1

k

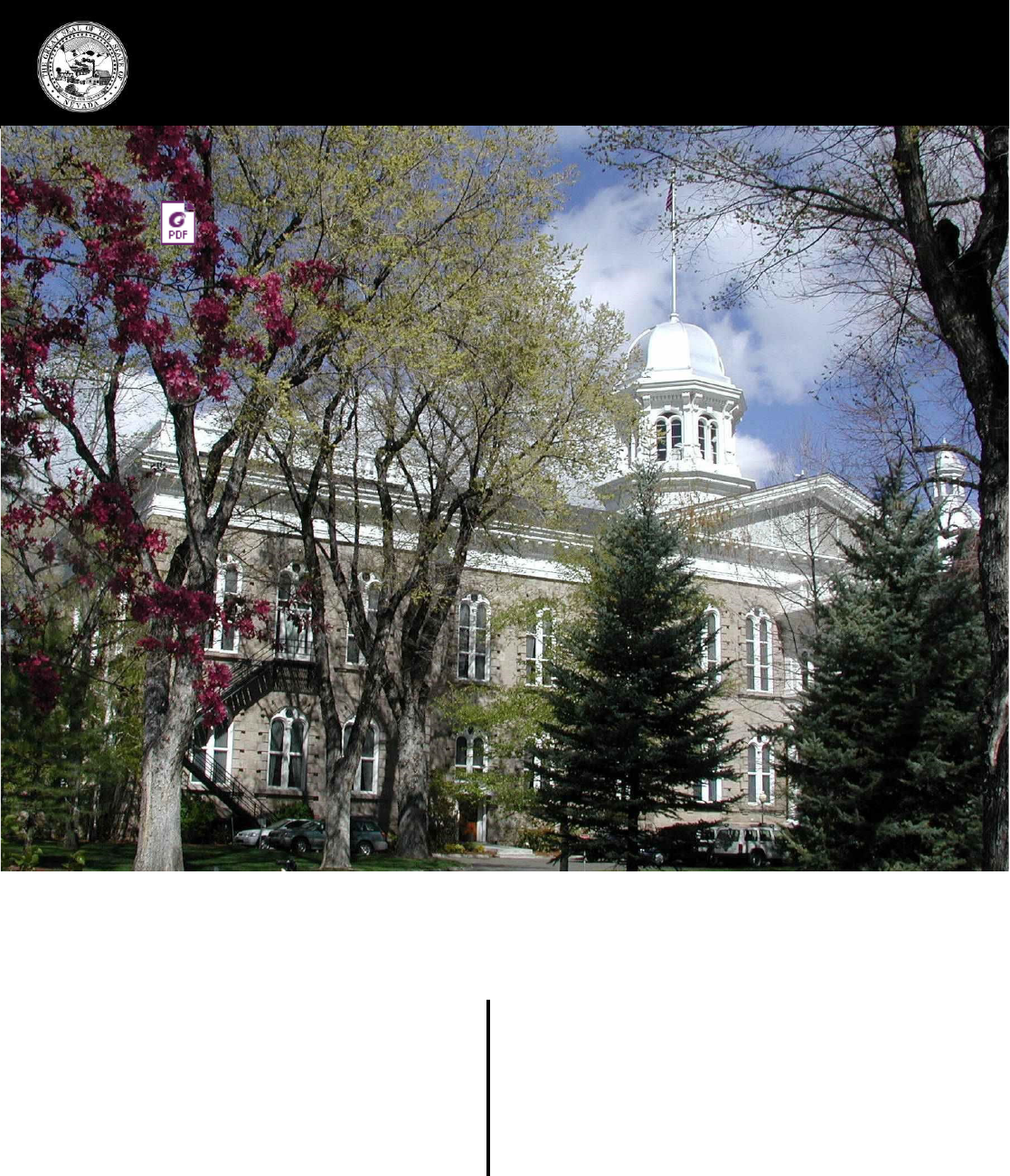

STATE OF NEVADA

State

Administrative

Manual

SAM Manual

3-8-24.pdf

State Administrative

Manual (SAM)

Revised March 12, 2024

Governor’s Finance Office

Budget Division

209 E. Musser Street, Room 200

Carson City, Nevada 89701-4298

(775) 684-0222

2

STATE ADMINISTRATIVE MANUAL

Table of Contents

CHAPTER REVISED

0000 Introduction August 9, 2016

0100 Board of Examiners Policies April 14, 2020

0200 Travel August 14, 2018; November 14, 2023

0300 Cooperative Agreements and Contracts October 13, 2020; September 14, 2021

0400 Records November 15, 2022

0500 Insurance and Risk Management

0600 Administrative Procedures August 9, 2016

0700 Open Meeting Law August 9, 2016

1000 Buildings and Grounds September 14, 2021

1200 Mail Service September 14, 2021

1300 State Vehicles November 10, 2020

1400 Fleet Services Division November 10, 2020

1500 Purchasing

1600 Information Technology January 11, 2022

1700 Attorney General November 8, 2016

1800 Printing November 8, 2016

1900 Public Works Board

2000 Nevada State Library Archives

2400 Division of Internal Audits August 8, 2017

2500 Budgeting September 12, 2017; March 12,2024

2600 Claims April 9, 2019; October 10, 2023

2700 State Accounting System January 9, 2018

2800 Chart of Accounts January 9, 2018

2900 Tort Claims March 14, 2023

3000 Federal Grant Procedures July 10, 2018

3500 Group Insurance August 9, 2016

3600 Retirement December 19, 2016

3700 Unemployment Compensation

3800 Deferred Compensation

3

0000 Introduction

The State Administrative Manual (SAM) is a compilation of policy statements concerning the internal

operations of State government. Policies are based on authorizing statute or other approved regulations,

although policies may be established in the absence of specific statutes where particular guidance and

instructions are necessary for agencies to conduct business. This manual is published for use as a guide

in conducting the State’s business, and individual departments or divisions within the Executive Branch

of state government may not establish policies that contradict or supersede the State Administrative Manual,

except where expressly outlined in this document. Departments, divisions, agencies, or other

organizations of state government that require more detailed information should reference the

applicable statutes that are cited following many of the policy statements, reference specific statutes

pertaining to the department, agency or office, or contact the Budget Division of the Governor’s

Finance Office.

This edition of SAM replaces all previous editions.

Questions or comments regarding SAM should be directed to:

Governor’s Finance Office

Budget Division

209 E. Musser Street, Room 200

Carson City, NV 89701-4298

(775) 684-0222

Governor’s Finance Office

0002 Purpose

The State Administrative Manual (SAM) presents to all State agencies a single reference source for

policies, procedures, regulations and information issued by the Legislature, the Board of Examiners, the

Governor’s Finance Office, the Department of Administration and other contributing agencies.

