KENTUCKY TRANSPORTATION CENTER

176 Raymond Building, University of Kentucky

859. 257. 4513 www.ktc.uky.edu

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

Cost Benefit Analysis: Applications and Future

Opportunities

Kentucky Transportation Center Research Report — KTC-16-04/SPR16-517-1F

DOI: http://dx.doi.org/10.13023/KTC.RR.2016.04

!

KTC’s Mission

We provide services to the transportation community through research, technology

transfer, and education. We create and participate in partnerships to promote safe and

effective transportation systems.

© 2016 University of Kentucky, Kentucky Transportation Center

Information may not be used, reproduced, or republished without KTC’s written consent.

Kentucky Transportation Center

176 Oliver H. Raymond Building

Lexington, KY 40506-0281

(859) 257-4513

www.ktc.uky.edu

!

Research Report

KTC-16-04/SPR16-517-1F

Cost Benefit Analysis: Applications and Future Opportunities

By

Bryan Gibson, Ph.D.

Kentucky Transportation Center

and

Candice Wallace, Ph.D.

Kentucky Transportation Center

Kentucky Transportation Center

College of Engineering

University of Kentucky

Lexington, KY

in cooperation with the

Kentucky Transportation Cabinet

The contents of this report reflect the views of the authors, who are responsible for the facts and accuracy of the data

presented herein. The contents do not necessarily reflect the official views or policies of the University of Kentucky,

the Kentucky Transportation Center, the Kentucky Transportation Cabinet, the United States Department of

Transportation, or the Federal Highway Administration. This report does not constitute a standard, specification, or

regulation. The inclusion of manufacturer names or trade names is for identification purposes and should not

be considered an endorsement.

June 2016

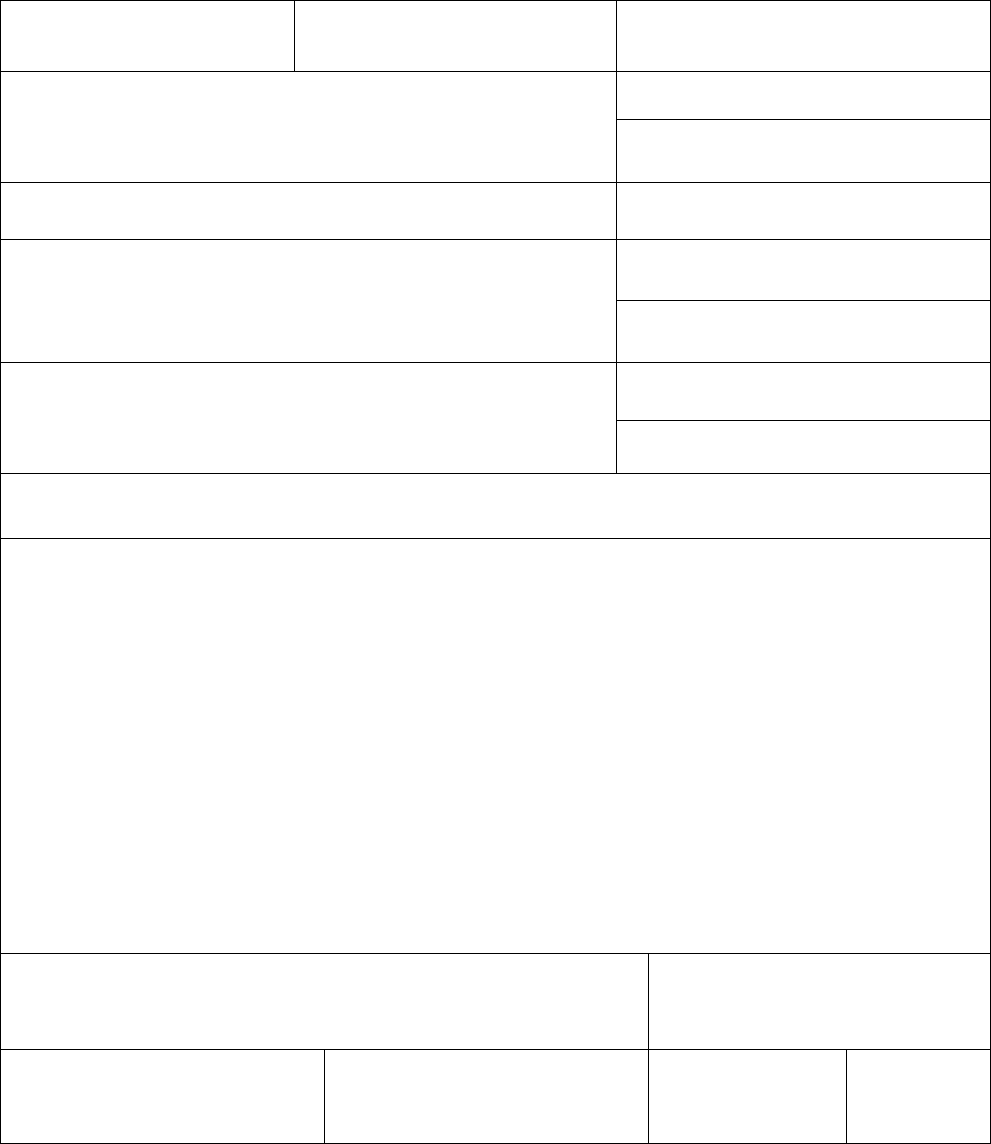

1. Report No.

KTC-16-04/SPR16-517-1F

2. Government Accession No.

3. Recipient’s Catalog No

4. Title and Subtitle

Cost Benefit Analysis: Applications and Future Opportunities

5. Report Date

June 2016

6. Performing Organization Code

7. Author(s):

Bryan Gibson and Candice Wallace

8. Performing Organization Report No.

KTC-16-04/SPR16-517-1F

9. Performing Organization Name and Address

Kentucky Transportation Center

College of Engineering

University of Kentucky

Lexington, KY 40506-0281

10. Work Unit No. (TRAIS)

11. Contract or Grant No.

SPR 16-517

12. Sponsoring Agency Name and Address

Kentucky Transportation Cabinet

State Office Building

Frankfort, KY 40622

13. Type of Report and Period Covered

14. Sponsoring Agency Code

15. Supplementary Notes

16. Abstract

Cost Benefit Analysis (CBA or Benefit Cost Analysis — BCA) is an evaluation tool that state transportation agencies can

use to compare infrastructure project options across transportation modes and gauge if the discounted value of benefits

exceed the costs. CBA lets policymakers compare alternative project proposals to a baseline scenario, or status quo case,

under which no investments are made. CBA is used to select which proposal is the most sensible investment — ideally,

the project that maximizes benefits while minimizing costs should be chosen. As the use of CBA to evaluate projects and

grant applications (e.g., TIGER Discretionary Grants) continues to grow, state transportation agencies must gain

knowledge of CBA methodologies, especially if they want to remain competitive for federal funding. This study

documents historical trends in CBA from literature and past studies, provides background on how CBA’s are performed,

and describes the purpose and basic function of CBAs. The researchers investigated CBA applications and programs that

the Kentucky Transportation Cabinet (KYTC) could potentially use to prioritize projects and identify other investment

opportunities. This report serves as a primer on the basic elements of CBA, describes what costs and benefits are typically

incorporated into analysis, and gives an overview of the formulas that are used to derive costs and benefits. In the

transportation context, most benefits are derived from travel time savings and crash reductions. Typical costs include

construction and subsequent maintenance. Researchers developed a simple workbook application that KYTC personnel

can use run a CBA. The workbook calculates present value of costs and benefits and makes both NPV and BCR available

to the user.

17. Key Words

Cost Benefit Analysis, NPV, BCR, travel time, crash reduction, economic

analysis, transportation infrastructure

18. Distribution Statement

Unlimited

19. Security Classification (report)

Unclassified

20. Security Classification (this page)

Unclassified

21. No. of Pages

47

19. Security

Classification

(report)

iii

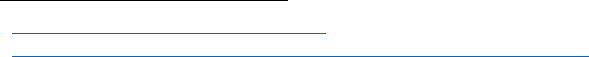

TABLE OF CONTENTS

ACKNOWLEDGEMENTS ............................................................................................................ v!

EXECUTIVE SUMMARY ........................................................................................................... vi!

CHAPTER ONE: INTRODUCTION ............................................................................................. 7!

1.1 Study Overview ..................................................................................................................... 7!

1.2 Research Objectives .............................................................................................................. 8!

1.3 Structure of the Report .......................................................................................................... 8!

CHAPTER TWO: LITERATURE REVIEW ................................................................................. 8!

CHAPTER THREE: COST BENEFIT ANALYSIS BACKGROUND ....................................... 12!

3.1 Introduction to Cost Benefit Analysis ................................................................................. 12!

3.2 Benefits ................................................................................................................................ 15!

3.3 Costs .................................................................................................................................... 17!

3.4 Cost Benefit Analysis Methodologies ................................................................................. 18!

CHAPTER FOUR: COST BENEFIT ANALYSIS APPROACHES ........................................... 27!

Highway Economic Requirements System (HERS-ST) ........................................................... 28!

BCA.NET .................................................................................................................................. 29!

TREDIS Multimodal Benefit-Cost Analysis Tool .................................................................... 30!

MicroBENCOST ....................................................................................................................... 33!

StratBENCOST ......................................................................................................................... 33!

California Life-Cycle Benefit-Cost Analysis Model (Cal-B/C) ............................................... 34!

Tool for Operations Benefit/Cost (TOPS-BC) .......................................................................... 37!

Trip Reduction Impacts of Mobility Management Strategies (TRIMMS) Model .................... 38!

CHAPTER FIVE: IMPLEMENTATION AND CONCLUSION ................................................ 40!

iv

REFERENCES ............................................................................................................................. 42!

LIST of FIGURES

Figure 1: Costs and Benefits Framework ...................................................................................... 15!

Figure 2: Minnesota DOT CBA Process ...................................................................................... 20!

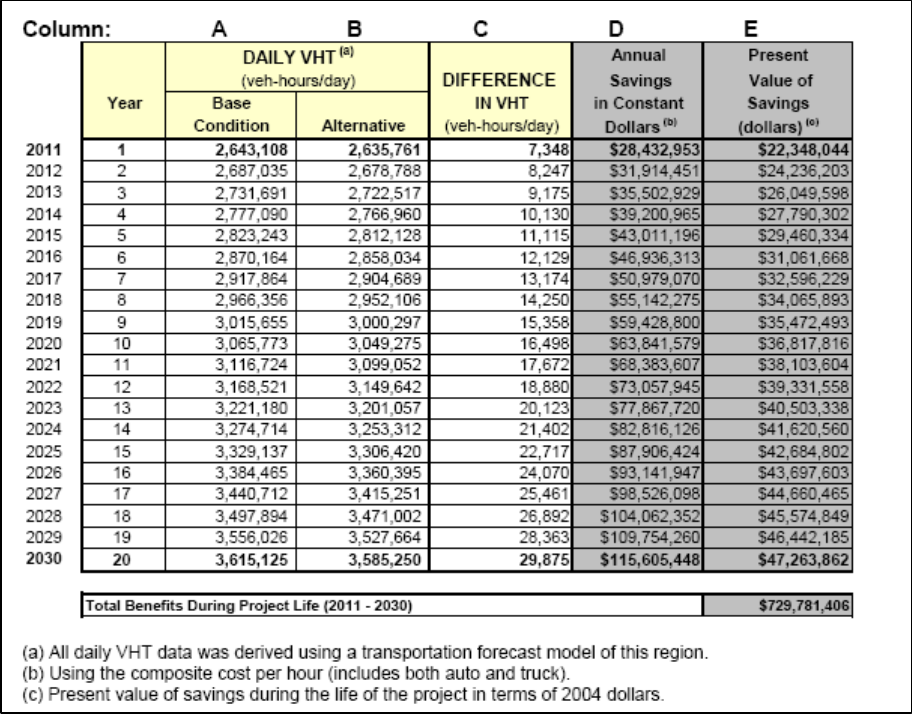

Figure 3: Minnesota DOT Example Benefit Calculation ............................................................. 21!

