressing cost-

effectiveness. Of particular interest is the development of indicators of program cost

effectiveness that can be used to assess the appropriateness of program scope (i.e. level of

funding) for General Rate Case proceedings. Additional tests, if constructed from the net

present worth in conformance with the equations designated in this manual, could prove

useful as a means of developing methodologies that will address issues such as the optimal

timing and scope of demand-side management programs in the context of overall resource

planning.

Balancing the Tests

The tests set forth in this manual are not intended to be used individually or in isolation. The

results of tests that measure efficiency, such as the Total Resource Cost Test, the Societal

Test, and the Program Administrator Cost Test, must be compared not only to each other but

also to the Ratepayer Impact Measure Test. This multi-perspective approach will require

program administrators and state agencies to consider tradeoffs between the various tests.

Issues related to the precise weighting of each test relative to other tests and to developing

formulas for the definitive balancing of perspectives are outside the scope of this manual.

The manual, however, does provide a brief description of the strengths and weaknesses of

each test (Chapters 2, 3, 4, and 5) to assist users in qualitatively weighing test results.

Limitations: Externality Values and Policy Rules

The list of externalities identified in Chapter 4, page 27, in the discussion on the Societal

version of the Total Resource Cost test is broad, illustrative and by no means exhaustive.

Traditionally, implementing agencies have independently determined the details such as the

components of the externalities, the externality values and the policy rules which specify the

contexts in which the externalities and the tests are used.

7

Externality Values

The values for the externalities have not been provided in the manual. There are separate

studies and methodologies to arrive at these values. There are also separate processes

instituted by implementing agencies before such values can be adopted formally.

Policy Rules

The appropriate choice of inputs and input components vary by program area and project.

For instance, low income programs are evaluated using a broader set of non-energy benefits

that have not been provided in detail in this manual. Implementing agencies traditionally

have had the discretion to use or to not use these inputs and/or benefits on a project- or

program-specific basis. The policy rules that specify the contexts in which it is appropriate to

use the externalities, their components, and tests mentioned in this manual are an integral part

of any cost-effectiveness evaluation. These policy rules are not a part of this manual.

To summarize, the manual provides the methodology and the cost-benefit calculations only.

The implementing agencies (such as the California Public Utilities Commission and the

California Energy Commission) have traditionally utilized open public processes to

incorporate the diverse views of stakeholders before adopting externality values and policy

rules which are an integral part of the cost-effectiveness evaluation.

8

Chapter 2

Participant Test

Definition

The Participants Test is the measure of the quantifiable benefits and costs to the customer

due to participation in a program. Since many customers do not base their decision to

participate in a program entirely on quantifiable variables, this test cannot be a complete

measure of the benefits and costs of a program to a customer.

Benefits and Costs

The benefits of participation in a demand-side program include the reduction in the

customer's utility bill(s), any incentive paid by the utility or other third parties, and any

federal, state, or local tax credit received. The reductions to the utility bill(s) should be

calculated using the actual retail rates that would have been charged for the energy service

provided (electric demand or energy or gas). Savings estimates should be based on gross

savings, as opposed to net energy savings

1

.

In the case of fuel substitution programs, benefits to the participant also include the avoided

capital and operating costs of the equipment/appliance not chosen. For load building

programs, participant benefits include an increase in productivity and/or service, which is

presumably equal to or greater than the productivity/ service without participating. The

inclusion of these benefits is not required for this test, but if they are included then the

societal test should also be performed.

The costs to a customer of program participation are all out-of-pocket expenses incurred as a

result of participating in a program, plus any increases in the customer's utility bill(s). The

out-of-pocket expenses include the cost of any equipment or materials purchased, including

sales tax and installation; any ongoing operation and maintenance costs; any removal costs

(less salvage value); and the value of the customer's time in arranging for the installation of

the measure, if significant.

1

Gross energy savings are considered to be the savings in energy and demand seen by the participant at the

meter. These are the appropriate program impacts to calculate bill reductions for the Participant Test. Net

savings are assumed to be the savings that are attributable to the program. That is, net savings are gross savings

minus those changes in energy use and demand that would have happened even in the absence of the program.

For fuel substitution and load building programs, gross-to-net considerations account for the impacts that would

have occurred in the absence of the program.

9

How the Results can be Expressed

The results of this test can be expressed in four ways: through a net present value per average

participant, a net present value for the total program, a benefit-cost ratio or discounted

payback. The primary means of expressing test results is net present value for the total

program; discounted payback, benefit-cost ratio, and per participant net present value are

secondary tests.

The discounted payback is the number of years it takes until the cumulative discounted

benefits equal or exceed the cumulative discounted costs. The shorter the discounted

payback, the more attractive or beneficial the program is to the participants. Although

"payback period" is often defined as undiscounted in the textbooks, a discounted payback

period is used here to approximate more closely the consumer's perception of future benefits

and costs.

2

Net present value (NPVp) gives the net dollar benefit of the program to an average

participant or to all participants discounted over some specified time period. A net present

value above zero indicates that the program is beneficial to the participants under this test.