0004 Jurisdiction

SAM is an official publication of the Governor’s Finance Office and is issued under authority of the

Governor and the Board of Examiners (NRS 353.040). The Governor instructs all State executive

agencies to comply with the provisions of this manual to promote economy and efficiency in the

government of the State of Nevada.

0006 Exceptions

Deviations from this manual are permitted only upon approval of the Board of Examiners for the agency

requesting the exception. Exceptions approved for one agency may not be used by other agencies without

Board of Examiners’ approval.

Constitutional agencies with broad powers (e.g., the Nevada System of Higher Education) are expected

to follow these regulations when not in conflict with the Constitution, Nevada Revised Statutes or Board

of Regents' regulations.

4

0100 Board of Examiners Policies

0102 Placement of Items on the Agenda

Any Board of Examiners (BOE) member is entitled to place items on the agenda; and any Constitutional

Officer of the State of Nevada may request items to be placed on the agenda upon the Clerk of the

Board’s determination that the item is legal and within the jurisdiction of the Board of Examiners.

0104 Agency Attendance and Notification

BOE agenda action items (items denoted as For Possible Action) require attendance by appropriate agency

staff to present their items. Agencies must also be prepared to present information regarding leases,

contracts, and Master Service Agreements, which may be pulled on a case by case basis by any Board

Member without prior notice. Any Board Member, who wishes to pull an agenda item for discussion,

particularly items generally taken on a consent basis, such as leases, contracts and Master Service

Agreements, shall notify the Clerk of the Board prior to the BOE meeting of the items he/she wishes to be

pulled for discussion.

The Clerk of the BOE or his or her designee shall use their best efforts to notify the appropriate agency of

any agenda item(s) that has been identified by a member of the Board as an item for discussion. However,

any agency with an item noted as For Possible Action, regardless of whether they receive notice that the item

has been pulled for discussion, should have the appropriate staff member(s) present at the BOE meeting to

respond to Board Members’ questions.

0106 Distribution of Meeting Materials

The Clerk of the Board must disseminate meeting materials to each member of the Board no less than 5

working days before the meeting unless notified by the Clerk or his designee.

0108 Sole Source Contracts

If a sole source contract is placed on the agenda, the contract materials provided to the Board members

must include the sole source or non-competitive procurement approval request. Agencies must attach

this in CETS in the tab marked “Addl. Info” and the document should be attached in the “Supporting

Info (Prints on BOE Agenda)” area.

0110 Retroactive Contracts

If an agency has submitted a retroactive contract for inclusion on the action item agenda, the agency

must attach a memorandum explaining why the contract should be approved retroactively. The

memorandum must be on agency letterhead and must be attached in CETS in the tab marked

“Addl. Info” and the memo should be attached in the “Supporting Info (Prints on BOE Agenda)” area.

5

0200 Travel

NRS 281.160 outlines the State’s statutes regarding travel and subsistence for State officers, board

and commission members, contractors, and employees, hereinafter referred to collectively as

“employees”.

0204 Board of Examiners' Travel Policy

In accordance with NRS 281.160(7) the Board of Examiners shall establish the rate of reimbursement

employees are entitled to receive while transacting public business. This rate must be the same as the

comparable rate established for employees of the Federal Government. However, certain State policies

may differ and supersede the established federal guidelines or policy. It is the Board of Examiners’

policy that travel should be by the least expensive method available when such factors as total travel

time, salary of employee, availability of agency cars or Fleet Services Division cars, and costs of

transportation are considered.

NRS 281.160 (6) allows an agency to adopt a rate of reimbursement less than the amounts specified in

NRS 281.160 (1) where unusual circumstances make that rate desirable. An agency adopting such rates,

must submit their proposed policy to the Board of Examiners for approval. The lesser rates may not be

adopted until such approval.

A person employed by an agency that has adopted a lesser reimbursement rate shall be reimbursed in

accordance with the agency’s policies.

Employees are eligible for per diem, lodging and/or vehicle rental reimbursements only if they are 50

miles or more from their official work station, unless the Board of Examiners has approved a policy for

a given department that permits travel reimbursements within 50 miles of the assigned duty station.

Advanced planning for travel will allow for the purchase of airline tickets at discounted rates.

0206 Agency Policies Regarding Travel

Because of the variety of situations faced by State agencies, it is important for State agencies to adopt agency-

specific policies. The Board of Examiners instructs all agencies to carefully review travel requirements and

to adopt detailed policies consistent with the Board of Examiners’ travel policy and within the legislatively

approved travel budget authority. These policies should address, but may not be limited to, the following

situations:

1. The hours and conditions during which an employee will be allowed to claim meals;

2. Overnight lodging, vehicles and per diem allowances within fifty (50) miles principal duty

station, if approved by the Board of Examiners;

3. Combining State business and personal travel;

6

4. Out-of-State travel requests;

5. Employees traveling as members of non-state agencies;

6. Use of private aircraft;

7. The conditions under which an employee will be allowed to claim mileage while using the

employee’s personal vehicle; and

8. Camping while on official State business. An employee camping while on official State

business may claim up to a $40 per night reimbursement while camping inside or outside of

established campgrounds. Additionally, employees may also be allowed reimbursement for

meals and incidentals in accordance with SAM 0210. State agencies may choose to adopt

agency-specific policies for camping, but those policies must not include rates which exceed

the rates identified in this section.

0208 Agency Accounting for Travel Expenses

All travel expenses of State employees will be charged to the budget account specifically appropriated

or authorized to provide for the employees' salary and/or travel expenses. The director of the department

paying for the travel must approve exceptions to this rule in advance of the travel.

0210 Travel Status

Employees in travel status shall receive reimbursement that matches the rates established by the U.S.

General Services Administration (GSA) for the employee’s primary destination. Maximum per diem

reimbursement rates for lodging, meals, and incidental expenses are established by city/county and vary

by season. State employees are directed to the GSA’s website http://gsa.gov and the link “Per Diem

Rates” under the “Travel” drop-down menu to locate the most current rates. Employees may receive

reimbursement for breakfasts even though continental breakfasts are provided. Employees shall not claim

full meals furnished to them during a conference, meeting, or other work function on their reimbursement

request. Employees may not claim full meals if a meal is offered as part of a conference, meeting, or other

work function even if the employee does not consume the meal offered, except when the department head

has approved an exception when the following applies:

1. Employee has a food allergy and/or dietary restriction that preclude the employee from

consuming the provided meal at a conference, meeting or other work function.

2. If the condition above exists, agencies may allow employee to claim meal reimbursements

for any meals provided at a conference, meeting or other work function that may pose a

health risk to the employee if consumed.

For out-of-state travel, employees are required to submit a Travel Request for approval prior to making

any travel arrangements.