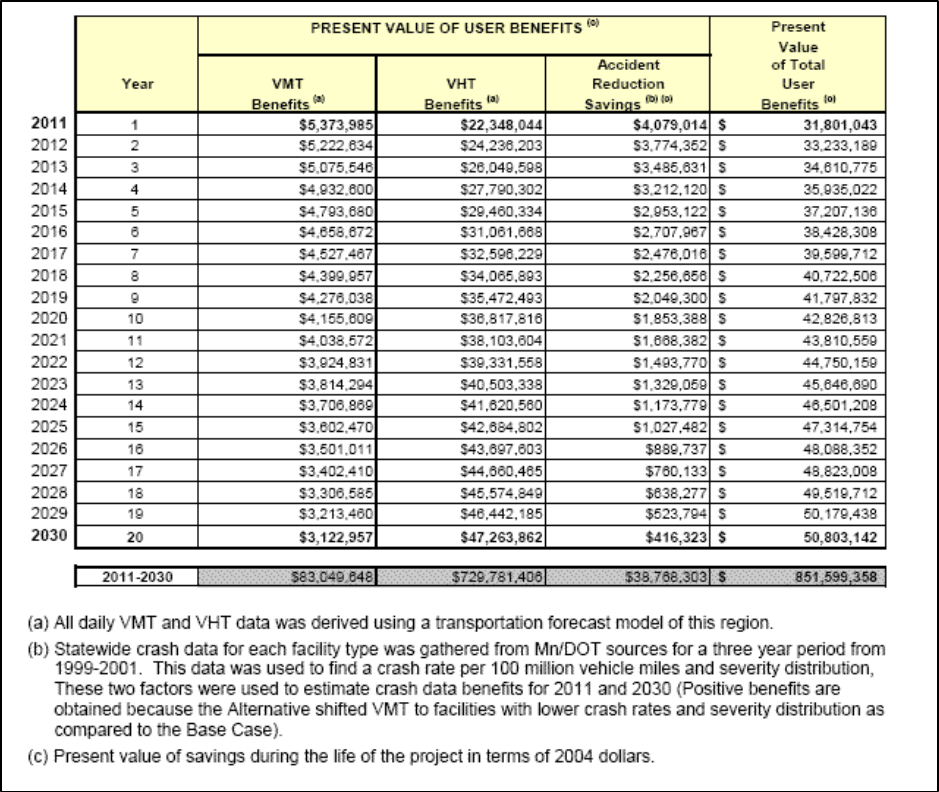

Figure 4: Minnesota DOT Total User Benefits ............................................................................. 22!

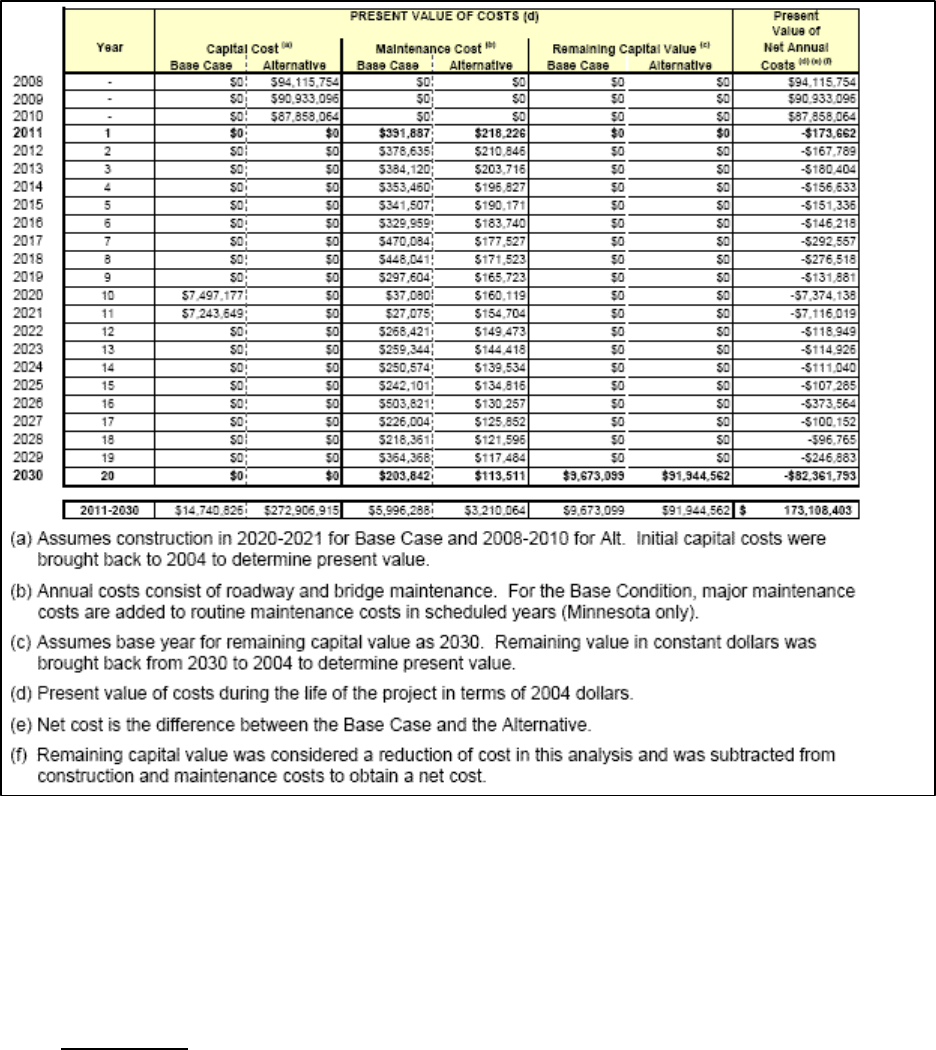

Figure 5: Minnesota DOT Example Cost Calculation .................................................................. 23!

Figure 6: Example Cost Benefit Analysis Calculation ................................................................. 26!

Figure 7: CBA Project Matrix ....................................................................................................... 26!

Figure 8: HERS-ST Screenshot .................................................................................................... 29!

Figure 9: BCA.NET Screenshot ................................................................................................... 30!

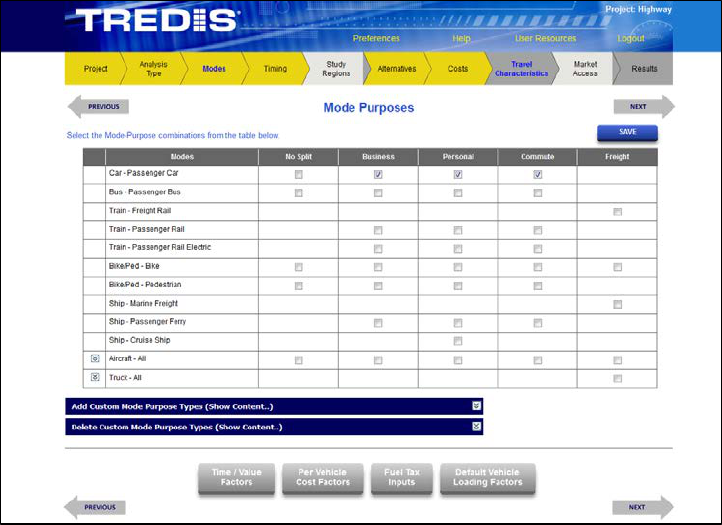

Figure 10: TREDIS MBCA Screenshots ...................................................................................... 31!

Figure 11: TREDIS MBCA Results ............................................................................................. 32!

Figure 12: Cal-B/C Screenshots .................................................................................................... 36!

Figure 13: TOPS-BC Screenshots ................................................................................................ 38!

Figure 14: TRIMMS Model Screenshot ....................................................................................... 39!

LIST OF TABLES

Table 1: FHWA Benefits and Costs to Consider .......................................................................... 14!

Table 2: Transportation Economics Committee Benefits and Costs ............................................ 14!

Table 3: Travel Time Values ........................................................................................................ 16!

Table 4: Crash Values ................................................................................................................... 17!

Table 5: Emissions Values ............................................................................................................ 17!

Table 6: Comparison of CBA and Economic Impact Analysis .................................................... 27!

Table 7: Cal-B/C Projects ............................................................................................................. 35!

v

ACKNOWLEDGEMENTS

The following individuals contributed greatly to the successful completion of this project through

their participation on the Study Advisory Committee.

David Talley (chair) - Kentucky Transportation Cabinet

Paul Looney - Kentucky Transportation Cabinet

Tonya Higdon - Kentucky Transportation Cabinet

vi

EXECUTIVE SUMMARY

Cost Benefit Analysis (CBA or Benefit Cost Analysis — BCA) is a tool that state transportation

agencies can use to perform economic comparisons of infrastructure improvement projects across

transportation modes to determine if a project is a justified investment. CBA lets policymakers

compare alternative project proposals to a baseline scenario, or status quo case, under which no

investments are made. Alternative proposals can also be contrasted with one another. CBA is used

to select which proposal is most sensible — ideally, the project that maximizes benefits while

minimizing costs should be chosen. To facilitate comparison between projects, CBA accounts for

costs and benefits of projects and discounts those in present value terms.

CBA has increasingly been applied to the evaluation of transportation infrastructure projects. Some

federal grant programs, such as Transportation Investments Generating Economic Recovery

(TIGER) Discretionary Grants, require that proposers submit CBA to demonstrate a project’s

expected cost-to-benefit ratio. Despite the increased use of CBA, there are no universal standards

that guide their performance. While most CBAs include similar parameters, there are a number of

programs and methodologies used to conduct them. Additionally, when calculating a CBA there

is some level of subjective judgment that is exercised to determine the costs and benefits associated

with the project being analyzed. This study investigated CBA applications and programs that the

Kentucky Transportation Cabinet (KYTC) could potentially use to prioritize projects and identify

other investment opportunities.

The study reviews literature and past studies on CBA and provides background on how CBAs are

performed. This report serves as a primer on the basic elements of CBA, describes what costs and

benefits are typically incorporated into analysis, and gives an overview of the formulas that are

used to derive costs and benefits. Individuals with limited background and understanding of CBA

should be able to quickly grasp the main concepts after reading this document.

In the transportation context, CBA has several limitations, such as omitting costs or key benefits.

Measuring changes in certain factors like travel time savings and safety improvements that reduce

the number of crashes are not easily converted into a single quantifiable (i.e., monetized) metric.

We also distinguish between CBA and economic impact analysis — an economic impact analysis

differs from CBA in that it measures the dollar value of impacts such as jobs created by a specific

project. Further, the report explores the various inputs required for CBA and the costs and benefits

typically associated with transportation projects. We provide examples of each (e.g., construction

and maintenance costs, emissions reductions, safety improvements (crash reduction), and vehicle

miles travelled). CBA outputs are also discussed such as Net Present Value and Benefit-Cost Ratio.

A number of applications that are used to perform CBAs are discussed, with screenshots of some

of these programs included so readers can understand their templates. After evaluating the options

currently available on the market, the research team decided the best course of action was to create

a modified Excel workbook that KYTC can use to execute CBA. This workbook is based on

Caltrans’ Life-Cycle Benefit-Cost Analysis Model. It is a standalone document that accompanies

this report.

7

CHAPTER ONE: INTRODUCTION

1.1 Study Overview

Cost Benefit Analysis (CBA or Benefit Cost Analysis — BCA) is a tool that state transportation

agencies can use to perform economic comparisons of infrastructure improvement projects across

transportation modes to determine if a project is a justified investment. It can inform long-term

planning processes by letting policymakers compare the costs and benefits associated with a range

of alternative projects. Often, such analysis is not part of the decision-making process but if

capabilities existed it could become an integral part of that process. Additionally, some grant

opportunities require a CBA as part of the application. Since detailed CBA analyses that present

accurate and defensible results are an important part of many application packages, reviewing and

detailing CBA methods is beneficial. A number of programs and methodologies have been

developed to execute CBAs. As a result, there are no consistent, clear guidelines or best practices

for CBA.

When prioritizing and selecting projects, return on investment is a key factor to consider. CBA

gives agencies a way to calculate the benefits and costs of projects. Once the costs and benefits

have been estimated, projects may be analyzed individually or, more often, alternative proposals

are compared to one another. CBA can illuminate whether a project is justified from an economic

perspective and thus is a worthwhile investment. CBA is useful for evaluating transportation

projects that meet the following criteria:

1. “The potential project expenditure is significant enough to justify spending resources on

forecasting, measuring and evaluating the expected benefits and impacts.

2. The project motivation is to improve the transportation system's efficiency at serving travel

and access-related needs, rather than to meet some legal requirement or social goal.

3. Environmental or social impacts that are outside of the transportation system efficiency

measurement are either: (a) negligible in magnitude, (b) measurable in ways that can

be used within the benefit-cost framework, or (c) to be considered by some other form of

project appraisal outside of the benefit-cost analysis.”