The benefit-cost ratio (BCRp) is the ratio of the total benefits of a program to the total costs

discounted over some specified time period. The benefit-cost ratio gives a measure of a

rough rate of return for the program to the participants and is also an indication of risk. A

benefit-cost ratio above one indicates a beneficial program.

Strengths of the Participant Test

The Participants Test gives a good "first cut" of the benefit or desirability of the program to

customers. This information is especially useful for voluntary programs as an indication of

potential participation rates.

For programs that involve a utility incentive, the Participant Test can be used for program

design considerations such as the minimum incentive level, whether incentives are really

needed to induce participation, and whether changes in incentive levels will induce the

desired amount of participation.

These test results can be useful for program penetration analyses and developing program

participation goals, which will minimize adverse ratepayer impacts and maximize benefits.

For fuel substitution programs, the Participant Test can be used to determine whether

program participation (i.e. choosing one fuel over another) will be in the long-run best

interest of the customer. The primary means of establishing such assurances is the net present

value, which looks at the costs and benefits of the fuel choice over the life of the equipment.

2

It should be noted that if a demand-side program is beneficial to its participants (NPVp > 0 and BCRp > 1.0)

using a particular discount rate, the program has an internal rate of return (IRR) of at least the value of the

discount rate.

10

Weaknesses of the Participant Test

None of the Participant Test results (discounted payback, net present value, or benefit-cost

ratio) accurately capture the complexities and diversity of customer decision-making

processes for demand-side management investments. Until or unless more is known about

customer attitudes and behavior, interpretations of Participant Test results continue to require

considerable judgment. Participant Test results play only a supportive role in any assessment

of conservation and load management programs as alternatives to supply projects.

Formulae

The following are the formulas for discounted payback, the net present value (NPVp) and the

benefit-cost ratio (BCRp) for the Participant Test.

NPV

P

= Bp - Cp

NPVavp = (Bp - Cp) / P

BCRp = Bp / Cp

DPp = Min j such that Bj > Cj

Where:

NPVp = Net present value to all participants

NPVavp = Net present value to the average participant

BCRp = Benefit-cost ratio to participants

DPp = Discounted payback in years

Bp = NPV of benefit to participants

Cp = NPV of costs to participants

Bj = Cumulative benefits to participants in year j

Cj = Cumulative costs to participants in year j

P = Number of program participants

J = First year in which cumulative benefits are cumulative costs.

d = Interest rate (discount)

The Benefit (Bp) and Cost (Cp) terms are further defined as follows:

!

=

"

+

++

=

N

t

t

ttt

d

INCTCBR

BP

1

1

)1(

+

!

=

"

+

+

N

t

t

atat

d

PAAB

1

1

)1(

!

=

"

+

+

=

N

t

t

tt

d

BIPC

C

1

1

)1(

Where:

BRt = Bill reductions in year t

Bit = Bill increases in year t

11

TCt = Tax credits in year t

INCt = Incentives paid to the participant by the sponsoring utility in year t

3

PCt = Participant costs in year t to include:

• Initial capital costs, including sales tax

4

• Ongoing operation and maintenance costs include fuel cost

• Removal costs, less salvage value

• Value of the customer's time in arranging for installation, if

significant

PACat = Participant avoided costs in year t for alternate fuel devices (costs of

devices not chosen)

Abat = Avoided bill from alternate fuel in year t

The first summation in the Bp equation should be used for conservation and load

management programs. For fuel substitution programs, both the first and second summations

should be used for Bp.

Note that in most cases, the customer bill impact terms (BRt, BIt, and AB

at

) are further

determined by costing period to reflect load impacts and/or rate schedules, which vary

substantially by time of day and season. The formulas for these variables are as follows:

! !

= =

+""#+""#=

I

i

I

i

tititititititt

OBRKDACDGKEACEGBR

1 1

):():(

AB

at

= (Use BRt formula, but with rates and costing periods appropriate for the alternate

fuel utility)

! !

= =

+"##$+"##$=

I

i

I

i

tititititititt

OBIKDACDGKEACEGBI

1 1

))1(:())1(:(

Where:

ΔEG

it

= Reduction in gross energy use in costing period i in year t

ΔDG

it

= Reduction in gross billing demand in costing period i in year t

AC:E

it

= Rate charged for energy in costing period i in year t

3

Some difference of opinion exists as to what should be called an incentive. The term can be interpreted

broadly to include almost anything. Direct rebates, interest payment subsidies, and even energy audits can be

called incentives. Operationally, it is necessary to restrict the term to include only dollar benefits such as rebates

or rate incentives (monthly bill credits). Information and services such as audits are not considered incentives

for the purposes of these tests. If the incentive is to offset a specific participant cost, as in a rebate-type

incentive, the full customer cost (before the rebate must be included in the PC

t

term

4

If money is borrowed by the customer to cover this cost, it may not be necessary to calculate the annual

mortgage and discount this amount if the present worth of the mortgage payments equals the initial cost. This

occurs when the discount rate used is equal to the interest rate of the mortgage. If the two rates differ (e.g., a

loan offered by the utility), then the stream of mortgage payments should be discounted by the discount rate

chosen.