Upon approval of the department head, agencies may make exceptions to the rate of reimbursement for

lodging when the following applies:

7

1. Lodging is procured at a prearranged place such as a hotel where a meeting, conference

or training session is held; or

2. Costs have escalated because of special events; lodging within prescribed allowances

cannot be obtained nearby; and costs to commute to/from the nearby location exceed the

cost savings from occupying less expensive lodging.

3. If the condition(s) above exist, agencies may apply the following rules to the rate of

reimbursement for:

In-State Travel

1. 150% of the standard Continental United States (CONUS) federal per diem rate

for non-surveyed sites, or

Out-of-State Travel

1. 175% of the federal per diem rate for surveyed out-of-state sites; or

2. 300% of the standard CONUS federal per diem rate for non- surveyed out-of-state

sites.

8

0212 Air Transportation between Las Vegas and Reno

State agencies travelling between Reno and Las Vegas are to use the Southwest Airlines corporate

Internet booking tool, SWABIZ. State agencies can obtain information about SWABIZ from the State

Purchasing Division’s website at http://purchasing.nv.gov/. Due to the fluid nature of the travel

industry, changes to the State’s travel program will be announced to State agencies via All Agency

Memoranda, as well as postings on the State Purchasing Division’s website.

0214 Bonus Flight Points

Most commercial airlines maintain customer loyalty programs which allow for the accumulation of free

bonus flight points to travelers based on miles flown or the amount of the fare as an inducement to travel

with that airline. Any bonus flight points or other rewards received by State agencies or State employees

as a result of State-paid air travel shall, whenever possible, be used by the agency to meet State travel

needs.

0216 Use of Rental Cars

The Fleet Services Division must be used for all in-state motor vehicle travel when an agency car is not

available. Employees should not independently rent vehicles for in-state use; instead, they must utilize

the Fleet Services Division. When traveling out-of-state, rental cars are to be rented from the State-

contracted companies. Visit the Purchasing Division’s website for the names of these companies and the

guidelines on how to access these contracts. When renting from these companies, it is not necessary to

purchase collision damage waivers, as these protections are already included in the negotiated overriding

agreement. Should an employee be required to rent a vehicle outside of these agreements, he/she should,

if possible, rent the vehicle using the State sponsored credit card, which provides coverage for physical

damage to the rented car.

0218 Travel Reimbursement

All claims for travel reimbursement to an individual should be filed on a “Travel Expense

Reimbursement Claim" (TE) form, as developed by each department. TE forms may not contain claims

for expenses associated with travelers other than the traveler indicated on the form, even if the traveler

paid for the other travelers’ expenses. All areas of the TE form must be completed, including:

1. start and end times of journey;

2. destination;

3. purpose of trip;

4. official station; and

5. authenticated signatures

If applicable, hotel bills noting the employee name, date(s) of stay, and breakdown of costs by day are

required for all lodging expenses. If lodging was paid for through a travel website, (Expedia,

Travelocity, etc.) the travel website receipt shall accompany the hotel bill. In addition to the

reimbursable lodging rates, employees may be reimbursed for lodging taxes and fees. Lodging taxes are

9

limited to the taxes on reimbursable lodging costs. For example, if the maximum lodging rate is $50 per

night, and the traveler elects to stay at a hotel that costs $100 per night, the traveler can only claim the

amount of taxes on $50 which is the maximum authorized lodging amount. Meals will be reimbursed in

accordance with the meals and incidental expense (M&IE) allowance for the primary destination.

Receipts are not required for the M&IE allowance. Pursuant to SAM 0206, the hours and conditions to

which employees are allowed to claim meals must be included within each agency’s travel policy.

Employees may be reimbursed for the following:

1. Actual expenses incurred for parking or vehicle storage fees for private automobiles and

commercial transportation costs (i.e., taxi, shuttle, etc.). Receipts are required.

2. Other miscellaneous reimbursable business related expenses including: use of internet services,

computers and other business machines, conference room rentals, and official telephone

calls/service. Receipts are required.

3. Laundry cleaning/pressing services if the employee’s official business related hotel stay is four

(4) consecutive nights or longer. Receipts are required.

4. A meal rate approved by the Board of Examiners for employees traveling outside the United

States, commensurate with the U.S. Department of State’s meal allowances for foreign cities as

listed in the U.S. Department of State’s publication, Maximum Travel Per Diem Allowance for

Foreign Areas. The current foreign per diem rates can be accessed at the U.S. Department of

S tate’s websit e.

5. Using his/her own personal vehicle for the State’s convenience, at the standard mileage

reimbursement rate for which a deduction is allowed for travel for federal income tax. The

Governor’s Finance Office, Budget Division, shall issue an All Agency Memorandum

periodically reflecting the current rate in effect at that time.

6. Using his/her own personal vehicle for his/her own convenience at one-half the standard mileage

reimbursement rate.

7. Using his/her own personal vehicle for any miles driven in excess of his/her normal commute

while on official State business. An employee’s normal commute is the roundtrip mileage

between the employee’s residence and his/her official duty station.

8. The standard credit card fee for cash advance transactions is reimbursable by the State to the

employee for every authorized advance obtained through the use of an ATM. Said expense

should be treated for budgeting purposes as any other travel expense, and should be limited to

one (1) per authorized trip.

9. Additional bank ATM facility charges relating to obtaining an authorized advance from an ATM

are also reimbursable by the State to the employee, and should be limited to one (1) per

authorized trip.

10. Interest charges incurred due to delays beyond the control of the traveler will be travel expenses

reimbursable by the employee’s agency.

The claimant’s signature on the TE form attests to the accuracy of the claim. A supervisor, manager, or

designee must sign the TE form approving the appropriateness of the travel. Travel claims must be

submitted within one month of completion of travel unless prohibited by exceptional circumstance. An

employee cannot sign as the authorizing signature on any travel voucher made out in his/her own name

unless that employee is the head of the agency. All TE forms must be retained either by the travelers’

agency or fiscal agency if electronic or facsimile copies are used for payment purposes pursuant to SAM

2616 (Supporting Documentation for Expenditures).

10

Alternate documentation and/or procedures which provide at least the level of control described in this

section are acceptable, but the documentation must be specified in the agency’s approved travel policy.

For the purposes of this chapter, a fiscal agency is an organization that performs accounting transactions

and budgeting functions for a given department, division, agency, or office within the Executive Branch

of State government.

0220 Reimbursements for Meals Purchased for Firefighters,

Patients, Wards, or Inmates

The Nevada Division of Forestry, when providing firefighters meals per NRS 472.110, may request

reimbursement for trips that are directly related to the provision of fire meals for firefighters when the

cost of the meal in total is less than or equal to the State per diem rate.

State officers or employees who purchase meals for people in their custody are entitled to

reimbursement for the actual cost of such meals, within the limits established for State employees. A receipt

for each meal purchased must accompany claims for reimbursement. If a State agency sends an

unchaperoned or unguarded client to an institution for treatment or care by public conveyance, an

employee of the agency may advance an allowance for meals at the same rate allowed State employees.