1

Some key questions that CBA can help answer/address are (Lawrence et al., 2014):

• Should a project be undertaken?

• When should a project be undertaken?

• Which projects and/or project alternatives should be funded?

• Evaluation of project performance.

CBA can be used to determine which among a range of project alternatives will produce the most

economic benefit. CBA can also help develop project and grant priorities. For example, CBA is a

required component of Transportation Investment Generating Economic Recovery (TIGER)

grants.

2

By developing benefit and cost estimates, policymakers gain a clearer picture of how to

1

http://bca.transportationeconomics.org/home/when-to-use-benefit-cost-analysis

2

“The Transportation Investment Generating Economic Recovery, or TIGER Discretionary Grant program,

provides a unique opportunity for the DOT to invest in road, rail, transit and port projects that promise to achieve

8

allocate funds if return on investment is a key factor to consider when prioritizing projects. If direct

comparison tools are lacking for projects such as those across different modes, CBA can be

utilized.

1.2 Research Objectives

This study investigates CBA applications and programs the Kentucky Transportation Cabinet

(KYTC) can use to assist with project prioritization and other opportunities. To develop accurate

and supportable CBA for projects and grant proposals, it is important to analyze all CBA methods

and practices. Based on the scope and data available for projects, methodology and desired outputs

may vary. This background information can assist the KYTC in selecting tools to develop realistic

cost and benefit estimates that will withstand scrutiny and meet the basic requirements previously

detailed.

1.3 Structure of the Report

Chapter 2 is a literature review that discusses, among other things, past studies on CBA, including

a study that details the impact of CBA on TIGER grant awards. Chapter 3 introduces CBA, which

is followed by a discussion of costs and benefits. TIGER Grant guidelines are used to exemplify

valuations of common costs and benefits. Following this, the research team reports on what steps

are needed to perform a CBA by leveraging guidance from the Minnesota Department of

Transportation and several other sources. Metrics used to compare costs and benefits across

projects, such as net present value, are enumerated. Lastly, differences between CBA and

economic impact analysis are noted. Chapter 4 reviews various CBA programs that KYTC can use

to inform its CBAs, including models developed by the Federal Highway Administration (FHWA)

and California’s Department of Transportation. Chapter 5 presents concluding suggestions and

information regarding the Excel workbook developed for KYTC.

CHAPTER TWO: LITERATURE REVIEW

Historically, CBA has not been widely applied to transportation projects. Barriers to using it have

included data needs, resource use, and political factors (Government Accountability Office, 2005).

However, as pressure has increased to maximize the benefits of public funding, CBA been used

with increasing regularity to justify project selections (Section 1909 Commission Staff, 2007).

Rapid growth in the adoption of CBA by federal agencies can be traced to executive orders issued

during the Reagan and Clinton administrations (Adler & Posner, 1999). Executive Order 12866,

issued by President Clinton, mandated that agencies perform a CBA to scrutinize any regulation

or action that affects the economy by $100 million or more each year:

In deciding whether and how to regulate, agencies should assess all costs and

benefits of available regulatory alternatives, including the alternative of not

regulating. Costs and benefits shall be understood to include both quantifiable

measures (to the fullest extent that these can be usefully estimated) and qualitative

national objectives. Since 2009, Congress has dedicated nearly $4.6 billion for seven rounds of TIGER to fund

projects that have a significant impact on the Nation, a region, or a metropolitan area.”

https://www.transportation.gov/tiger/about

9

measures of costs and benefits that are difficult to quantify, but nevertheless

essential to consider. Further, in choosing among alternative regulatory approaches,

agencies should select those approaches that maximize net benefits (including

potential economic, environmental, public health and safety, and other advantages;

distributive impacts; and equity), unless a statute requires another regulatory

approach (Executive Order, 12866).

President Obama issued Executive Order 13563 to reaffirm the Executive Order 12866’s basic

framework:

As stated in that Executive Order and to the extent permitted by law, each agency

must, among other things: (1) propose or adopt a regulation only upon a reasoned

determination that its benefits justify its costs (recognizing that some benefits and

costs are difficult to quantify); (2) tailor its regulations to impose the least burden

on society, consistent with obtaining regulatory objectives, taking into account,

among other things, and to the extent practicable, the costs of cumulative

regulations; (3) select, in choosing among alternative regulatory approaches, those

approaches that maximize net benefits (including potential economic,

environmental, public health and safety, and other advantages; distributive impacts;

and equity); (4) to the extent feasible, specify performance objectives, rather than

specifying the behavior or manner of compliance that regulated entities must adopt;

and (5) identify and assess available alternatives to direct regulation, including

providing economic incentives to encourage the desired behavior, such as user fees

or marketable permits, or providing information upon which choices can be made

by the public (Executive Order, 13563).

CBA has been used in a number of contexts, such as the Environmental Protection Agency (EPA),

where it has increased the agency’s transparency with respect to project impacts and prioritization.

As the private sector becomes more involved in the delivery of government-funded projects there

will be a need to routinely perform CBAs to evaluate their anticipated public benefits.

Limitations of Cost Benefit Analysis

Agencies must consider a number of factors and limitations when they conduct a CBA. It can be

challenging to accurately estimate the value of costs and benefits associated with a project (Guo

et al., 2008). Status-quo base cases must be developed with extreme care — if these are incorrect,

subsequent calculations will also be inaccurate. Agencies should avoid bundled CBAs, which

evaluate the costs and benefits across multiple projects using a single analysis. The benefits and

costs for each project may not be transparent (i.e., they may be hidden by other projects. When

estimating benefits and costs, the potential for omission always exists. A prime example of this is

neglecting to count benefits and costs that may accrue beyond an agency’s jurisdiction.

Calculations must avoid double-counting benefits that may already be captured (such as economic

benefits within reductions in congestion) as well.

Travel time savings and crash reductions (safety improvements) are the benefits most frequently

realized from transportation projects (Kulkarni et al., 2004). However, it can be difficult to measure

10

the changes in these two factors. “With regard to estimating the change in the pre-project impact

levels, many factors besides the project improvement impact such parameters as travel time and

accident frequency, and assessing the effect of such project improvement is often difficult”

(Kulkarni et al., 2004 p. 151). For example, variability in travel times may be omitted from CBAs

despite unreliability in travel times imposing significant costs on motorists (Peer, Koopmans, &

Verhoef, 2012). A number of scholars have indicated that variable costs can be an important factor,

accounting for 10 to 15 percent of travel time costs (Eliasson, 2006; Fosgerau et al., 2008). Peer

et al. (2012) used both an expected constant travel time for a particular road over a certain time

period and travel times based on factors that are unique to a certain day such as weather. They

argued that mean travel time can be used to predict variable travel times and that longer delays are

related to higher variability. Benefits like improved rideability may also be difficult to measure by

a CBA because they are not easily quantified.

A single project is sometimes framed as combinations of several smaller interrelated projects,

which makes developing a comprehensive CBA problematic (Lawrence et al., 2014). Inaccurate

or missing data, an inconsistent or methodologically unsound framework, or the absence of tools

to facilitate analysis can also pose significant obstacles when performing a CBA. These issues can

lead to omitted values, double counting, inaccurate discounting, and other errors that undermine a

CBA’s usefulness. Questions have been raised about how to value time savings versus human lives

in the context of transportation safety projects (Hauer, 2011). By discounting the value of deaths

prevented by safety improvements, Hauer argues that CBA can produce results biased against

projects that emphasize safety. Policymakers should also keep in mind that a CBA is a decision

tool — it does not favor outcomes on moral grounds (Adler & Posner, 1999). Many agencies do

not perform CBAs because there are few resources available to do so once the challenges of

mandatory planning, environmental analysis, and other assessments have been tackled. Political

influence can dampen the influence of CBAs as well, which is a result of competing constituencies

and interest groups lobbying for specific projects irrespective of their costs and benefits.

CBA has limitations when applied to large-scale projects, such as statewide highway plans

(Kulkarni et al., 2004). But it has been used to measure the impacts of significant corridor projects

(Balducci, 2012), intercity bus service (Guo et al., 2008), and winter maintenance approaches

(Veneziano et al., 2010) through road weather management (RWM) programs (Lawrence et al.,

2014). Because transportation projects often generate impacts outside of the local area in which

they are constructed, properly delineating the area that should be included in a CBA is critical

(Bartin et al., 2012). The geographic area analysis that is focused on significantly influences

results. For example, traffic levels can affect how specific projects are valued. As such, projects

focused on rural areas may yield fewer calculated benefits; policymakers may use this information

to argue projects in areas with low traffic do not merit funding because projects in more populated

areas will produce greater returns. When examining a statewide plan, there are a large number and

variety of projects that improve various facets of the transportation system. Projects in different

regions may also have differences in construction costs, which can affect a CBA. Geographic

variability is likely to be more problematic for states with a large footprint.

11

Advantages of Cost Benefit Analysis

Despite its potential limitations, from a budgetary perspective CBA is a more reliable way to rank

maintenance and rehabilitation projects than approaches such as a worst-first ranking (Menendez

et al., 2013). Problems arise over the ability of the organization, particularly smaller organizations,

to conduct a CBA and the data needed for inputs. Incomplete data can have significant impacts on

the sensitivity of CBA (Williges & Mahdavi, 2008). CBA may be inappropriate if projects have to

meet legal requirements that a typical CBA is unable to capture, such as safety, addressing equity

concerns, and maintaining or renovating existing infrastructure (often a base case scenario).

Because a CBA is not a dynamic analysis, there can be questions of optimal timing when selecting

infrastructure projects (Godinho & Dias, 2012). Some researchers have raised questions about

when CBAs are executed during project development. If they are completed too late in the planning

process or require so much information that comprehensive planning has already taken place, they

may not be helpful to transportation agencies (Beukers et al., 2012).

Another potential issue with CBA relates to their treatment of the distribution of benefits among

various population and income groups (Brent, 1996). Traditionally, stakeholders that may either

reap benefits or suffer costs include people who use infrastructure, the agency responsible for the

project, and the community (Sallman et al., 2012; see Table 1). Martens (2011, p. 961) proposed

that an equity analysis should accompany a CBA. The equity analysis should ask three questions:

1) Which goods and bads or benefits and costs should be at the focus of the equity

analysis?

2) How should ‘members of society’ be conceptualized, i.e. which population groups

should be distinguished?

3) What constitutes a ‘morally proper distribution’, i.e. which yardstick or distributive

principle should be used to determine whether a particular distribution is fair?

Evaluating a CBA from an equity perspective decomposes the benefits and costs of a project, and

it reveals how costs and benefits are distributed among various populations (e.g., pollution affects

different age groups differently). Once there has been a decision about what costs and benefits to

focus on, the analysis can divide the population into appropriate demographic segments. For

example, straight benefits could be divided by income or other measures, mobility benefits divided

by car ownership and income, and individual benefits by criteria that are relevant to each benefit

and cost under consideration. Several factors can be used to determine what an acceptable

distribution of benefits and costs looks like. Benefits and costs can be equally distributed among

all demographics. An equity perspective would discourage saddling particular demographics with

either disproportionate costs or benefits. Equalizing benefits and costs can be considered where

benefits and costs are distributed in an effort to narrow existing societal differences. This can also

be considered a compensatory approach that redistributes wealth (Schofield, 1987). If

policymakers want to include these additional parameters, then it is customary to supplement CBA

results with an equity analysis, although the latter is separate from the basic CBA results

(Levinson, 2002).

CBA has been used as criteria for awarding TIGER grants. Homan et al. (2014) explored what role

CBAs played in awarding of the first round of TIGER grants. The multi-layered review process

12

consisted of evaluation, economic analysis, and control and calibration review teams. Evaluating

the proposals of awardees and non-awardees along several analytical axes, the authors found that

some aspects of the CBA, such as quality and expected benefits, were insignificant factors. Projects

that funded transit were found to be significant (more likely to receive funding) along with projects

that showed additional shared funding. However, the most important factor was whether the

project was forwarded to an additional evaluation team, referred to as a Control and Calibration

Team (p.48).

Ultimately, the single most important factor was whether a special Control and

Calibration Team had forwarded a project to the RT (Review Team). This team

relied on other considerations besides the published primary and secondary

evaluation criteria used by the Evaluation Team. We found that the outcome of the

BCA and likelihood of net social benefits were significantly lower for projects

forwarded by the Control and Calibration Team vis-a-vis than those forwarded by

the Evaluation Team. When analyzing only the projects forwarded by the

Evaluation Team we found that the quality (outcome) of the BCA was significantly

better for projects that received a grant. At the margin, this might indicate that the

RT did consider the quality of a BCA somewhat in deciding whether to award a

project when the Evaluation Team forwarded projects based on the accepted

criteria.