12

AC:D

it

= Rate charged for demand in costing period i in year t

K

it

= 1 when ΔEGit or ΔDGit is positive (a reduction) in costing period i in

year t, and zero otherwise

OBR

t

= Other bill reductions or avoided bill payments (e.g.,, customer charges,

standby rates).

OBI

t

= Other bill increases (i.e. customer charges, standby rates).

I = Number of periods of participant’s participation

In load management programs such as TOU rates and air-conditioning cycling, there are

often no direct customer hardware costs. However, attempts should be made to quantify

indirect costs customers may incur that enable them to take advantage of TOU rates and

similar programs.

If no customer hardware costs are expected or estimates of indirect costs and value of service

are unavailable, it may not be possible to calculate the benefit-cost ratio and discounted

payback period.

13

Chapter 3

The Ratepayer Impact Measure Test

5

Definition

The Ratepayer Impact Measure (RIM) test measures what happens to customer bills or rates

due to changes in utility revenues and operating costs caused by the program. Rates will go

down if the change in revenues from the program is greater than the change in utility costs.

Conversely, rates or bills will go up if revenues collected after program implementation are

less than the total costs incurred by the utility in implementing the program. This test

indicates the direction and magnitude of the expected change in customer bills or rate levels.

Benefits and Costs

The benefits calculated in the RIM test are the savings from avoided supply costs. These

avoided costs include the reduction in transmission, distribution, generation, and capacity

costs for periods when load has been reduced and the increase in revenues for any periods in

which load has been increased. The avoided supply costs are a reduction in total costs or

revenue requirements and are included for both fuels for a fuel substitution program. The

increase in revenues are also included for both fuels for fuel substitution programs. Both the

reductions in supply costs and the revenue increases should be calculated using net energy

savings.

The costs for this test are the program costs incurred by the utility, and/or other entities

incurring costs and creating or administering the program, the incentives paid to the

participant, decreased revenues for any periods in which load has been decreased and

increased supply costs for any periods when load has been increased. The utility program

costs include initial and annual costs, such as the cost of equipment, operation and

maintenance, installation, program administration, and customer dropout and removal of

equipment (less salvage value). The decreases in revenues and the increases in the supply

costs should be calculated for both fuels for fuel substitution programs using net savings.

How the Results can be Expressed

The results of this test can be presented in several forms: the lifecycle revenue impact (cents

or dollars) per kWh, kW, therm, or customer; annual or first-year revenue impacts (cents or

dollars per kWh, kW, therms, or customer); benefit-cost ratio; and net present value. The

primary units of measurement are the lifecycle revenue impact, expressed as the change in

rates (cents per kWh for electric energy, dollars per kW for electric capacity, cents per therm

for natural gas) and the net present value. Secondary test results are the lifecycle revenue

5

The Ratepayer Impact Measure Test has previously been described under what was called the

"Non-Participant Test." The Non-Participant Test has also been called the "Impact on Rate Levels Test."

14

impact per customer, first-year and annual revenue impacts, and the benefit-cost ratio.

LRI

RIM

values for programs affecting electricity and gas should be calculated for each fuel

individually (cents per kWh or dollars per kW and cents per therm) and on a combined gas

and electric basis (cents per customer).

The lifecycle revenue impact (LRI) is the one-time change in rates or the bill change over the

life of the program needed to bring total revenues in line with revenue requirements over the

life of the program. The rate increase or decrease is expected to be put into effect in the first

year of the program. Any successive rate changes such as for cost escalation are made from

there. The first-year revenue impact (FRI) is the change in rates in the first year of the

program or the bill change needed to get total revenues to match revenue requirements only

for that year. The annual revenue impact (ARI) is the series of differences between revenues

and revenue requirements in each year of the program. This series shows the cumulative rate

change or bill change in a year needed to match revenues to revenue requirements. Thus, the

ARIRIM for year six per kWh is the estimate of the difference between present rates and the

rate that would be in effect in year six due to the program. For results expressed as lifecycle,

annual, or first-year revenue impacts, negative results indicate favorable effects on the bills

of ratepayers or reductions in rates. Positive test result values indicate adverse bill impacts or

rate increases.

Net present value (NPV

RIM

) gives the discounted dollar net benefit of the program from the

perspective of rate levels or bills over some specified time period. A net present value above

zero indicates that the program will benefit (lower) rates and bills.

The benefit-cost ratio (BCR RIM) is the ratio of the total benefits of a program to the total

costs discounted over some specified time period. A benefit-cost ratio above one indicates

that the program will lower rates and bills.

Strengths of the Ratepayer Impact Measure (RIM)

Test

In contrast to most supply options, demand-side management programs cause a direct shift in

revenues. Under many conditions, revenues lost from DSM programs have to be made up by

ratepayers. The RIM test is the only test that reflects this revenue shift along with the other

costs and benefits associated with the program.

An additional strength of the RIM test is that the test can be used for all demand-side

management programs (conservation, load management, fuel substitution, and load building).

This makes the RIM test particularly useful for comparing impacts among demand-side

management options.