Reimbursement for such advance shall be made upon a regular travel claim, with the receipt waived.

Agencies may, with the approval of the Clerk of the Board of Examiners, which is appealable to the

Board of Examiners, set up petty cash accounts to reimburse employees for meals purchased for

firefighters, patients, wards or inmates. A receipt for each meal purchased must accompany claims for

reimbursement to the petty cash account.

0222 Travel Advances from the Agency Budget Account

In the event an advance is not available through the use of the State sponsored credit card, a State employee

may be advanced money to cover anticipated travel expenses from the agency budget account at the

discretion of the agency or, in the case of a temporary budget restriction, the Budget Director.

Only State officers and employees may receive a travel advance. Independent contractors are not

eligible to receive travel advances. The agency head, or his/her designee, must approve employees'

written requests. The amount advanced must be justified by the circumstances. Travel advances

constitute a lien upon the accrued wages of the requesting employee. (NRS 281.172, 281.173)

The procedure for obtaining a travel advance through the agency budget is:

1. If the administrative head or his/her designee approves the request, the agency shall process a

voucher for a cash advance for travel in the approved amount in the same manner as other claims

against the State are processed.

2. Unless approved by the Budget Division in advance, all cash advances for travel issued by the

administrative head or his designee must be charged to the budget account to which money was

appropriated or authorized for expenditure for the travel.

11

3. If the administrative head or his/her designee cannot process a cash advance for travel because of

a temporary budget restriction, the administrative head may, with the approval of the Budget

Division, forward a copy of the request and approval to the State Treasurer.

4. The administrative head or his/her designee must reconcile cash advances to actual travel taken.

0224 State Sponsored Credit Cards for Official Travel Only

The State Department of Administration has contracted with a provider of credit card services for travel

related expenses. The State sponsored credit card is for official State travel only. The credit cards are for

official use only, and they should only be used to pay for travel related expenses. Employees must contact

their agency’s designated Travel Card Administrator (TCA) to request approval. The payment of the credit

card bill is the responsibility of the individual to whom the card is issued and payment in full is due monthly.

It is the State agency’s responsibility to monitor employees’ credit card activity on a monthly basis.

Information regarding the State sponsored credit card program can be found on the Purchasing Division’s

website under the “C redit Card Programs” link within the “State Contracts” section.

0226 Claims and Payments When Credit Cards Have Been Used

When an employee who has used a State sponsored credit card for State travel expenses submits a claim

for reimbursable expenses, all agencies must process the claim timely to preclude the employee from

incurring an interest charge on the credit card account. Claims must be filed by the traveler within five

days after returning from travel status. The employee’s agency should take no more than two working

days to process the claim.

Whenever an employee uses a State sponsored credit card for authorized cash advances and/or travel

expenses and the receipt of his/her travel reimbursement may be delayed more than five working days

after the date of the initial submission of the travel reimbursement claim, the administrative head or

his/her designee may issue to the employee, for payment to the issuer of that credit card, a cash advance

in the amount of the total travel expenses charged on the State sponsored credit card.

Payment of the credit card bill is the responsibility of the employee to whom the credit card has been

issued and payment is due in full monthly. If a State sponsored credit card bill is not paid timely, NRS

281.1745 authorizes the State to withhold from an employee’s paycheck the amount required to pay any

delinquent balance.

0228 Disposition of State Sponsored Credit Cards upon

Employee’s Change of Employment Status

When an employee who has been issued a credit card for official State travel expenses transfers to a different

agency or leaves State service, the employee’s agency Travel Card Administrator shall suspend the card

within 5 days and cancel the card after the current statement cycle. If the employee is moving to a new

agency, rather than leaving State service altogether, it is at the discretion of the employee’s new agency to

determine if a travel card will be required in their new position.

12

0230 Travel & Moving Expenses on Transfer or Hire of Employee

NRS 281.167 defines the State’s minimum requirements for authorizing reimbursement of travel and

moving expenses with regard to the transfer or hire of State employees. All requests for payment of

travel expenses, subsistence allowances and moving expenses must be submitted to the Clerk of the

Board of Examiners before obligations are incurred. An estimate of costs to be incurred must be

provided with the request and include the following, at a minimum:

1. A listing of the individual (s) being considered for reimbursement.

2. An explanation of the purpose of the reimbursement including:

i. For new hires:

1. An explanation detailing the position's critical need and why this need

cannot otherwise be filled.

ii. For transfers, one of two criteria must be met:

1. An explanation of how the transfer is for the convenience of the State and

not for the convenience of the employee; or

2. An explanation of the critical need being met by the transfer, including an

explanation of why this need cannot otherwise be filled.

3. The dates the obligations will be incurred.

4. A detailed estimate of the total expenses including an itemization of travel costs, per diem rates

and moving expenses.

Upon approval by the Clerk of the Board, claims are submitted for payment in the same manner as other

travel claims against the State from the agency's funds and must include a copy of the approved request.

Receipts must support all moving expense reimbursements. Agencies must ensure that funds are

available within their existing budgets.

0232 Reimbursement Eligibility

To be eligible for reimbursement, the following conditions must be met:

1. The transferring or hiring agency head must approve moving reimbursement, or in the case of a

permanent employee who is transferring between State agencies, the head of the agency, board

or commission accepting the employee.

2. The payment of moving expenses must be justified. For transfers, it must be less expensive for

the agency to pay moving expenses than to pay the employee per diem and travel expenses for

new duty station assignments of short duration.

3. The relocation must occur within six months of transfer or appointment.

4. Except for people newly hired due to critical need, the employee must have achieved permanent

status within the agency, thus being permanent to the agency rather than permanent in position

classification.

5. Where citing “convenience of the State” as justification for the transfer or hire pursuant to SAM

0238, the agency must show that the transfer is for the convenience of the State and not for the

convenience of the individual.

6. The move must be for more than fifty (50) miles between duty station or home address,

whichever is less.

13

7. Subject to all other conditions of eligibility, the State may, on behalf of those current State

employees with demonstrated financial hardship, pay a vendor directly for moving expenses

incurred. For example, the State may pay the common carrier directly for moving of household

goods in lieu of reimbursement to the employee. All requests for a direct payment to a vendor

shall be submitted as part of the request for payment to the Clerk of the Board of Examiners

before obligations are incurred.

8. Departments must have policies related to allowances for moving household goods by common

carrier, rental truck or trailer, and mobile home.

9. An agency may, with the approval of the Board of Examiners, establish a rate of reimbursement

less than the amounts specified in 0248 and 0250 for per diem and mileage for moving

0234 Per Diem and Subsistence Allowances for Moving

Allowable per diem and subsistence allowances:

1. Per Diem will be paid for the actual days in transit not to exceed six (6) days. The employee may

elect to utilize a portion of the total day allocation to locate suitable housing before the move,

with prior approval from the agency head.