While this analysis of early TIGER grant awards did not indicate that CBA was a significant factor,

it is important to note that if CBA included with a proposal did not hold up under scrutiny with the

Economic Analysis Team, then that information was transmitted to the Review Team along with

recommendations from the Evaluation Team.

CHAPTER THREE: COST BENEFIT ANALYSIS BACKGROUND

3.1 Introduction to Cost Benefit Analysis

In a transportation context, CBA is used to calculate project benefits and costs to decide whether

a project can be financially justified. They are also used to compare alternative scenarios and/or

projects.

3

The Minnesota Department of Transportation’s (MNDOT) Planning and Programming

Section describes CBA in the following manner:

A benefit-cost analysis is a systematic evaluation of the economic advantages

(benefits) and disadvantages (costs) of a set of investment alternatives. Typically,

a “Base Case” is compared to one or more Alternatives (which have some

significant improvement compared to the Base Case). The analysis evaluates

incremental differences between the Base Case and the Alternative(s). In other

words, a benefit-cost analysis tries to answer the question: What additional benefits

will result if this Alternative is undertaken, and what additional costs are needed to

bring it about?

4

3

http://bca.transportationeconomics.org/

4

http://www.dot.state.mn.us/planning/program/benefitcost.html#section2

13

The Transportation Economics Committee of the Transportation Research Board (TRB) defines

CBA as a tool for economic evaluation that “uses monetized (measured in monetary units) values

to compare total incremental benefits with total incremental costs.”

5

CBA accounts for changes in

benefits and costs compared to the status-quo across the project’s lifecycle. This provides initial

information as to whether the project should be undertaken at all (benefits>costs). Once this first

measure has been completed, a CBA can discriminate among alternative project options along the

same roadway or evaluate the costs and benefits of competing projects located on different

roadways. According to the Transportation Economics Committee, CBA is most applicable for

projects that:

• Are large enough to justify the price of a thorough analysis

• Improve transportation systems rather than altering them to meet legal requirements or

some other measure

• Have environmental costs which are insignificant or can be assigned monetary values to

include in the analysis.

To analyze all years of a project’s lifecycle, a discount rate is used to derive benefits and costs.

The discount rate measures the “marginal social opportunity cost of funds allocated to public

investment” (Zhuang et al., 2007, p. 1).

Generally, benefits accrue over a number of years while most costs are incurred up front during

the initial construction. Smaller annual maintenance costs accumulate over the life of the asset.

CBA assigns benefits dollar values and discounts them in order to calculate the cost-benefit ratio.

“The primary transportation-related elements that can be monetized are travel time costs, vehicle

operating costs, safety costs, ongoing maintenance costs, and remaining capital value (a

combination of capital expenditure and salvage value).”

6

CBA is conducted at various points

during project development and can supplement other project development measures, such as

public input. Additionally, CBA is not used strictly for infrastructure analysis. It can measure the

costs and benefits of projects related to management and operations (Sallman et al., 2012).

When conducting CBA, the selection and valuation of appropriate benefits and costs is critical to

the process. Failing to identify all relevant costs and benefits may produce inaccurate results. The

FHWA lists common benefits and costs that are often investigated when conducting CBA (Table

1)

7

.

5

http://bca.transportationeconomics.org/home/when-to-use-benefit-cost-analysis

6

http://www.dot.state.mn.us/planning/program/benefitcost.html#section2

7

http://www.fhwa.dot.gov/infrastructure/asstmgmt/primer05.cfm

14

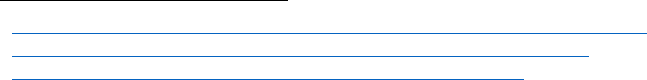

Table 1: FHWA Benefits and Costs to Consider

Agency Costs

Design and Engineering

Land Acquisition

Construction

Reconstruction/Rehabilitation

Preservation/Routine Maintenance

Mitigation

Users

(work zones)

Delay

Crashes

Vehicle Operating Costs

Users

(operations)

Travel Time and Delay

Crashes

Vehicle Operating Costs

Externalities

Emissions

Noise

Other

TRB’s Transportation Economics Committee also lists a number of benefits and costs to evaluate

(summarized in Table 2).

8

Table 2: Transportation Economics Committee Benefits and Costs

Benefits

Travel time

Vehicle cost savings

Safety improvements (crash reduction)

Emissions reductions

Parking savings (if project reduces vehicle ownership/use)

Costs

Initial costs (acquisition, planning, design, engineering, and construction)

Continuing costs (operations, maintenance)

Rehabilitation costs

End of project costs (residual value, salvage value)

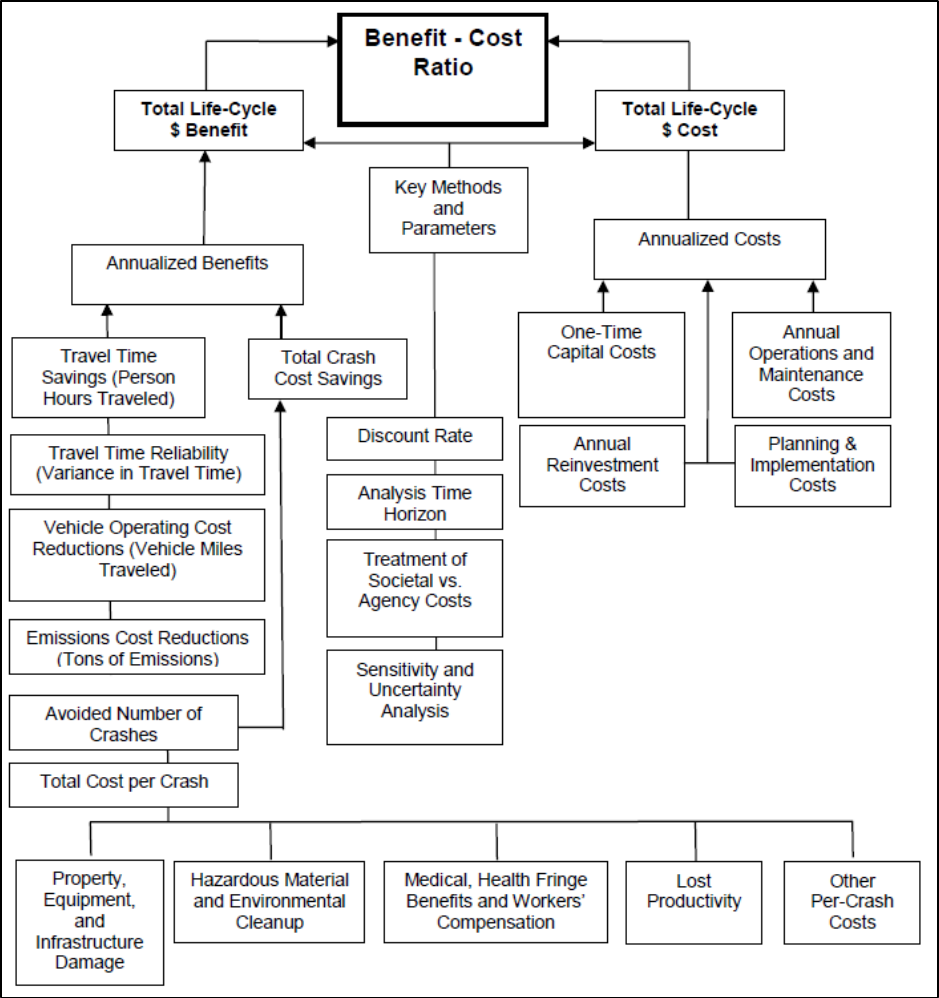

Figure 1 (Balducci 2012, p. 2-2, Figure 2-2) illustrates a more complex accounting of benefits and

costs in a corridor analysis.

8

http://bca.transportationeconomics.org/home

15

Figure 1: Costs and Benefits Framework

3.2 Benefits

Sullivan et al. (2008) listed the four benefits most commonly realized from transportation projects.

These are: travel time savings, a reduction in vehicle operating costs, improved safety, and reduced

emissions. Williges and Mahdavi (2008) noted that outside of travel time savings, operating costs,

and safety, other benefits are often bracketed as externalities because they are not part of travel

decision making. Assigning values and developing accurate data and measures for these potential

benefits is often difficult, and many times they are not included in CBA. Many of the benefits and

16

costs that should be considered are easily identifiable. For example, a reduction in crashes (and/or

crash severity) benefits users by shrinking travel times, reducing vehicle operating costs, and

preventing injuries and fatalities (which can be assigned a monetary value). Minnesota DOT notes

that travel time savings are often the greatest project benefit, generally expressed in terms of

vehicle-hours travelled. Section 1909 Commission Staff (2007) described the valuation of travel

time as follows (p.5):

An hour of travel associated with a business trip or commerce is usually valued at

the average traveler's wage plus overhead—representing the cost to the traveler's

employer. Personal travel time (either for commuting or leisure) is usually valued

as a percentage of average personal wage based on estimates of what travelers

would be willing to pay to reduce their travel time.

During CBA, estimates of travel times prior to and after project implementation demonstrate the

total change in travel time which can be attributed to a specific project alternative. More exactly,

the annual benefits that stem from a reduction in vehicle-hours travelled equals the total annual

hours saved multiplied by the hourly value of time, which varies based on the type of travel and

mode of travel. Projects are designed to reduce congestion (e.g., adding a lane), reduce travel time,

and potentially reduce vehicle costs. TIGER Grants have an accompanying Benefit-Cost Resource

Guides

9

with updated values of travel time in 2013 dollars.

10

These are shown below in Table 3.

Table 3: Travel Time Values

Type

Surface Modes

(excluding High Speed

Rail)

Air and High

Speed Rail

Local

Personal

$12.42

Business

$25.23

All (weighted averages 95.4% person, 4.6%

business)

$12.98

Intercity

Personal

$17.39

$33.05

Business

$24.44

$60.74

All (weighted averages 78.6% personal,

21.4% business for surface; 59.6% personal,

40.4% business for air and high speed rail )

$18.90

$44.24

Vehicle operating costs can result from changing travel distance, the number of stops, and altering

roadway conditions. At a micro level, analysis can focus on the type of vehicle, speed, changes in

speed, grade and curve of route travelled, and road surface condition. Safety improvements can be

measured by valuing crashes (severity), the changes which result from improvements, and trends

in accident costs. Crash elements investigated often include property damage, traffic delay, lost

9

https://www.transportation.gov/sites/dot.gov/files/docs/TIGER%20BCA%20Resource%20Guide%202014.pdf.

17

wages, pain, and emergency services. Table 4 summarizes the values assigned for loss of life and

injuries of different scenarios found in the TIGER Benefit-Cost Resource Guide.

Table 4: Crash Values

Value of Statistical Life (VSL)

$9.2 million per fatality

Value of Injuries

Severity

Fraction of VSL

Value

Minor

0.003

$27,600

Moderate

0.047

$432,400

Serious

0.105

$966,000

Severe

0.266

$2,447,200

Critical

0.593

$5,455,600

Property Damage Only

$3,927 per vehicle

A cutback in emissions is another potential benefit of transportation projects. If a proposed project

reduces travel time and miles travelled, emissions will decline, yielding health and environmental

benefits. However, the linkage between different types of emissions and their levels is less clear.

Once a CBA estimates the changes in traffic activity that will result from a project, the implications

for emissions can be assessed, and changes in emissions can be monetized based on recommended

values. Emission values from the TIGER Benefit-Cost Resource Guide are shown in Table 5.

Table 5: Emissions Values

Emission

Dollars per metric ton

Carbon dioxide

$39*

Volatile Organic Compounds

$1,999

Nitrogen Oxides

$7,877

Particulate Matter

$360,383

Sulfur Dioxide

$46,561

*Social cost of carbon (3%) is present value of marginal future climate damage

Additional benefits to consider when developing a CBA include: induced travel changes resulting

from a project (changes in route, mode, travel time, new trips), changes in travel time reliability

(measure and value needed), the negative impact of construction on overall benefits (additional

costs due to congestion, diversion, and so forth during construction), noise, and parking impacts

of certain projects. Many of these benefits are more difficult to estimate or only apply to certain

types of projects.