Some of the units of measurement for the RIM test are of greater value than others,

depending upon the purpose or type of evaluation. The lifecycle revenue impact per customer

is the most useful unit of measurement when comparing the merits of programs with highly

variable scopes (e.g.,, funding levels) and when analyzing a wide range of programs that

15

include both electric and natural gas impacts. Benefit-cost ratios can also be very useful for

program design evaluations to identify the most attractive programs or program elements.

If comparisons are being made between a program or group of conservation/load

management programs and a specific resource project, lifecycle cost per unit of energy and

annual and first-year net costs per unit of energy are the most useful way to express test

results. Of course, this requires developing lifecycle, annual, and first-year revenue impact

estimates for the supply-side project.

Weaknesses of the Ratepayer Impact Measure (RIM)

Test

Results of the RIM test are probably less certain than those of other tests because the test is

sensitive to the differences between long-term projections of marginal costs and long-term

projections of rates, two cost streams that are difficult to quantify with certainty.

RIM test results are also sensitive to assumptions regarding the financing of program costs.

Sensitivity analyses and interactive analyses that capture feedback effects between system

changes, rate design options, and alternative means of financing generation and non-

generation options can help overcome these limitations. However, these types of analyses

may be difficult to implement.

An additional caution must be exercised in using the RIM test to evaluate a fuel substitution

program with multiple end use efficiency options. For example, under conditions where

marginal costs are less than average costs, a program that promotes an inefficient appliance

may give a more favorable test result than a program that promotes an efficient appliance.

Though the results of the RIM test accurately reflect rate impacts, the implications for long-

term conservation efforts need to be considered.

Formulae: The formulae for the lifecycle revenue impact (LRI RIM)' net present value

(NPV RIM), benefit-cost ratio (BCR RIM)' the first-year revenue impacts and annual

revenue impacts are presented below:

LRIRIM = (CRIM - BRIM) / E

FRIRIM = (CRIM - BRIM) / E for t = I

ARIRIMt = FRIRIM for t = I

= (CRIMt - BRIMt )/Et for t=2, ………….., N

NPVRIM = BRIM-CRIM

BCRRIM` = BRIM/CRIM where:

LRIRIM = Lifecycle revenue impact of the program per unit of energy (kWh or therm)

or demand (kW) (the one-time change in rates) or per customer (the change

in customer bills over the life of the program). (Note: An appropriate

choice of kWh, therm, kW, and customer should be made)

16

FRIRIM = First-year revenue impact of the program per unit of energy, demand, or

per customer.

ARIRIM = Stream of cumulative annual revenue impacts of the program per unit of

energy, demand, or per customer. (Note: The terms in the ARI formula are

not discounted; thus they are the nominal cumulative revenue impacts.

Discounted cumulative revenue impacts may be calculated and submitted if

they are indicated as such. Note also that the sum of the discounted stream

of cumulative revenue impacts does not equal the LRI RIM')

NPVRIM = Net present value levels

BCRRIM = Benefit-cost ratio for rate levels

BRIM = Benefits to rate levels or customer bills

CRIM = Costs to rate levels or customer bills

E = Discounted stream of system energy sales (kWh or therms) or demand sales

(kW) or first-year customers. (See Appendix D for a description of the

derivation and use of this term in the LRIRIM test.)

The B

RIM

and C

RIM

terms are further defined as follows:

!!

=

"

=

"

+

+

+

+

N

t

t

at

N

t

t

t

RIM

d

UAC

d

RGUAC

B

t

1

1

1

1

)1()1(

!!

=

"

=

"

+

+

+

+++

N

t

t

at

N

t

t

tttt

RIM

d

RL

d

INCPRCRLUIC

C

1

1

1

1

)1()1(

!

=

"

+

=

N

t

t

t

d

E

E

1

1

)1(

Where:

UACt = Utility avoided supply costs in year t

UICt = Utility increased supply costs in year t

RGt = Revenue gain from increased sales in year t

RLt = Revenue loss from reduced sales in year t

PRCt = Program Administrator program costs in year t

Et = System sales in kWh, kW or therms in year t or first year customers

UACat = Utility avoided supply costs for the alternate fuel in year t

Rlat = Revenue loss from avoided bill payments for alternate fuel in year t (i.e.,

device not chosen in a fuel substitution program)

17

For fuel substitution programs, the first term in the B RIM and C RIM equations represents

the sponsoring utility (electric or gas), and the second term represents the alternate utility.

The RIM test should be calculated separately for electric and gas and combined electric and

gas.

The utility avoided cost terms (UAC

t

, UIC

t

, and UAC

at

) are further determined by costing

period to reflect time-variant costs of supply:

):():(

1 1

ititit

I

i

I

i

itititt

KDMCDNKEMCENUCA !!"+!!"=

# #

= =

UAC

at

= (Use UACt formula, but with marginal costs and costing periods appropriate

for the alternate fuel utility.)

! !

= =

"##$+"##$

I

i

I

i

itititititt

KDMCDNKEMCENUIC

1 1

))1(:())1(:(

Where:

[Only terms not previously defined are included here.]