Per Diem and mileage rates allowable for location of housing will only apply to the employee

and spouse and will be reimbursed at the established in-State rates.

2. Allowable per diem shall be equal to regular travel status for the employee and family members.

3. Allowable lodging will be approved as follows:

a. For the employee: Established in-State rates per the GSA schedule.

b. For the spouse: Three-fourths (3/4) of the amount allowed the employee up to the actual.

c. For each additional member of the family: Age twelve or over, three fourths (3/4) of the

employee allowance up to the actual; under age twelve, one-half (1/2) of the employee

allowance up to the actual.

4. Receipts are required for lodging if the family accompanies the employee.

0236 Mileage Allowance for Moving

In addition to the allowances for moving household goods, an agency may pay one-way personal vehicle

mileage from the old to the new place of residence for a maximum of two personal vehicles. The actual

miles travelled are reimbursable at the rate established by GSA for relocation.

0238 Interview Expenses

NRS 281.169 allows an agency to pay for the travel and per diem expenses of the three most highly

rated applicants, for a permanent position with that agency, incurred while those applicants interview for

that position. All requests for travel and per diem expenses must be submitted to the Clerk of the Board

of Examiners before obligations are incurred. An estimate of the costs to be incurred must be included

with the request and include:

14

1. A list of the individual(s) being considered for reimbursement;

2. The purpose of the reimbursement;

3. The dates the obligations will be incurred; and

4. A detailed estimate of the total expenses including an itemization of travel costs and per diem

rates.

Upon Board of Examiners’ approval, claims are submitted for payment in the same manner as other

travel claims and must include a copy of the approved request. Agencies must ensure that funds are

available within their existing budgets.

No reimbursement may be made to an applicant who has been offered the position and declined.

15

0300 Cooperative Agreements and Contracts

0302 Cooperative Agreements/Interlocal Contracts

Cooperative Agreements and Interlocal Contracts are contracts between public agencies to provide

services or facilities to one another or to the public in accordance with the "Interlocal Cooperation Act."

(NRS 277.080 to 277.180)

0304 Definitions of Public Agency

Public Agency means:

1. Any political subdivision of this State, including without limitation, counties, incorporated cities

and towns including Carson City, unincorporated towns, school districts and other districts.

2. Any agency of this State or of the United States.

3. Any political subdivision of another State.

4. Any Indian tribe, group of tribes, organized segment of a tribe or any organization representing

two or more such entities.

State includes any of the United States and the District of Columbia.

0306 Cooperative Agreements

A cooperative agreement is an agreement between two or more public agencies for the "joint exercise of

powers, privileges and authority," including, but not limited to law enforcement. (NRS 277.080 to

277.170)

0308 Contents of Agreements

1. Any agreement made pursuant to NRS 277.110 that establishes a separate legal or administrative

entity to conduct the joint or cooperative undertaking shall specify:

a. The precise organization, composition and nature of such entity and the powers delegated

thereto.

b. The duration of the agreement.

c. The purpose of the agreement.

d. The manner of financing such undertaking and of establishing and maintaining a budget.

e. The method or methods to be employed in accomplishing the partial or complete

termination of the agreement and for disposing of property upon such partial or complete

termination.

f. Any other necessary or proper matters.

2. Any agreement so made which does not establish such an entity shall contain:

a. The provisions enumerated in paragraphs B to F, inclusive, of subsection 1.

16

b. Provision for an administrator or joint board responsible for administering the

undertaking. In the case of a joint board, public agencies that are parties to the agreement

shall be represented.

c. The manner of acquiring, holding and disposing of real and personal property used in

such undertaking. Any agreement must be in writing.

0310 Approval of Cooperative Agreements

1. Cooperative agreements become effective only upon:

a. Ratification by appropriate official action of the governing body of each party to the contract

as a condition precedent to its entry into force. Cooperative agreements ranging in cost from

zero to $1,999 require approval of the agency head; cooperative agreements ranging in cost

from $2,000 to $99,999 require the approval of the Clerk of the Board of Examiners, or

designee, on behalf of the Board of Examiners; and cooperative agreements totaling $100,000

or more require the approval of the Board of Examiners; and

b. Ratification by appropriate ordinance, resolution or otherwise by law on the part of the

governing bodies of the participating public agencies.

2. Cooperative agreements shall be submitted to the Attorney General before becoming

effective for determination of proper form and compatibility with the laws of this State. If

the Attorney General does not disapprove an agreement within 30 days after its submission,

the failure to disapprove constitutes approval.

3. Cooperative agreements must be recorded with the county recorder of each county in which a

participating political subdivision of this State is located, and filed with the Secretary of State.

4. Cooperative agreements dealing in whole or in part with services or facilities over which an

officer or agency of this State has control must be submitted to that State officer or agency for

approval or disapproval as to all matters within his/her or its jurisdiction before the

agreement's entry into force. This requirement is in addition to the requirement of submission

and approval by the Attorney General.

A Contract Summary Form must accompany all cooperative agreements submitted for review and

approval.

0312 Administrative Support of Cooperative Agreements

Any public agency that has entered into a cooperative agreement may support the administrative joint

board or other legal or administrative entity created pursuant to NRS 277.080 to 277.170 in any one or

more of the following ways:

1. By appropriating funds;

2. By selling, leasing, giving or otherwise supplying property; or

3. By providing such personnel or services as may be within its legal power to furnish.

17

0314 Interlocal Contracts

Any one or more public agencies may contract with any one or more other public agencies to perform

any governmental service, activity or undertaking which any of its public agencies is authorized by law

to perform. (NRS 277.180)

Interlocal contracts are distinguished from cooperative agreements in that cooperative agreements are

for the "joint exercise of powers, privileges and authority" by public agencies and interlocal contracts

are agreements by public agencies to "obtain a service" from another public agency.

Agencies are advised to work closely with the Attorney General to ensure compliance with the statutes

governing any cooperative agreement or interlocal contract entered into pursuant to NRS 277.080

through 277.180.

0316 Approval of Interlocal Contracts

If an agency of this State is a party to the interlocal contract, the interlocal contract must be approved by

the Attorney General as to form and compliance with law.

Interlocal contracts must be ratified by appropriate official action of the governing body of each party to

the contract as a condition precedent to its entry into force. Interlocal contracts ranging in cost from zero

to $1,999 require approval of the agency head; interlocal contracts ranging in cost from $2,000 to $99,999

require the approval of the Clerk of the Board of Examiners, or designee, on behalf of the Board of

Examiners; interlocal contracts totaling $100,000 or more require the approval of the Board of Examiners.