3.3 Costs

Agency, or project, cost is the amount of money needed to complete a specified project (Tables 1

and 2). Initial costs are incurred from the design and construction phases. If resources already in

use — such as engineering staff — are diverted to a project, a CBA should include the opportunity

cost of those resources. Sunk costs (i.e., resources that are already owned and lack any opportunity

cost) should be excluded from calculations. After construction is finished on a project, there are

continuing costs, which may encompass traffic management, tolling operations, maintenance, and

rehabilitation (e.g., resurfacing or major repairs that general maintenance would not cover). When

18

the project reaches the end of its lifecycle, a residual or salvage value may exist. This value will

vary among projects and is partially offset by final costs associated with project closeout.

Costs must include those related to construction and future maintenance (Minnesota DOT, 2012).

As such, capital, major rehabilitation, and annual maintenance costs should be factored into CBAs.

Costs generally appear straightforward, including initial construction costs and maintenance costs

over the life of the project. However, other considerations when determining costs are (Sullivan et

al., 2008, p. 284):

• Discounting of future costs (and benefits), including selection of the discount rate

• Dealing with opportunity costs

• Dealing with inflation, and the distinction between economic and financial analyses

• Proper treatment of transfer payments and avoidance of double counting

• Avoidance of sunk costs

• Dealing with joint costs

• Dealing with uncertainty and the role of sensitivity analysis

Additional variables may influence benefits and costs, but are difficult to value. These include

changes in travel patterns due to the project, noise pollution or abatement, environmental impacts

to habitats and water quality, economic and other impacts on surrounding community, and traffic

impacts during construction (e.g., increased congestion or diversions). Benefits that are less certain

may be documented by interviewing and surveying affected population demographics.

Also difficult to calculate are the residual value of the asset that remains after its lifecycle has

ended and the impact of externalities on people who do not benefit from the project. Economic

Development Research Group (2010) defines residual value as: “The value of an investment as a

benefit after: (1) depreciating the investment to the end of the BCA analysis period, and then (2)

discounting the depreciated nominal value” (p. 23). Subtracting cumulative depreciation over the

life of the asset and applying the discount rate yields its residual value. Positive and negative

externalities can result from projects. Valuing these is often difficult, and may not be possible in

some cases (e.g., emissions). Environmental impacts such as emissions may be calculated based

on EPA data. In cases where no dollar amount can be assigned, qualitative perceptions of

externalities may integrated into CBA.

3.4 Cost Benefit Analysis Methodologies

Generally, transportation projects are designed to meet objectives such as increased road capacity,

crash reductions, or some other goal. Many projects have multiple objectives, and these will need

to be accounted for by CBA. Constraints may include policy and legal impediments to the proposed

project. When developing a CBA, the first step is to identify the costs and benefits of the base case,

which is the minimal option wherein operations continue without any major capital investment.

The base case scenario is then compared to different project options (e.g., rehabilitating or entirely

reconstructing a deteriorating road), specifically, the costs and benefits that would be realized

under each scenario. The period for analysis includes the alternatives’ lifecycles, ensuring that the

CBA captures all benefits and costs. Then, dollar amounts are assigned to the benefits and costs

and discounted appropriately. If an analyst is uncertain about the specific impacts of a project (and

19

therefore its costs and benefits), the likelihood of CBA generating an error increases, which makes

the prospect of doing comparisons shaky.

We review and summarize several sources that describe the application of CBA to transportation,

including the FHWA’s Economic Analysis Primer on Benefit-Cost Analysis and the Minnesota

DOT’s Benefit-Cost Analysis for Transportation Projects, below.

The FHWA lists the major steps in the CBA process

11

:

1. Establish objectives

2. Identify constraints and specify assumptions

3. Define base case and identify alternatives

4. Set analysis period

5. Define level of effort for screening alternatives

6. Analyze traffic effects

7. Estimate benefits and costs relative to base case

8. Evaluate risk

9. Compare net benefits and rank alternatives

10. Make recommendations

Guo et al. (2008, p. 4-5) synthesized a novel approach to CBA based on several sources:

1. Define the base case and the options

2. Identify the scope of the CBA

3. Identify investment impacts within the scope

4. Measure the impacts and convert them into dollar values

5. Calculate the net present value for the options proposed

6. Conduct sensitivity and/or risk analyses

7. Make funding decisions based on the information gathered

Although a number of other sources provide guidance on CBA, they usually mirror the approaches

noted. There appears to be consensus among researchers that the most basic steps of CBA involve

defining the base case and proposed alternative, listing and valuing benefits and costs, conducting

net present value calculations, and producing recommendations.

Minnesota DOT has developed a blueprint for conducting CBA on highway projects.

12

Many

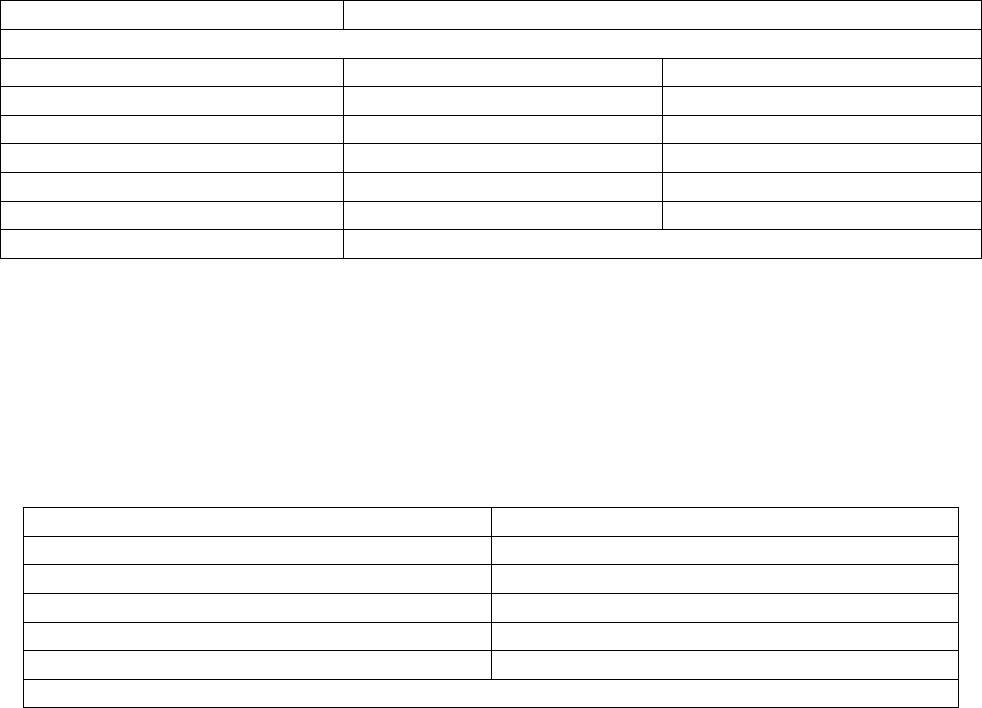

aspects of their CBA process align with the FHWA’s. The four steps of CBA are: 1) planning and

defining the scope of the analysis, 2) analyzing the alternatives, 3) calculating benefits and costs

to present value, and 4) evaluating results. Several figures illustrate how to perform these

calculations.

Figure 2 captures the inputs and outputs for CBA in relation to the four steps.

11

http://www.fhwa.dot.gov/infrastructure/asstmgmt/primer05.cfm

12

For a discussion of benefits and costs associated with transit projects see Guo et al. (2008) p. 9-12.

20

Figure 2: Minnesota DOT CBA Process

13

Each stage includes several sub-tasks. As part of the initial scope and project planning, the purpose

of the analysis needs to be defined. Data availability must be assessed because it will determine

13

Source: Minnesota DOT, http://www.dot.state.mn.us/planning/program/benefitcost.html

21

the level of detail that is feasible. Initial work should define the base case and alternatives it will

be compared to and the timeframe (construction, benefits lifecycle) the analysis should cover.

Once these decisions have been made, the salient data must be collected. The next step is to analyze

the alternatives relative to one another and the base case. This analysis should focus on benefits

that arise from changes in travel times, vehicle operations, and safety, and the costs including

construction, maintenance, and minor rehabilitation. Deriving present value calculations requires

monetization of costs and benefits. Minnesota DOT’s guidance suggests quantifying highway user

benefits (e.g. vehicle miles travelled, vehicle hours travelled, safety) and leveraging the resulting

calculations to make comparisons among the alternatives and base case. Once the benefits and

costs of the alternatives for the specified period of analysis have been identified, the next step is

to aggregate and convert dollar amounts using present value calculations (formula and details are

discussed later). Figure 3 is an example the Minnesota DOT provides that relates to benefits

derived from vehicle hours per day. Figure 4 summarizes the total benefits that users might derive

from a highway project including vehicle miles travelled, vehicle hours travelled, and safety.

Figure 3: Minnesota DOT Example Benefit Calculation

22

Figure 4: Minnesota DOT Total User Benefits

Next, the base case is compared to the alternatives by calculating how they differ from one another

in terms of highway user metrics. To facilitate comparisons, those differences are converted to

dollar amounts, which in turn are adjusted to present value. The total user benefits for each scenario

equals the sum of individual benefits calculations. Cost calculations allocate expenditures across

the project’s life and/or period of analysis for construction and associated maintenance. Whatever

value remains at the end of the period of analysis is the remaining capital value. This is calculated

by determining the percentage of remaining useful life at the last year of the analysis. Figure 5

illustrates one method for calculating total project costs.

23

Figure 5: Minnesota DOT Example Cost Calculation

Results can be evaluated using several approaches. Net present value (NPV), Benefit-Cost Ratio,

and Incremental Benefit-Cost Ratio are often used to contrast the alternatives from an economic

perspective. Payback period and internal rate of return can be used as well. NPV discounts all

benefits and costs and then subtracts costs from benefits. The following equation can be used to

calculate the present value of benefit and cost flows. Results are then summed for multiple benefits

and/or costs:

!" #

$

%

&' ( )*

&%+,*

Where: PV = present value

B = benefit (cost)

N = year benefit (cost) is incurred

o = year to which discounting is occurring

24

d = discount rate

14

Thus, -!" # ./.!"

0

1 !"

2

Where: PV

b

= present value of benefits

PV

c

= present value of costs

If benefits are greater than costs, the NPV is positive. This would suggest a project may be worth

investigating further and potentially undertaken. When a state transportation agency compares

project alternatives, in general it should move forward with the project having the highest NPV.

But there is a caveat to this statement. As the FHWA notes, “Policy issues, perceived risk, and

funding availability may lead to the selection of an alternative with a lower, positive NPV.” That

is, other variables — which are not factored into CBA — may dictate project selection. The FHWA

also observes that benefit-cost ratio (BCR) is another measure that can be used. It is applicable if

there are funding issues that must be considered. To calculate BCR, the benefits are discounted in

the numerator and the agency investment cost discounted in the denominator.

$34 #

/!"

0

/.!"

2

After calculations are completed, a project recommendation can be made. If multiple alternatives

are being considered, the Incremental Benefit-Cost Ratio can be used. The Incremental Benefit-

Cost Ratio compares the change in present value between two alternatives. Alternative project

scenarios are ordered from least to most expensive. The first round of analysis compares only the

first two options. These options are termed the defender and challenger, with the challenger being

the more expensive alternative. The Incremental Benefit-Cost Ratio formula is applied to contrast

projects:

5$34 #

&/.!"

06)

1 /.!"

067

*

&/.!"

26)

1 /.!"

267

*

Where: IBCR = Incremental Benefit-Cost Ratio

PV

b,d

= present value of defender benefits

PV

b,f

= present value of challenger benefits

PV

c,d

= present value of defender costs

PV

c,f

= present value of challenger costs

The difference in the projects’ net benefits is divided by the difference in their net costs. If the

IBCR is greater than or equal to 1.0, it means the benefits of the challenger are equal to or greater

than its increase in costs. If this occurs in the next round of analysis, the current challenger

becomes the defender and is compared to another project. If the IBCR is less than 1.0, the current

defender is retained, and the new challenger is the next alternative on the project list. Comparisons

14

TIGER grants use a 7 percent rate from OMB Circulars A-4 and A-94; an alternative analysis is also allowed with

3 percent. The Congressional Budget Office and General Accounting Office use the rate of marketable Treasury

securities with maturities similar to the length of the project in question (Zhuang et al. 2007).

25

of challengers and defenders are made until all Alternatives have been considered. The surviving

defender is the most economically efficient.