ΔENit = Reduction in net energy use in costing period i in year t

ΔDNit = Reduction in net demand in costing period i in year t

MC:Eit = Marginal cost of energy in costing period i in year t

MC:Dit = Marginal cost of demand in costing period i in year t

The revenue impact terms (RG

t

, RL

t

, and RL

at

) are parallel to the bill impact terms in the

Participant Test. The terms are calculated exactly the same way with the exception that the

net impacts are used rather than gross impacts. If a net-to-gross ratio is used to differentiate

gross savings from net savings, the revenue terms and the participant's bill terms will be

related as follows:

RGt = BIt * (net-to-gross ratio)

RLt = BRt * (net-to-gross ratio)

Rlat = Abat * (net-to-gross ratio)

18

Chapter 4

Total Resource Cost Test

6

Definition

The Total Resource Cost Test measures the net costs of a demand-side management program

as a resource option based on the total costs of the program, including both the participants'

and the utility's costs.

The test is applicable to conservation, load management, and fuel substitution programs. For

fuel substitution programs, the test measures the net effect of the impacts from the fuel not

chosen versus the impacts from the fuel that is chosen as a result of the program. TRC test

results for fuel substitution programs should be viewed as a measure of the economic

efficiency implications of the total energy supply system (gas and electric).

A variant on the TRC test is the Societal Test. The Societal Test differs from the TRC test in

that it includes the effects of externalities (e.g.,, environmental, national security), excludes

tax credit benefits, and uses a different (societal) discount rate.

Benefits and Costs: This test represents the combination of the effects of a program on both

the customers participating and those not participating in a program. In a sense, it is the

summation of the benefit and cost terms in the Participant and the Ratepayer Impact Measure

tests, where the revenue (bill) change and the incentive terms intuitively cancel (except for

the differences in net and gross savings).

The benefits calculated in the Total Resource Cost Test are the avoided supply costs, the

reduction in transmission, distribution, generation, and capacity costs valued at marginal cost

for the periods when there is a load reduction. The avoided supply costs should be calculated

using net program savings, savings net of changes in energy use that would have happened in

the absence of the program. For fuel substitution programs, benefits include the avoided

device costs and avoided supply costs for the energy, using equipment not chosen by the

program participant.

The costs in this test are the program costs paid by both the utility and the participants plus

the increase in supply costs for the periods in which load is increased. Thus all equipment

costs, installation, operation and maintenance, cost of removal (less salvage value), and

administration costs, no matter who pays for them, are included in this test. Any tax credits

are considered a reduction to costs in this test. For fuel substitution programs, the costs also

include the increase in supply costs for the utility providing the fuel that is chosen as a result

of the program.

6

This test was previously called the All Ratepayers Test

19

How the Results Can be Expressed

The results of the Total Resource Cost Test can be expressed in several forms: as a net

present value, a benefit-cost ratio, or as a levelized cost. The net present value is the primary

unit of measurement for this test. Secondary means of expressing TRC test results are a

benefit-cost ratio and levelized costs. The Societal Test expressed in terms of net present

value, a benefit-cost ratio, or levelized costs is also considered a secondary means of

expressing results. Levelized costs as a unit of measurement are inapplicable for fuel

substitution programs, since these programs represent the net change of alternative fuels

which are measured in different physical units (e.g.,, kWh or therms). Levelized costs are

also not applicable for load building programs.

Net present value (NPVTRC) is the discounted value of the net benefits to this test over a

specified period of time. NPVTRC is a measure of the change in the total resource costs due

to the program. A net present value above zero indicates that the program is a less expensive

resource than the supply option upon which the marginal costs are based.

The benefit-cost ratio (BCRTRC) is the ratio of the discounted total benefits of the program

to the discounted total costs over some specified time period. It gives an indication of the rate

of return of this program to the utility and its ratepayers. A benefit-cost ratio above one

indicates that the program is beneficial to the utility and its ratepayers on a total resource cost

basis.

The levelized cost is a measure of the total costs of the program in a form that is sometimes

used to estimate costs of utility-owned supply additions. It presents the total costs of the

program to the utility and its ratepayers on a per kilowatt, per kilowatt hour, or per therm

basis levelized over the life of the program.

The Societal Test is structurally similar to the Total Resource Cost Test. It goes beyond the

TRC test in that it attempts to quantify the change in the total resource costs to society as a

whole rather than to only the service territory (the utility and its ratepayers). In taking

society's perspective, the Societal Test utilizes essentially the same input variables as the

TRC Test, but they are defined with a broader societal point of view. More specifically, the

Societal Test differs from the TRC Test in at least one of five ways. First, the Societal Test

may use higher marginal costs than the TRC test if a utility faces marginal costs that are

lower than other utilities in the state or than its out-of-state suppliers. Marginal costs used in

the Societal Test would reflect the cost to society of the more expensive alternative

resources. Second, tax credits are treated as a transfer payment in the Societal Test, and thus

are left out. Third, in the case of capital expenditures, interest payments are considered a

transfer payment since society actually expends the resources in the first year. Therefore,

capital costs enter the calculations in the year in which they occur. Fourth, a societal discount

rate should be used

7.

Finally, Marginal costs used in the Societal Test would also contain

externality costs of power generation not captured by the market system. An illustrative and

7 Many economists have pointed out that use of a market discount rate in social cost-benefit analysis

undervalues the interests of future generations. Yet if a market discount rate is not used, comparisons with

alternative investments are difficult to make

.