A Contract Summary Form must accompany all interlocal contracts submitted for review and approval.

0318 Board of Examiners’ Requirements

All State agencies are required to file one copy of any approved cooperative agreement or interlocal

contract with the Clerk of the Board of Examiners.

The approval of the Board of Examiners and the Office of the Attorney General is required on

cooperative agreements and interlocal contracts pursuant to SAM sections 0310 and 0316.

0320 Independent Contractors

1. The determination as to whether an individual performing services for the State should be treated

as an independent contractor or as a State employee is an important one. That determination can

affect the individual's status in several regards, including:

a. His/Her treatment by the Internal Revenue Service for tax and Social Security

withholding purposes;

b. His/Her treatment by the U.S. Department of Labor for purposes of overtime calculation

under the Fair Labor Standards Act;

18

c. His/Her treatment by the insurance companies providing workers’ compensation

coverage relative to coverage for on-the-job injury; however, if the contractor qualifies as

a sole proprietor as defined in NRS Chapter 616A.310, and has elected not to purchase

industrial insurance for himself/herself, the sole proprietor must submit to the contracting

State agency a signed and notarized affidavit so stating.

d. His/Her treatment by the Employment Security Department in the determination of

unemployment benefits; and

e. His/Her treatment by the courts in determining possible liability to the State of Nevada

for his actions.

2. The following is the definition of an independent contractor .

"An independent contractor is a natural person, firm or corporation who agrees to perform

services for a fixed price according to his/her or its own methods and without subjection to the

supervision or control of the other contracting party, except as to the results of the work, and not

as to the means by which the services are accomplished."

3. There are several additional factors that should be balanced to determine whether the State, as an

employer, has such control over the worker so as to render the relationship one of employment

rather than that of independent contract.

a. The following factors indicate the creation of an employer-employee relationship rather

than that of an independent contractor:

i. The lack of any completion date, time limit or unit of work designation;

ii. The employer's right to hire and fire the person holding the contract;

iii. The payment of a regular salary;

iv. The delegation to the contractor of administrative powers over employees; and/or

v. The level of control over the means and manner of accomplishment of the work.

b. A person is not an independent contractor simply because there is an agreement

designating him/her as such or because the employer permits him/her considerable

discretion and freedom of action. If a person performs services subject to the will and

control of the employer, that person is an employee and his/her salary must come from

the salary category.

4. Agencies unsure whether or not an employee-employer relationship exists in a potential contract

should request the assigned Deputy Attorney General to review the contract for compliance with

the provisions of NRS. An independent contractor is not provided the following:

a. Withholding of income taxes or Social Security by the State;

b. Participation in group insurance plans which may be available to employees of the State;

c. Participation or contributions by either the independent contractor or the State to the

Public Employees' Retirement System;

d. Accumulation of vacation or sick leave; or

e. Coverage for unemployment compensation provided by the State.

5. Agencies contemplating the use of State employees as independent contractors must adhere to

the following conditions:

a. Contracts with State employees must meet the criteria for independent contractors

outlined above.

b. All State permanent employees must devote full time attention and effort to State

employment during official duty hours and not to contractual obligations. (NAC 284.766)

19

c. A State employee shall not enter into a contract with the State in any capacity that may be

construed as an extension of his/her assigned duties or responsibilities to the State (NAC

284.754).

d. Contracts with public officers or employees are prohibited in instances in which the

officer or employee "has a pecuniary interest." (NRS 281.221)

e. A member of any board, commission or similar body engaged in the profession

occupation or business regulated by such board or commission and faculty members of

the Nevada System of Higher Education, may bid on or enter into a contract with any

governmental agency if he is not part of the development of contract plans or

specifications, and if he/she is not personally involved in opening, considering or

accepting offers. (NRS 281)

f. A public officer or employee may bid or enter into a contract with any governmental

agency if the contracting process is governed by rules of open competitive bidding, the

sources of supply are limited, and if he/she is not personally involved in opening,

considering or accepting offers. (NRS 281)

g. An employee may be disciplined for a violation of NAC 284.738, "Conflicting

Activities." An appointing authority has the power under the regulations to define which

activities are in conflict with functions of an agency. (NAC 284.650)

h. State employees employed by one agency may lawfully work on contract for another

State agency while on annual leave from the first agency.

i. Agencies contracting with State employees must provide a written justification as

to why this individual was selected and a written description of the proposed work

and the employee's normal job duties so the Board can make a determination as to

whether or not the contract can be construed "as an extension of assigned job

duties." The Board's favorable consideration of such requests would be assisted if

the contract service and regular employment of the contractor benefit different

agencies, or will be under the supervision of different individuals.

6. Travel expenses, per diem and other expenses may be paid to an independent contractor if

provided for in the contract and must conform to the procedures and rates allowed for State

officers and employees. It is the policy of the Board of Examiners to restrict contractors to the

same rates and procedures allowed State employees.

7. While proposed independent contracts are reviewed by the Attorney General as to form under

NRS that review is only as to the terms of the relationship that appear in the writing presented for

review. If the actual relationship between the worker and the State later changes and does not

comport with that writing, such as if the State subsequently provides office space, secretarial

help or requires the worker to report to a supervisor, the nature of the agreement may well

become one of employment and not contract. For this reason, it is important for agency heads to

monitor the actual work relationships of persons hired pursuant to NRS to ensure that an

independent contract relationship is truly present under the above referenced standards. If there is

some doubt as to that relationship, consult your assigned deputy attorney general.

8. If the services of an independent contractor are contracted to represent an agency of the State in

any proceeding in any court, the contract must require the independent contractor to identify in

all pleadings the specific State agency that he/she is representing.

9. Any person, firm or corporation who performs work under any contract with the State must

furnish the State agency with a certificate of the insurer or other evidence certifying that the

contractor has complied with the provisions of law regarding providing workers compensation

coverage. NRS Chapters 616A to 616D, inclusive. (616B, 616C)

20

0321 Warranties for All Contracts

It is the Board of Examiners recommendation that, in the negotiations of all contracts, warranties as set

forth in the model contract form approved by the Attorney General, remain as stipulated unless

negotiated with the assistance of and approved by the agency’s Deputy Attorney General.

0322 Independent Contract Review

1. Contracts must be ratified by appropriate official action of the governing body of each party to

the contract as a condition precedent to its entry into force. Contracts under $2,000 require the

approval of the agency head or designee; contracts ranging in cost from $2,000 to under

$100,000 require the approval of the Clerk of the Board of Examiners (BOE), or designee, on

behalf of the BOE; and contracts totaling $100,000 or more require the approval of the Board

of Examiners. All revenue-generating contracts require approval limits consistent with the

dollar thresholds as set forth herein. All contracts and amendments with current or former

employees require BOE approval regardless of the contract amount. A current employee is a

person who is an employee of an agency of the State; and a former employee is an employee

of any agency of the State at any time within 24 months preceding the commencement date of

the proposed contract. See SAM 0323 for requirements related to contracts with current or

former employees.