15

Often, state transportation agencies select their preferred evaluation tool; multiple tools can be

used if agency staff think they will improve comparisons. The Transportation Economics

Committee lists several additional measures that can be used to evaluate proposed projects. The

Internal Rate of Return (IRR) is the discount rate that results in the net present value of project

cash flows equal to zero. Projects with a high IRR are considered to have greater value. The

Payback Period is the amount of time required for the cumulative benefits to equal cumulative

costs (both discounted to present value). Last, Cost Effectiveness compares discounted benefits of

alternative projects with the assumption of budgetary constraints. This measure can also be used

to quantify the discounted costs needed to reach a specified benefit.

TIGER Discretionary Grants are an example of a federal grant program that emphasizes CBA. The

U.S. DOT’s 2013 Notice of Funding Availability for TIGER grants noted:

Each applicant should provide evidence that the expected benefits of the project

justify the costs (recognizing that some costs and benefits are difficult to quantify).

If it is clear that the benefits do not justify the costs, the Department will not award

a TIGER Discretionary Grant to the project.

CBAs submitted as part of a TIGER proposal should include the following components:

• Project Summary

• Monetized estimates of benefits and costs

• Replicable Methodology

• Demonstration of independent utility

16

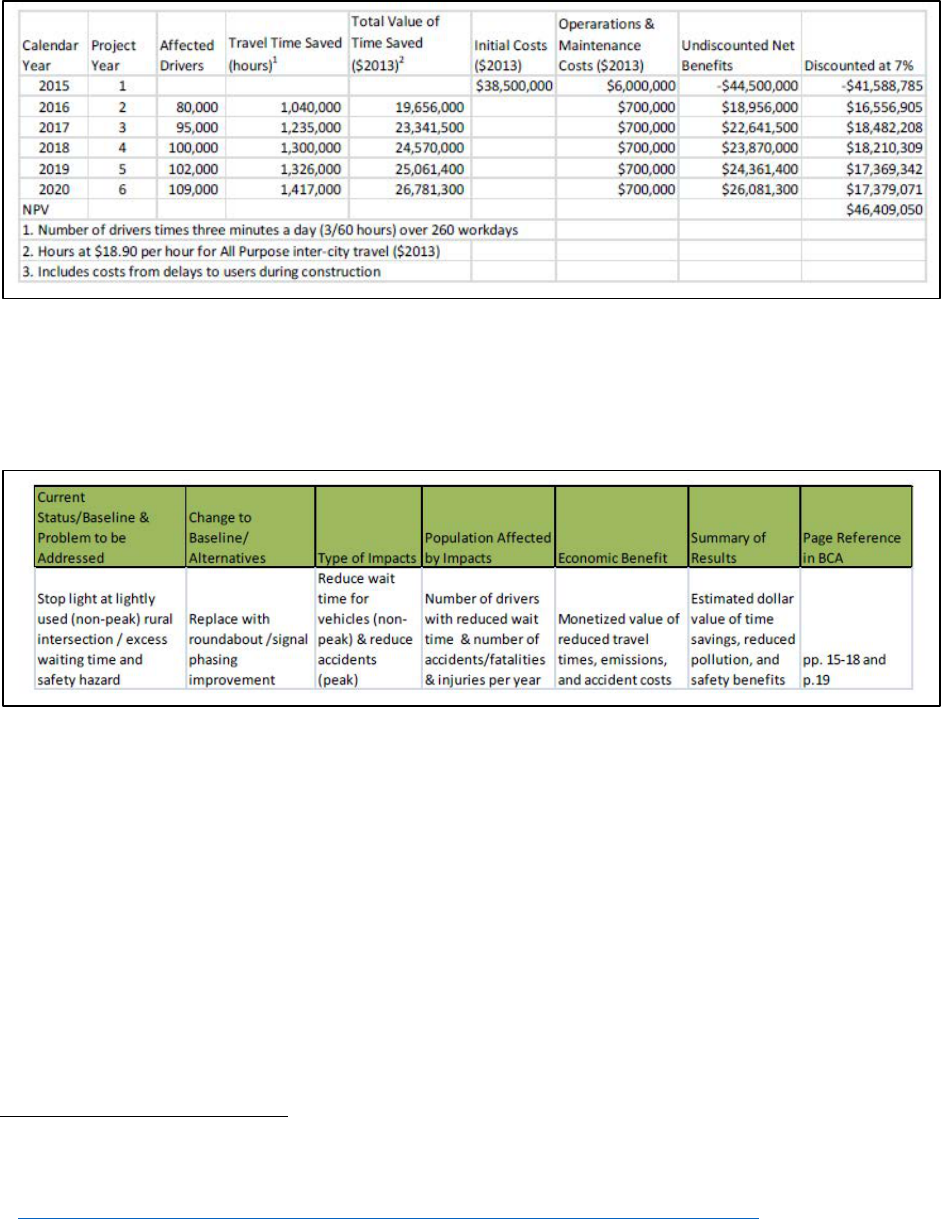

Figure 6 provides an example of a simple CBA calculation used in a TIGER grant proposal. It

shows information from the CBA and the results.

15

http://www.dot.state.mn.us/planning/program/benefitcost.html

16

Information from webinar presented by the Office of Assistant Secretary for Transportation Policy in the U.S.

Department of Transportation.

26

Figure 6: Example Cost Benefit Analysis Calculation

17

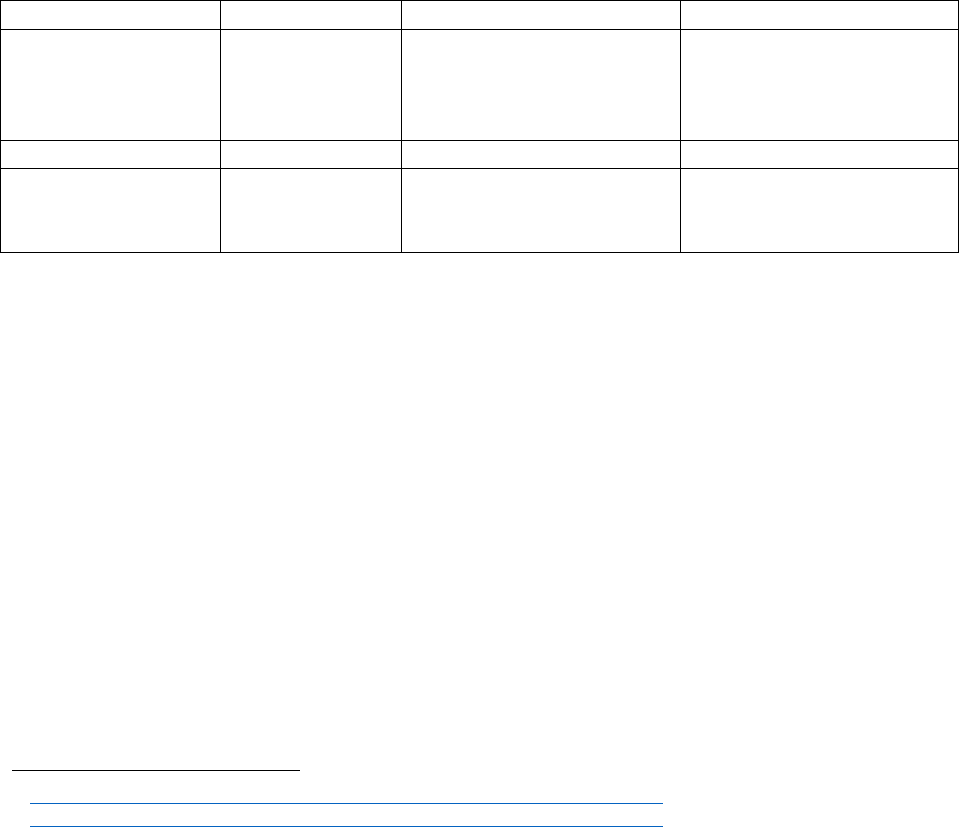

As the TIGER CBA guidance notes, one strategy to effectively communicate the results of a CBA

to wider audiences that are not well-versed in the technical aspects of CBAs is to build a project

matrix that summarizes the findings. Figure 7 is an example from TIGER CBA guidance.

Figure 7: CBA Project Matrix

18

Programs such as the Transportation Infrastructure Finance and Innovation Act (TIFIA) require a

CBA to qualify for federal credit assistance.

19

The FHWA notes that at a minimum “a project's

public and private benefits would be required to exceed the sum of its public and private costs.”

20

Thus, CBA is used to demonstrate whether a project surpasses that threshold.

It is often challenging to distinguish between economic impact studies

21

and CBAs. According to

TIGER grant guidance, CBA measures benefits and costs to society by assigning dollar values. An

economic impact analysis, conversely, measures the dollar value of a specific project’s impacts

(e.g., number of jobs created). It is typically a locally focused analysis that evaluates a project’s

effects on economic activity rather than measuring overall social improvement:

Economic impacts are the effects a project or policy has on the economy of a

designated project area, measured in terms of the change in business sales, jobs,

17

TIGER BCA Guidance, U.S. Department of Transportation.!

18

TIGER BCA Guidance, U.S. Department of Transportation.!

19

TIFIA provides credit assistance for surface transportation projects.

20

http://www.fhwa.dot.gov/ipd/tifia/technical_resources/federal_credit_policy_paper/ch3.aspx

21

See Kreis, Howell, and O’Connell (2006) for an examination of several options for assessing economic impacts of

proposed transportation investment in Kentucky.

27

value added, income, or tax revenue. These effects are sometimes referred to as

“economic development impacts.” Whereas Benefit-Cost Analysis is an exercise to

determine an action's social welfare effects (compared to costs), Economic Impact

Analysis is an exercise to determine how a project or policy affects the amount and

type of economic activity in a region.

22

One way to differentiate economic impact analysis from CBA is by thinking about the questions

they attempt to answer:

• CBA: is society better off by undertaking the project versus doing nothing?

• Economic Impacts: how will the economy change due to a project?

23

Sallman et al. (2012, Table 2-3) looked at several examples of benefits and noted whether CBA or

economic impact analysis explicitly consider them. Table 6 has been reproduced from their piece:

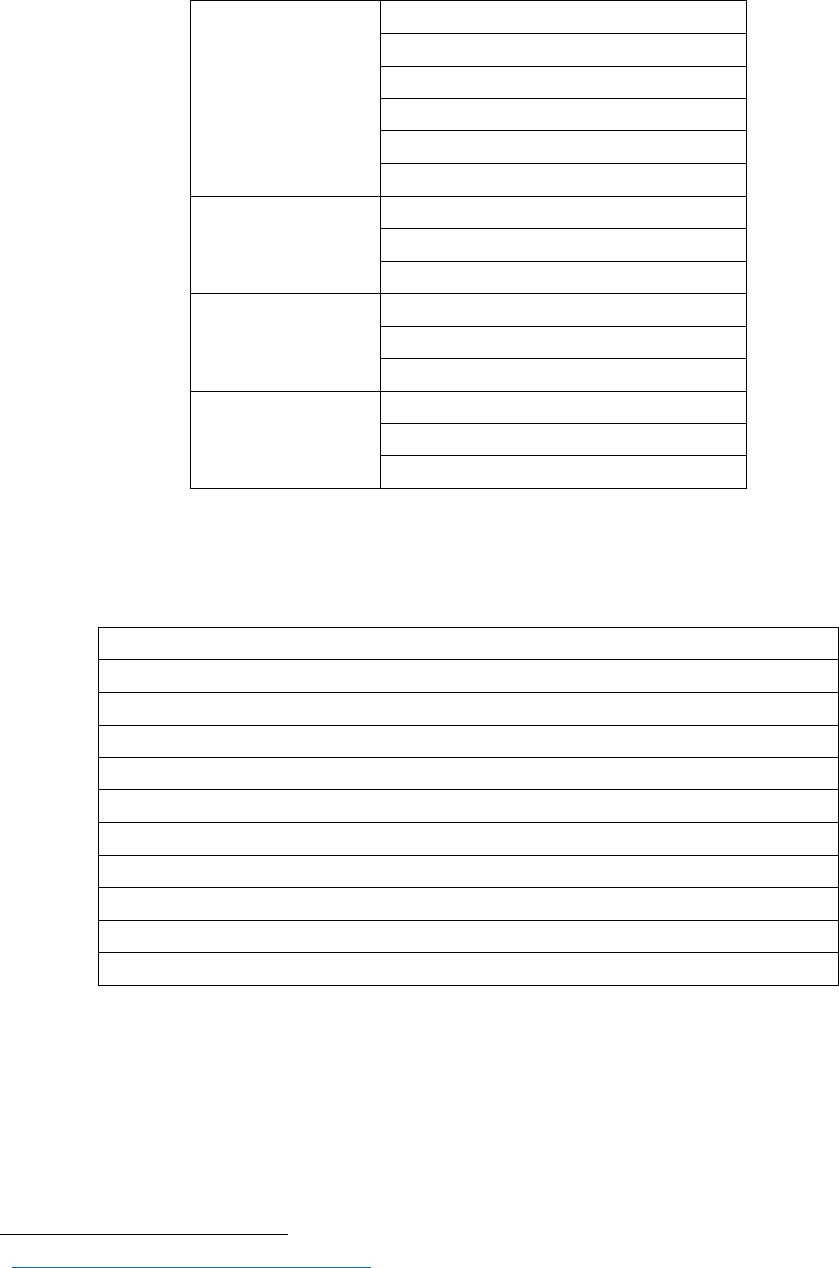

Table 6: Comparison of CBA and Economic Impact Analysis

Type of Benefit

Direct Benefit

Indirect Benefit

Induced Benefit

Example of Benefit

Reduction in

corridor travel

times.