20

by no means exhaustive list of ‘externalities and their components’ is given below (Refer to

the Limitations section for elaboration.) These values are also referred to as ‘adders’

designed to capture or internalize such externalities. The list of potential adders would

include for example:

1. The benefit of avoided environmental damage: The CPUC policy specifies two ‘adders’

to internalize environmental externalities, one for electricity use and one for natural gas

use. Both are statewide average values. These adders are intended to help distinguish

between cost-effective and non cost-effective energy-efficiency programs. They apply to

an average supply mix and would not be useful in distinguishing among competing

supply options. The CPUC electricity environmental adder is intended to account for the

environmental damage from air pollutant emissions from power plants. The CPUC-

adopted adder is intended to cover the human and material damage from sulfur oxides

(SOX), nitrogen oxides (NOX), volatile organic compounds (VOC, sometimes called

reactive organic gases or ROG), particulate matter at or below 10 micron diameter

(PM10), and carbon. The adder for natural gas is intended to account for air pollutant

emissions from the direct combustion of the gas. In the CPUC policy guidance, the

adders are included in the tabulation of the benefits of energy efficiency programs. They

represent reduced environmental damage from displaced electricity generation and

avoided gas combustion. The environmental damage is the result of the net change in

pollutant emissions in the air basins, or regions, in which there is an impact. This change

is the result of direct changes in powerplant or natural gas combustion emission resulting

from the efficiency measures, and changes in emissions from other sources, that result

from those direct changes in emissions.

2. The benefit of avoided transmission and distribution costs – energy efficiency measures

that reduce the growth in peak demand would decrease the required rate of expansion to

the transmission and distribution network, eliminating costs of constructing and

maintaining new or upgraded lines.

3. The benefit of avoided generation costs – energy efficiency measures reduce

consumption and hence avoid the need for generation. This would include avoided

energy costs, capacity costs and T&D line

4. The benefit of increased system reliability: The reductions in demand and peak loads

from customers opting for self generation, provide reliability benefits to the distribution

system in the forms of:

a. Avoided costs of supply disruptions

b. Benefits to the economy of damage and control costs avoided by customers and

industries in the digital economy that need greater than 99.9 level of reliable

electricity service from the central grid

c. Marginally decreased System Operator’s costs to maintain a percentage reserve of

electricity supply above the instantaneous demand

d. Benefits to customers and the public of avoiding blackouts.

21

5. Non-energy benefits: Non-energy benefits might include a range of program-specific

benefits such as saved water in energy-efficient washing machines or self generation

units, reduced waste streams from an energy-efficient industrial process, etc.

6. Non-energy benefits for low income programs: The low income programs are social

programs which have a separate list of benefits included in what is known as the ‘low

income public purpose test’. This test and the sepcific benefits associated with this test

are outside the scope of this manual.

7. Benefits of fuel diversity include considerations of the risks of supply disruption, the

effects of price volatility, and the avoided costs of risk exposure and risk management.

Strengths of the Total Resource Cost Test

The primary strength of the Total Resource Cost (TRC) test is its scope. The test includes

total costs (participant plus program administrator) and also has the potential for capturing

total benefits (avoided supply costs plus, in the case of the societal test variation,

externalities). To the extent supply-side project evaluations also include total costs of

generation and/or transmission, the TRC test provides a useful basis for comparing demand-

and supply-side options.

Since this test treats incentives paid to participants and revenue shifts as transfer payments

(from all ratepayers to participants through increased revenue requirements), the test results

are unaffected by the uncertainties of projected average rates, thus reducing the uncertainty

of the test results. Average rates and assumptions associated with how other options are

financed (analogous to the issue of incentives for DSM programs) are also excluded from

most supply-side cost determinations, again making the TRC test useful for comparing

demand-side and supply-side options.

Weakness of the Total Resource Cost Test

The treatment of revenue shifts and incentive payments as transfer payments, identified

previously as a strength, can also be considered a weakness of the TRC test. While it is true

that most supply-side cost analyses do not include such financial issues, it can be argued that

DSM programs should include these effects since, in contrast to most supply options, DSM

programs do result in lost revenues.

In addition, the costs of the DSM "resource" in the TRC test are based on the total costs of

the program, including costs incurred by the participant. Supply-side resource options are

typically based only on the costs incurred by the power suppliers.

Finally, the TRC test cannot be applied meaningfully to load building programs, thereby

limiting the ability to use this test to compare the full range of demand-side management

options.

Formulas

22

The formulas for the net present value (NPV

TRC

)' the benefit-cost ratio (BCR

TRC

and

levelized costs are presented below:

NPVTRC = BTRC - CTRC

BCRTRC = BTRC /CTRC

LCTRC = LCRC / IMP

Where:

NPVTRC = Net present value of total costs of the resource

BCRTRC = Benefit-cost ratio of total costs of the resource

LCTRC = Levelized cost per unit of the total cost of the resource (cents per kWh for

conservation programs; dollars per kW for load management programs)

BTRC = Benefits of the program

CTRC = Costs of the program

LCRC = Total resource costs used for levelizing

IMP = Total discounted load impacts of the program

PCN = Net Participant Costs

The B

TRC

C

TRC

LCRC, and IMP terms are further defined as follows:

! !