No department, division or agency of the State shall enter into any contract with a person to provide

services without ensuring that the person is in active and good standing with the Secretary of State.

1. The Board of Examiners shall review each contract submitted for approval and consider whether

sufficient authority exists to expend the money required by the contract and whether the services

that are the subject of the contract could be provided by a State agency in a more cost-effective

manner.

2. State agencies shall identify an internal, professional level position to function as a contract

manager. This position would be responsible for facilitating the agency’s RFPs, conducting

complex agency solicitations or, in the event of decentralized agency purchasing procedures,

the review and approval of agency solicitations and the resulting contracts for compliance

with NRS Chapter 333, NAC Chapter 333, and SAM Chapter 0300. Agency contract

managers must become certified through the State Purchasing Division’s Contract

Certification Class. Contract managers will be responsible for completing a comprehensive

training course that will cover all aspects of the RFP process, informal solicitation process,

law pertaining to the State Purchasing Act, contract negotiations, interlocal contracts and

cooperative agreements and other topics relevant to State contracting and reducing the State’s

exposure to risk. Contract manager certification classes are available in NEATS.

3. All contracts submitted to the Board of Examiners which are less than $100,000, and those

contracts entered into by the State Gaming Control Board for the purposes of investigating an

applicant for or holder of a gaming license MAY be approved on behalf of the Board by the

Clerk of the Board of Examiners or his designee. The clerk’s denial of a contract is appealable to

the Board of Examiners. The appeal must be made in writing to the Clerk and include a full

explanation and justification for the appeal. The appeal will be placed on subsequent Board of

21

Examiner’s Agenda subject to the same deadlines established for all other agenda items. Such

contracts are not effective until signed by the Clerk.

4. All services provided to an agency by persons and/or firms falling under the definition of an

independent contractor as enumerated in SAM 0320 must be supplied under a contract executed

by the agency receiving the services. Examples of such services include, but are not limited to:

a. Medical services (does not include employee physicals).

b. Consultants.

c. Training.

d. Telephone answering services.

e. Repair, replacement or installation of parts for automobiles and light trucks more than $5,000

and heavy equipment more than $15,000.

f. Clipping services.

g. Information Technology, including IT services, cloud solutions (e.g. Software-as-a-Service

applications, Platform-as-a-Service, Function-as-a-Service, Infrastructure-as-a-Service), hardware,

software, and maintenance must be reviewed and approved by the Department of

Administration, Division of Enterprise Information Technology Services (EITS) before submittal to

the Board of Examiners. See SAM 1600.

h. Alarm System Monitoring (fire, burglar, etc.).

5. Whenever possible, agencies should anticipate and negotiate contracts for preventive services to

eliminate the need for emergency services at some future date. Such contracts may include minor

remodeling, repair or preventive maintenance work. The following rules must be considered in the

preparation of such contracts.

a. All such contracts are subject to the requirements of SAM.

b. All such contracts must conform to the bidding requirements in SAM 0338 and the minor

remodeling, repair and maintenance requirements in SAM 0338.

c. Funding must be available for payments against the contract.

0323 Contracts with State Employees, Former State Employees

and Secondary Employment

This section relates to current or former employees who contract with the State to provide services, and

certain contracts with business entities who employ current or former state employees. Reference NRS

333.705. Additionally, this section addresses the responsibilities of current employees who hold outside

employment.

The contracting process for a department, division or agency of the State that intends to contract with a

current or former State employee is a two-step process. The proposed relationship between the State

and a current or former employee must be documented using the forms prescribed in this section and

submitted to BOE for consideration. Subject to approval of the relationship by the BOE, the agency

may then execute the contract and in accordance with current contract policy submit it to the BOE.

Definitions of Employee for purposes of this section:

1. Current employee is a person who is an employee of an agency of the State;

2. Former employee is a person who was an employee of any agency of the State at any time in

the 2 years preceding the commencement date of the proposed contract, and who will be

22

receiving retirement benefits under the Public Employees’ Retirement System at any time

during the period of the contract.

Note: Employees of the Nevada System of Higher Education (NSHE), Boards and Commissions are

considered State employees.

BOE Pre-Approval Required

Before any department, division or agency of the State may execute a contract for services with a current

employee, a former employee, or a person employed by the Nevada Department of Transportation

(NDOT) for transportation projects that are entirely funded by federal money and the term of the contract

exceeds 4 years, the Board of Examiners (BOE) must give pre-approval for entering into a contract with

that person. (As noted in section 5 below, contracts executed by NSHE, Boards and Commissions and

certain other contracts do not require BOE pre-approval) This pre-approval does not constitute approval

of the contract terms, but only approval to contract with the particular current employee or former

employee.

The authorization form and contract to initiate the employment of the person must be submitted for

review in accordance with SAM 0324. The authorization form and contract may be considered at the

same BOE meeting; however they will be agendized as separate items. In the event the employment of

the person is not approved by the BOE, the contract cannot be considered by the BOE and will be

withdrawn from the agenda.

A limited exception exists for contracts less than four months in circumstances that have been

determined by the department, division or agency to constitute an emergency situation necessitating a

contract with a current or former employee.

A department, division or agency of the State may seek blanket pre-approvals from BOE for former

employees who work in seasonal, intermittent or other temporary capacities if the person will be

performing or producing services for which the business or entity is employed. For example, five

seasonal snow plow drivers terminate their employment at the end of winter. The drivers are later hired

by construction companies to drive trucks as part of contracts the companies have with a State agency;

in this instance, BOE pre-approval for entering into each contract is required unless the State agency

has a blanket pre-approval for the former employees.

Standards for Pre-Approval of Contracts with Temporary Employment Services and Current or

Former Employees

If an agency will be using a temporary worker to be supplied through a contract with a temporary

employment service, and that person is a current or former state employee, the Board of Examiners shall

not approve the use of the temporary worker unless the Board of Examiners determines that:

1. The person provides services not provided by any other employee of the agency or for which a critical

labor shortage exists; or

2. A short-term need or unusual economic circumstance exists.

The Board of Examiners will apply these standards to all proposed contracts for services involving

current employees or former employees.

23

Contracts Potentially Requiring BOE Pre-Approval

Contracts affecting current or former employees and requiring Board of Examiners pre-approval may

take the form of:

1. A direct contract between a department, division or agency of the State and a current

employee or former employee.

2. A contract with a business or any other entity that employs a current or former employee who will

be performing or producing the contracted services.

3. A contract with a temporary employment service that provides a former state employee to the

State to perform services as a temporary worker.

A person who is a current or former employee may not evade the intent of this section by performing

contract work for the State through creation of a corporation or other business entity.