New businesses are

attracted to the corridor by

the improved corridor

performance.

Employees of the new

businesses spend their

incomes at other regional

businesses.

Considered in CBA

Yes

No

No

Considered in

Economic Impact

Analysis

Yes

Yes

Yes

An example of economic impacts runs as follows: building a new road will entice businesses to

relocate near it; as businesses move into the area, new jobs are created and tax revenues increase;

in turn, local residents will enjoy the better transit access which connects them to their new jobs.

CBA is a widely-accepted method of comparing projects options. Data requirements are contingent

on the project in question and which benefits and costs are identified for the project. Identifying a

comprehensive list of these and costing them appropriately will ensure a CBA is valid. Multiple

evaluation criteria can be used to evaluate projects. The information they generate gives decision

makers project-specific information they can use to select and implement projects that will provide

the greatest benefit levels to the constituencies affected.

CHAPTER FOUR: COST BENEFIT ANALYSIS APPROACHES

The FHWA made several efforts to develop CBA tools in the 1990s. While there are no longer

active links to these models online, briefly reviewing their capabilities contextualizes the

development of similar tools today. The Sketch-Planning Analysis Spreadsheet Model (SPASM)

was one of these early models;

24

it was a spreadsheet for use in multimodal analysis at the sketch

22

http://bca.transportationeconomics.org/home/bca-vs-economic-impact-analysis

23

http://bca.transportationeconomics.org/home/bca-vs-economic-impact-analysis

24

For more on SPASM, see Findley et al. (2007) p. 7-9.

28

planning detail level. SPASM was a precursor to the Surface Transportation Efficiency Analysis

Model (STEAM), which assessed multimodal transportation alternatives and approaches to travel

demand. It used travel demand models and outputs to analyze projects such as corridor plans

(Coley, 2012). STEAM focused on regional multimodal analysis. Benefits considered in STEAM

included travel time, vehicle costs, emissions, noise, and energy consumption, whereas the costs

focused on were the initial capital costs and operating and maintenance costs. Other impacts were

also factored in, such as congestion and job impacts. Results were presented as net present value

calculations or benefit-cost ratios.

Given the widespread use of CBA in transportation and other sectors, there are a number of current

applications that can be used to perform CBA. This research involved summarizing and

commenting on a number of these applications; they are listed below. Also provided are any costs

and relevant links. Additionally, the Transportation Economics Committee of TRB describes these

models and provides an example of each.

25

These models can aid policymakers interested in

comparing project alternatives by giving them a more representative look at the benefits and costs

associated with each choice. Used appropriately, these models will lead to improved, cost efficient

project selection and safer, improved travel outcomes for users.

Highway Economic Requirements System (HERS-ST) (Free)

Available at: https://www.fhwa.dot.gov/infrastructure/asstmgmt/hersrprep.cfm

The Highway Economic Requirements System — State Version (HERS-ST) is an FHWA software

program that is an extension of the national-level model used to predict the level of investment

required to meet specified highway performance measures.

HERS-ST is an engineering/economic analysis (EEA) tool that uses engineering

standards to identify highway deficiencies, and then applies economic criteria to

select the most cost-effective mix of improvements for system-wide

implementation. HERS-ST is designed to evaluate the implications of alternative

programs and policies on the conditions, performance, and user cost levels

associated with highway systems. The model will provide cost estimates for

achieving economically optimal program structures, as well as predict system

condition and user cost levels resulting from a given level of investment.

26

HERS-ST is linked to the Highway Performance Monitoring System (HPMS). It can be used to

estimate the highway performance that would be expected from different levels of investment. The

program can consider capital projects focused on addressing issues on the highway system such as

capacity and condition. HERS-ST can select improvement scenarios where the benefits exceed the

costs. Scenarios can be developed using different criteria:

• Given a specified level of funding, determine the best project combinations from an

economic perspective

• Determine the minimum level of spending to achieve performance measures

25

http://bca.transportationeconomics.org/models

26

https://www.fhwa.dot.gov/infrastructure/asstmgmt/hersindex.cfm

29

• Identify the project combinations and spending levels needed to undertake all projects

that meet a certain economic target such as a benefit cost ratio

HERS-ST uses interview screens to assist with data entry and verification. Inputs from the HPMS

format are accepted for highway sections. After data are input, the model identifies future condition

and capacity issues and alternatives, corrects for these, and performs a CBA for each. Examining

different scenarios and the numerous ways of displaying results offers the user greater flexibility

when conducting analyses, which can include an incremental benefit-cost approach. Benefits that

can be evaluated include travel time, vehicle operating costs, reduction in crashes, emissions,

agency costs for maintenance and operation, and residual values. Costs are limited to right-of-way

acquisition and construction costs. Funding constraints or specified performance measures can be

used to drive the analysis. A user’s guide and examples of the software in action can be found on

the HERS-ST website.

27

Figure 8: HERS-ST Screenshot

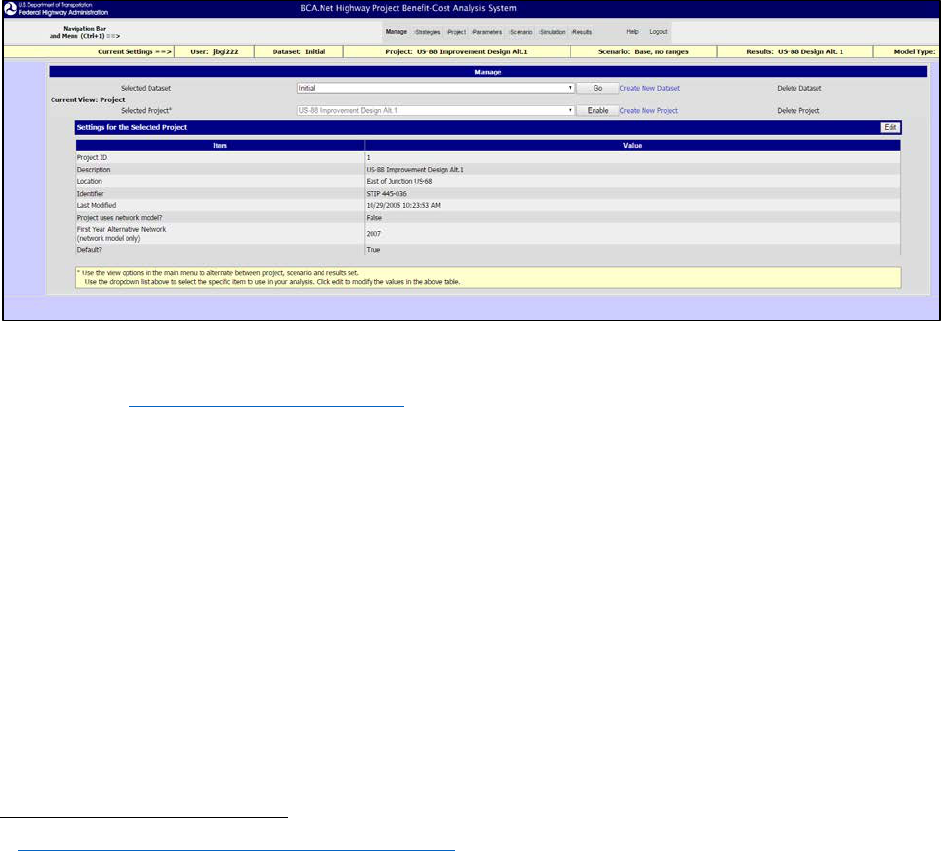

BCA.NET (Free)

Available at: http://bca.decisiontek.com/

BCA.Net is home to the FHWA’s benefit-cost analysis tool, which can support the highway project

decision-making process. BCA.NET is a web-based application that lets users compare alternative

approaches for managing and improving highways. BCA.NET is supported by the FHWA Asset

Management Evaluation and Economic Investment Team:

The BCA.Net system enables users to: manage the data for an analysis; select from

a wide array of sample data values; develop cases corresponding to alternative

strategies for improving and managing highway facilities; evaluate and compare

27

See also: http://www.gao.gov/products/GAO-01-299

30

the benefits and costs of the alternative strategies; and, provide summary indicators

for informing investment decisions.

28

BCA.NET input options include capital cost, physical characteristics, performance impacts, and

forecasted travel demand. Design, project timing, and project alternatives can also be factored into

analysis. BCA.NET is most appropriate for small- to medium-sized highway capacity projects that

involve significant resources, but which do not necessarily alter traffic patterns (Coley, 2012).

During analysis, the user can specify needed maintenance during the project’s lifecycle. BCA.NET

then calculates the present value of benefits and costs, which gives the user several measures to

compare alternatives, including net present value, internal rate of return, and benefit-cost ratio.

BCA.NET is free and, because of its web-based format, does not require software installation. A

workshop is available to interested users that provides information on Highway Investment

Analysis, including the BCA.NET tool. Workshop sessions are held at various points throughout

the year.

Figure 9: BCA.NET Screenshot

TREDIS Multimodal Benefit-Cost Analysis Tool (Free)

Available at: http://www.tredis.com/mbca

The TREDIS Multimodal Benefit-Cost Analysis (MBCA) is a web-based program that compares

the benefits and costs of transportation projects. It includes passenger and freight transport across

all modes. MBCA meets USDOT requirements and can be used to support grant applications in

addition to executing project assessments.

MBCA lets users conduct multimodal analysis that covers air, water, rail, and highway. Even non-

motorized methods of transportation are included (e.g., pedestrian and bicycle).

MBCA is unique in that it covers both passenger and freight transportation

spanning all modes – highway, rail, air, and marine – and it also includes pedestrian

and bicycle modes. It is designed to be consistent with USDOT guidelines, making

it useful for multimodal project assessments, grant applications, and education

28

http://bca.transportationeconomics.org/models/bca-net

31

programs. MBCA is set up with standard U.S. and Canadian values for user benefit,

which are not tied to any specific study area. (Lawrence et al., 2014, p. 3-3)

TREDIS notes that the MBCA tool is useful for three project types: 1) single mode projects with

one or more alternatives, 2) single mode projects that impact other modes, and 3) multimodal

projects that cross modes (e.g., combination transit/highway corridor project). MBCA inputs

include project costs and timelines and common benefits, such as changes in congestion, safety,

and travel distance. MBCA accounts for benefits that accrue directly to users as well as

externalities, such as emissions and business productivity. TREDIS offers additional tools that

may come with a cost.