= =

""

+

+

+

+

+

=

N

t

N

t

t

atat

t

tt

d

PACUAC

d

TCUAC

BTRC

1 1

11

)1()1(

!

=

"

+

++

=

N

t

t

ttt

d

UICPCNPRC

CTRC

1

1

)1(

!

=

"

+

"+

=

N

t

t

ttt

d

TCPCNPRC

LCRC

1

1

)1(

1

1 1

)1(

) ( )(

!

= =

+

"

#

$

%

&

'

=((=

) )

t

n

t

n

i

itit

d

periodpeakIwhereDNorENIMP

[All terms have been defined in previous chapters.]

The first summation in the BTRC equation should be used for conservation and load

management programs. For fuel substitution programs, both the first and second summations

should be used.

23

Chapter 5

Program Administrator Cost Test

Definition

The Program Administrator Cost Test measures the net costs of a demand-side management

program as a resource option based on the costs incurred by the program administrator

(including incentive costs) and excluding any net costs incurred by the participant. The

benefits are similar to the TRC benefits. Costs are defined more narrowly.

Benefits and Costs

The benefits for the Program Administrator Cost Test are the avoided supply costs of energy

and demand, the reduction in transmission, distribution, generation, and capacity valued at

marginal costs for the periods when there is a load reduction. The avoided supply costs

should be calculated using net program savings, savings net of changes in energy use that

would have happened in the absence of the program. For fuel substitution programs, benefits

include the avoided supply costs for the energy-using equipment not chosen by the program

participant only in the case of a combination utility where the utility provides both fuels.

The costs for the Program Administrator Cost Test are the program costs incurred by the

administrator, the incentives paid to the customers, and the increased supply costs for the

periods in which load is increased. Administrator program costs include initial and annual

costs, such as the cost of utility equipment, operation and maintenance, installation, program

administration, and customer dropout and removal of equipment (less salvage value). For

fuel substitution programs, costs include the increased supply costs for the energy-using

equipment chosen by the program participant only in the case of a combination utility, as

above.

In this test, revenue shifts are viewed as a transfer payment between participants and all

ratepayers. Though a shift in revenue affects rates, it does not affect revenue requirements,

which are defined as the difference between the net marginal energy and capacity costs

avoided and program costs. Thus, if NPVpa > 0 and NPVRIM < 0, the administrator’s

overall total costs will decrease, although rates may increase because the sales base over

which revenue requirements are spread has decreased.

How the Results Can be Expressed

The results of this test can be expressed either as a net present value, benefit-cost ratio, or

levelized costs. The net present value is the primary test, and the benefit-cost ratio and

levelized cost are the secondary tests.

24

Net present value (NPVpa) is the benefit of the program minus the administrator's costs,

discounted over some specified period of time. A net present value above zero indicates that

this demand-side program would decrease costs to the administrator and the utility.

The benefit-cost ratio (BCRpa) is the ratio of the total discounted benefits of a program to the

total discounted costs for a specified time period. A benefit-cost ratio above one indicates

that the program would benefit the combined administrator and utility's total cost situation.

The levelized cost is a measure of the costs of the program to the administrator in a form that

is sometimes used to estimate costs of utility-owned supply additions. It presents the costs of

the program to the administrator and the utility on per kilowatt, per kilowatt-hour, or per

therm basis levelized over the life of the program.

Strengths of the Program Administrator Cost Test

As with the Total Resource Cost test, the Program Administrator Cost test treats revenue

shifts as transfer payments, meaning that test results are not complicated by the uncertainties

associated with long-term rate projections and associated rate design assumptions. In contrast

to the Total Resource Cost test, the Program Administrator Test includes only the portion of

the participant's equipment costs that is paid for by the administrator in the form of an

incentive. Therefore, for purposes of comparison, costs in the Program Administrator Cost

Test are defined similarly to those supply-side projects which also do not include direct

customer costs.

Weaknesses of the Program Administrator Cost

Test

By defining device costs exclusively in terms of costs incurred by the administrator, the

Program Administrator Cost test results reflect only a portion of the full costs of the resource.

The Program Administrator Cost Test shares two limitations noted previously for the Total

Resource Cost test: (1) by treating revenue shifts as transfer payments, the rate impacts are

not captured, and (2) the test cannot be used to evaluate load building programs.

Formulas

The formulas for the net present value, the benefit-cost ratio and levelized cost are presented

below:

NPVpa = Bpa - Cpa

BCRpa = Bpa/Cpa

LCpa = LCpa/IMP

Where:

NPVpa Net present value of Program Administrator costs

BCRpa Benefit-cost ratio of Program Administrator costs

25

LCpa Levelized cost per unit of Program Administrator cost of the resource

Bpa Benefits of the program

Cpa Costs of the program

LCpc Total Program Administrator costs used for levelizing

!!

+

"

=

"

+

+

+

=

N

t

t

at

N

t

t

t

pa

d

UAC

d

UAC

B

1

1

1

1

)1()1(

!