Figure 10: TREDIS MBCA Screenshots

32

Figure 11: TREDIS MBCA Results

33

MicroBENCOST ($50)

Available at: http://mctrans.ce.ufl.edu/

MicroBENCOST was created by the National Cooperative Highway Research Program (NCHRP)

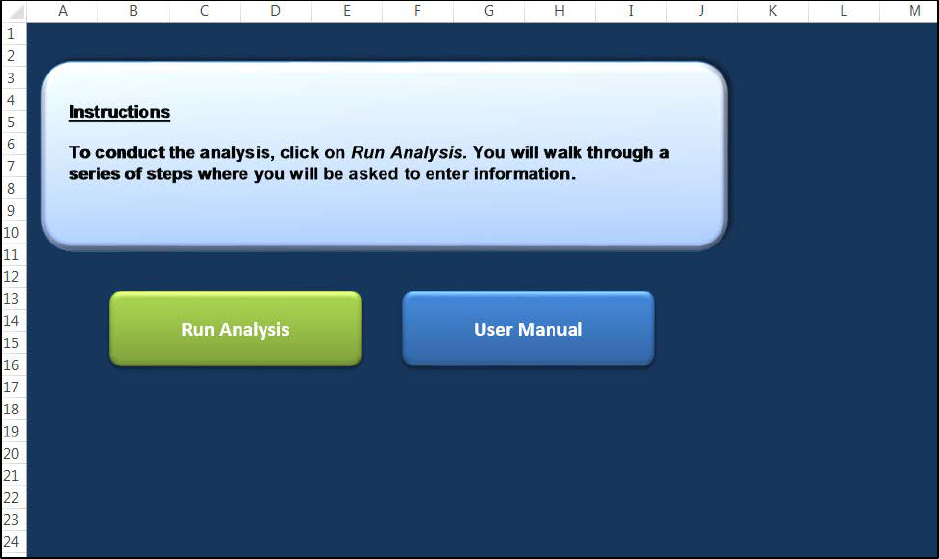

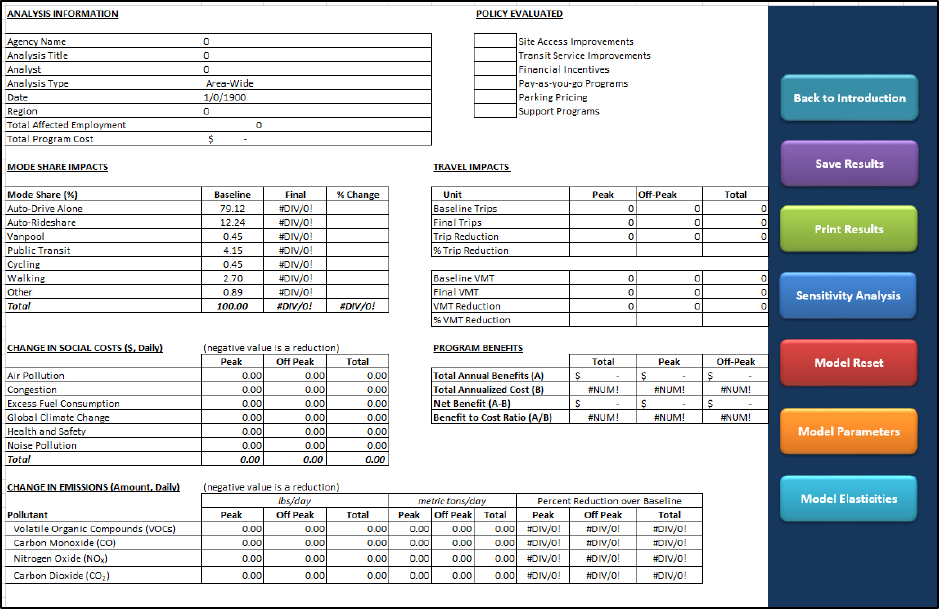

to perform CBA. Developed in the early 1990s, the program is a DOS application, but also runs

with Windows. It is distributed by the Texas Transportation Institute and the McTrans Center at

the University of Florida:

MicroBENCOST is a computer program for analyzing benefits and costs of a wide

range of highway improvements. It also can allocate corridor traffic and calculate

forecasted traffic volumes. The program is capable of analyzing seven categories

of projects: added-capacity, bypass, intersection/interchange, pavement

rehabilitation, bridge, safety, and highway-railroad grade crossing.

In general, the program compares the motorist costs in the existing situation, the

“without improvement” alternative, to the motorist costs if the improvement is

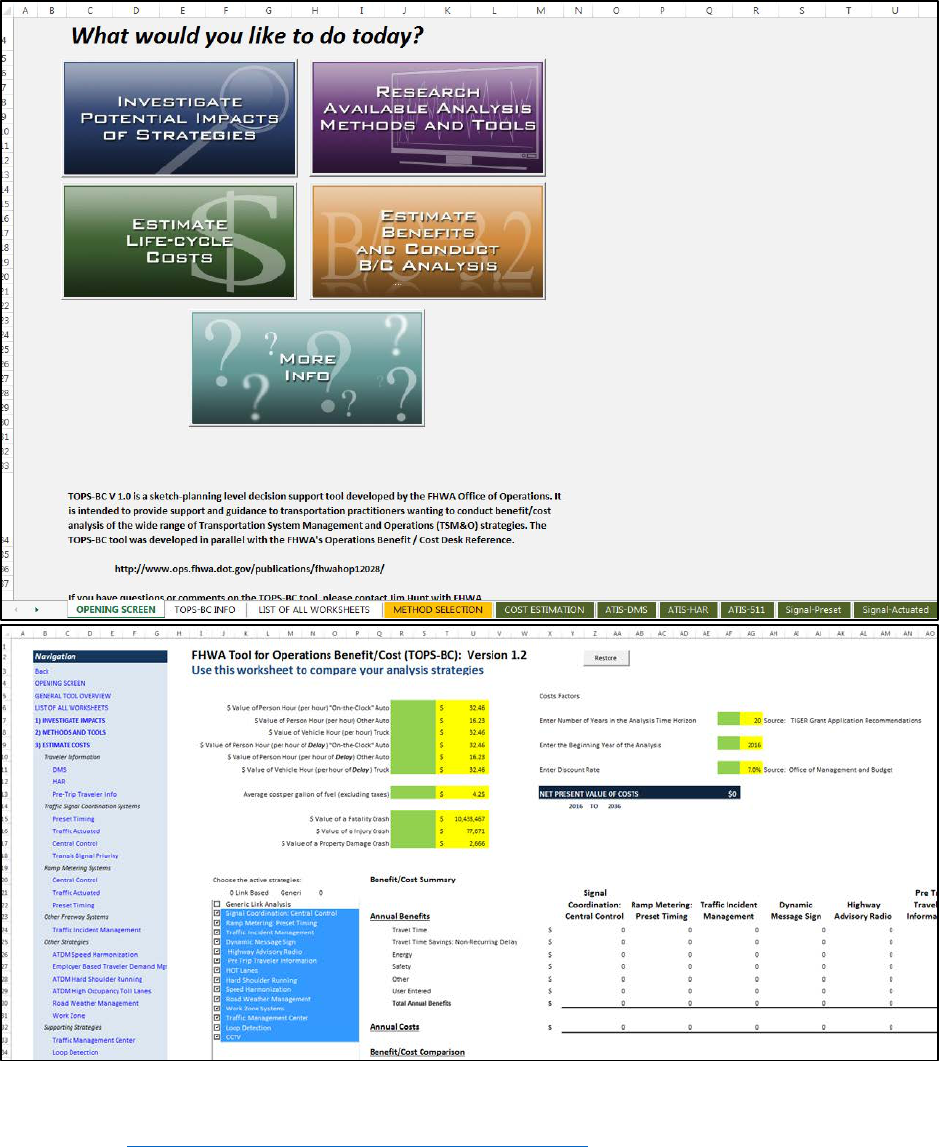

completed, the “with improvement” alternative. In all cases, the “without

improvement” alternative includes an existing route and an optional alternate route.

Except for new location projects, the “with improvement” alternative includes a

proposed route that replaces the existing route and an optional alternate route. For

new location projects, the “with improvement” alternative includes an existing

route, a proposed route, and an optional alternate route. The proposed route does

not replace the existing route in a bypass project although it may take some of the

traffic off the existing route.

29

Users can examine highway improvement projects with MicroBENCOST. Benefits that may be

factored into analysis are travel time, vehicle costs, and accidents. Impacts to vehicles can be

estimated across nine different passenger types and nine different truck types. Cost analysis is

based on initial project cost, residual value at the end of the analysis period, and

rehabilitation/maintenance costs. Results are in the form of NPV calculations, internal rate of

return, or benefit cost ratios.

StratBENCOST ($55)

Available at: http://mctrans.ce.ufl.edu/

Also available at: http://apps.trb.org/cmsfeed/TRBNetProjectDisplay.asp?ProjectID=498

StratBENCOST combines aspects of HERS and MicroBENCOST into CBA. It was developed as

part of NCHRP Project 2-18(4). StratBENCOST’s lifecycle analysis can run 30 years, and the user

can specify when benefits start to accumulate. The program can analyze two project types: a road

segment with no significant traffic diversions or an investment with larger network implications

that diverts traffic. StratBENCOST lets users compare up to 20 alternatives against the base case.

The program also generates random variables if the user inputs a median or tenth and ninetieth

percentiles. It can also generate probability distributions using Monte Carlo simulations to show a

range of values. StratBENCOST calculates benefits like travel times, vehicle costs, accidents, and

29

http://mctrans.ce.ufl.edu/store/description.asp?itemID=166

34

emissions; costs include capital, right-of-way, maintenance, and lifecycle, among others. The

program calculates NPV, IRR, BCR, and total benefits or total costs:

StratBENCOST32 is designed as a decision support tool for state and local

transportation agencies engaged in multi-year strategic planning and budgeting for

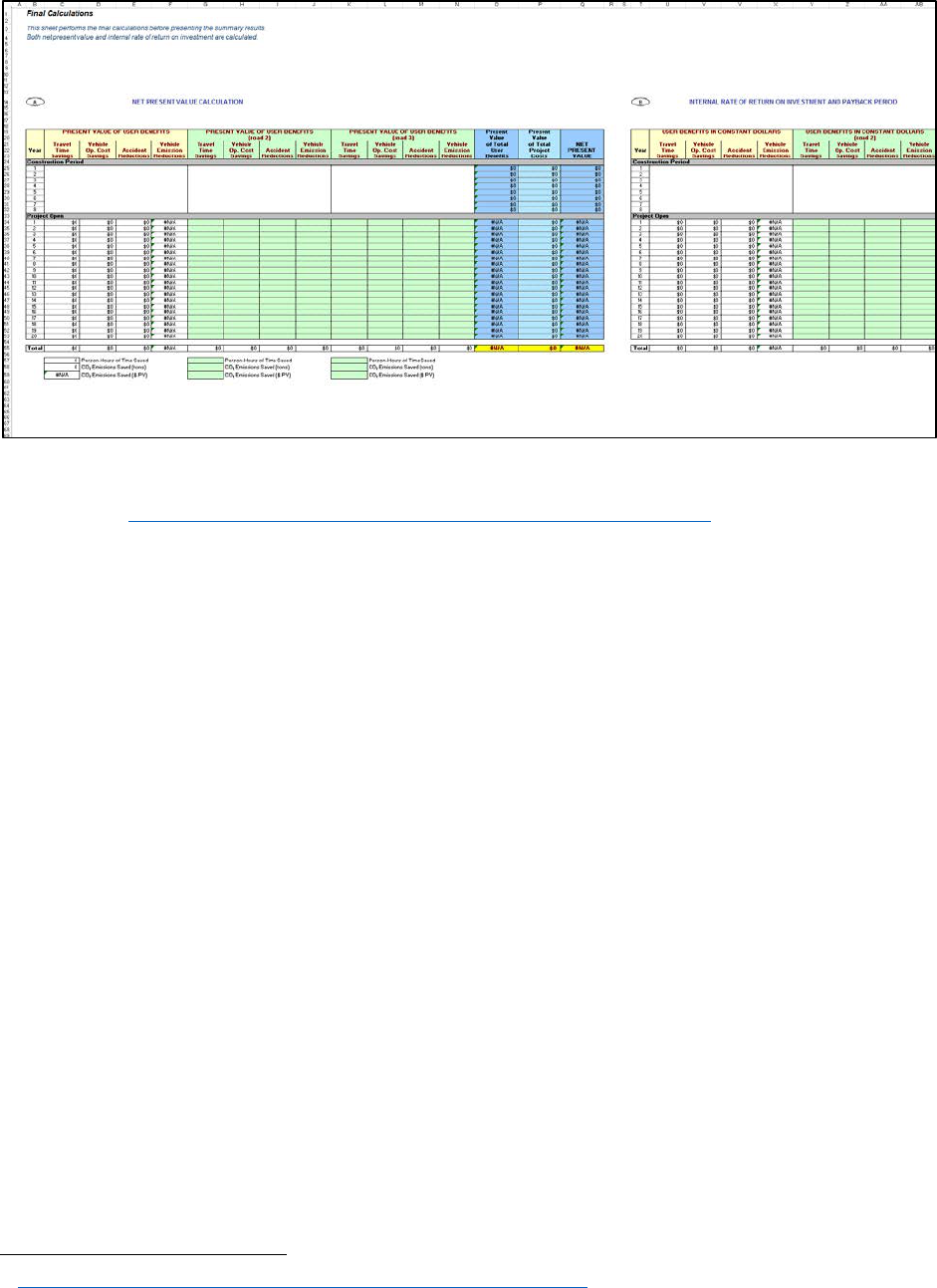

highways. StratBENCOST32 consists of two models, one for network analysis and