=

"

+

++

=

N

t

t

ttt

pa

d

UICINCPRC

C

1

1

)1(

!

=

"

+

+

=

N

t

t

tt

d

INCPRC

LCpc

1

1

)1(

[All variables are defined in previous chapters.]

The first summation in the Bpa equation should be used for conservation and load

management programs. For fuel substitution programs, both the first and second summations

should be used.

26

Appendix A

Inputs to Equations and

Documentation

A comprehensive review of procedures and sources for developing inputs is beyond the

scope of this manual. It would also be inappropriate to attempt a complete standardization of

techniques and procedures for developing inputs for such parameters as load impacts,

marginal costs, or average rates. Nevertheless, a series of guidelines can help to establish

acceptable procedures and improve the chances of obtaining reasonable levels of consistent

and meaningful cost-effectiveness results. The following "rules" should be viewed as

appropriate guidelines for developing the primary inputs for the cost-effectiveness equations

contained in this manual:

1. In the past, Marginal costs for electricity were based on production cost model

simulations that clearly identify key assumptions and characteristics of the existing

generation system as well as the timing and nature of any generation additions and/or

power purchase agreements in the future. With a deregulated market for wholesale

electricity, marginal costs for electric generation energy should be based on forecast

market prices, which are derived from recent transactions in California energy markets.

Such transactions could include spot market purchases as well as longer term bilateral

contracts and the marginal costs should be estimated based on components for energy as

well as demand and/or capacity costs as is typical for these contracts.

2. In the case of submittals in conjunction with a utility rate proceeding, average rates used

in DSM program cost-effectiveness evaluations should be based on proposed rates.

Otherwise, average rates should be based on current rate schedules. Evaluations based on

alternative rate designs are encouraged.

3. Time-differentiated inputs for electric marginal energy and capacity costs, average

energy rates, and demand charges, and electric load impacts should be used for (a) load

management programs, (b) any conservation program that involves a financial incentive

to the customer, and (c) any Fuel Substitution or Load Building program. Costing periods

used should include, at a minimum, summer and winter, on-, and off-peak; further

disaggregation is encouraged.

4. When program participation includes customers with different rate schedules, the average

rate inputs should represent an average weighted by the estimated mix of participation or

impacts. For General Rate Case proceedings it is likely that each major rate class within

each program will be considered as program elements requiring separate cost-

effectiveness analyses for each measure and each rate class within each program.

27

5. Program administration cost estimates used in program cost-effectiveness analyses

should exclude costs associated with the measurement and evaluation of program impacts

unless the costs are a necessary component to administer the program.

6. For DSM programs or program elements that reduce electricity and natural gas

consumption, costs and benefits from both fuels should be included.

7. The development and treatment of load impact estimates should distinguish between

gross (i.e., impacts expected from the installation of a particular device, measure,

appliance) and net (impacts adjusted to account for what would have happened anyway,

and therefore not attributable to the program). Load impacts for the Participants test

should be based on gross, whereas for all other tests the use of net is appropriate. Gross

and net program impact considerations should be applied to all types of demand-side

management programs, although in some instances there may be no difference between

gross and net.

8. The use of sensitivity analysis, i.e. the calculation of cost-effectiveness test results using

alternative input assumptions, is encouraged, particularly for the following programs:

new programs, programs for which authorization to substantially change direction is

being sought (e.g.,, termination, significant expansion), major programs which show

marginal cost-effectiveness and/or particular sensitivity to highly uncertain input(s).

The use of many of these guidelines is illustrated with examples of program cost

effectiveness contained in Appendix B.

28

Appendix B

Summary of Equations and Glossary of

Symbols

Basic Equations

Participant Test

NPVP = BP - CP

NPVavp = (BP - CP) / P

BCRP = BP/CP

DPP = min j such that Bj > Cj

Ratepayer Impact Measure Test

LRIRIM = (CRIM - BRIM) / E

FRIRIM = (CRIM - BRIM) / E for t = 1

ARIRIMt = FRIRIM for t = 1

= (CRIMt- BRIMt )/Et for t=2,... ,N

NPVRIM = BRIM — CRIM

BCRRIM = BRIM /CRIM

Total Resource Cost Test

NPVTRC = BTRC - CTRC

BCRTRC = BTRC / CTRC

LCTRC = LCRC / IMP

Program Administrator Cost Test

NPVpa = Bpa - Cpa

BCRpa = Bpa / Cpa

LCpa = LCpa / IMP

29

Benefits and Costs

Participant Test

! !

= =

""

+

+

+

+

++

=

N

t

N

t

t

atat

t

ttt

d

PACAB

d

INCTCBR

Bp

1 1

11

)1()1(

!

=

"

+

+

N

t

t

tt

d

BIPC

Cp

1

1

)1(

Ratepayer Impact Measure Test

! !

= =

""

+

+

+

+

=

N

t

N

t

t

at

t

tt

RIM

d

UAC

d

RGUAC

B

1 1

11

)1()1(

!!

=

"

=

"

+

+

+

+++

=

N

t

t

at

N

t

t

tttt

RIM

d

RL

d