Exemptions

The requirements for BOE pre-approval of contracts with current employees or former employees do not

apply to the following contracts:

1. A contract with a current employee or former employee for less than four months, where the

executive head of the department/division/agency determines an emergency exists that

necessitates the contract. (Note: a copy of the contract and a description of the emergency must

be submitted to the BOE. BOE shall review the contract and the description of the emergency

and notify the department, division or agency utilizing this emergency exception whether the

BOE would have approved the contract).

2. Contracts with Professional engineers employed by the Department of Transportation for a

transportation project entirely funded by federal funds.

3. Contracts with Nevada System of Higher Education, or a board or commission of the State

4. Contracts with a person employed by an entity, which is a provider of services for Medicaid, and

which provides services on a fee for service basis or through managed care.

5. Contracts for $1 million or more entered into:

a. Pursuant to the State Plan for Medicaid established pursuant to NRS 422.271

b. For financial services

c. Pursuant to the Public Employees' Benefits Program

Complete Contract Authorization – The agency must complete an Authorization form (available on the

Purchasing Division's website) requesting authorization to contract with a current or former employee

and receive approval from the BOE before entering into a contract for services with a current employee

or former employee, or with an entity that will be having a current employee or former employee

perform the contracted services. In the case of pre-approval to contract with a current or former

employee through a Master Service Agreement, the Authorization form is submitted through the

Purchasing Division.

Contract Approval Process - If the contract is going to be with a:

• Current employee

• Former employee

24

• Person who is employed by the Department of Transportation for a transportation project, which

is entirely federally funded, and the term of the contract is over 4 years

• Business employing a current or former employee who will be performing or producing the

contracted services

The following flowchart summarizes steps to be performed

Flow Chart

7. Additional Requirements for Current Employees

a. Time Keeping

i. State time tracking - Current employees, during the pay period they perform

contract or provider agreement work with the State, must include in their time

sheet notes for each day, the specific times they used flex, sick, compensatory

time, annual leave, etc. If contract work is performed during their standard shift,

the employee must document the specific times in the notes and explain how this

was performed during flex time, compensatory leave, annual leave, or non-state

paid time.

ii. Contract time tracking - The contracted employee must document all time (date

and time of day) spent working on the contract and include it in the invoice.

Additionally, the employee must provide a supervisor approved copy of their

State time sheet with their invoice.

b. Contractor Oversight

i. Current employee's supervisor's responsibilities - The employee's supervisor

must compare the employee's NEATS time sheet to the times per the contract

invoice to ensure contract work was not done during state time. The supervisor

must sign the time sheet and the invoice certifying that contract work was

performed during flex time, compensatory leave, annual leave, or non-state paid

time.

ii. Contracting agency's responsibilities - The Contract Monitor must reconcile the

current employee's approved NEATS time sheets to the times noted on the

invoices to ensure contract work was performed during flex time, compensatory

leave, annual leave, or non-state paid time.

c. Secondary Employment

i. Any employee with secondary employment must complete a Secondary

Employment Disclosure form (available on the Purchasing Division's website)

and submit it for approval by the agency head. When an employee obtains or has

a change in their secondary employment, they must submit a Secondary

Employment Disclosure form within 30 days of acceptance and must renew the

Disclosure by July 1st of each year. The agency head must review the form for

conflicts with State employment. Approved forms should be filed in the

employee's personnel file.

ii. Secondary employment includes but not limited to contracts with the State, work

with temporary employment agencies, and provider agreements.

0324 Independent Contract Review Procedure

25

The following procedures should be adhered to when submitting a contract for review:

1. Contracts should be submitted to the Clerk of the Board of Examiners by the deadline

established by the Clerk and disseminated to State agencies via agency memorandums.

2. Each contract must include a clause that specifically states that the State is not obligated under

the agreement before approval by the Board of Examiners.

3. The contract should consist of the Attorney General’s approved contract form for independent

contractors, the State’s solicitation and the successful vendor’s proposal. Any negotiated items or

clarifications should be reduced to writing and incorporated into the contract document as a

separate attachment. It is important, when listing the order of the attachments within a contract,

to give consideration to the order of precedence to prevent potential conflict in the terms.

4. Three copies of the contract must be submitted; each copy must include signatures of the

Attorney General or representative, the responsible agency representative and the contractor. The

signature requirement may be met in counterparts and with facsimile and/or electronically scanned

copies of the signature page with the use of electronic symbols to substitute or supplement the

handwritten or facsimile signature of an authorized signer. Contract distribution is as follows: one

copy for the Fiscal Analysis Division of the Legislative Counsel Bureau; one copy to be returned

to the agency; and one copy for the independent contractor. Access to all submitted proposals

shall be made available by the soliciting agency and will be retained for the life of the contract or

six (6) years, or for a period

of time as determined by the soliciting agency’s records retention schedule, whichever is longer.

5. The Board of Examiners requests agencies to substantiate all contracts entered into with former

employees who would perform work similar to their State employment.

6. Bidding requirements for contracts are outlined in NRS Chapter 333, NAC Chapter 333, and

SAM 0338.

7. Board of Examiners' policy is to review and approve contracts prior to the services being

rendered. Agencies are to present contracts in a timely manner and prior to the obligation of

State funds. Contracts with a retroactive effective date, e.g., work commenced prior to the Board

of Examiners’ approval date, must be accompanied by a memorandum clearly justifying the

circumstances.

8. All contracts involving information systems must be reviewed and approved by the Department

of Informational Services prior to submittal to the Board of Examiners.

9. All applicable contracts placed on the agenda for Board approval or the Clerk of the Board

approval must provide satisfactory proof from the Secretary of State’s Office (SoS) that the

contractors have a current Nevada State Business License (SBL), and if they are a Nevada

corporation, LLC, LP, LLP, or LLLP, or non-profit corporation, that their corporation is active

and in good standing. Satisfactory proof may include one of the following: from the contractor; a

copy of the certificate of good standing or of an unexpired business license or a print-out from

the SoS free Business Entity Search showing active status. Additionally, if they are a corporation,

LLC, LP, LLP, or LLLP, or non-profit corporation based out of state, they must be registered as

a foreign equivalent in Nevada, in active status and in good standing. Any business, except non-

profit organizations organized pursuant to NRS Chapters 82 Non Profit Corporations and

Chapter 84 Corporations Sole that qualifies for an exemption from the business license

requirement must file a notice of exemption which will be on record with the SoS’s Office.

26

0325 State Agencies, Boards, and Commissions with Independent

Contracts for Outside Legal or Professional Services

Professional services shall include consultation or representative services within the professional’s area

of educational expertise performed by licensed practitioners as defined in NRS Chapter 439A, attorneys,

accountants, engineers, architects, or experts (by education or experience) for judicial or administrative

proceedings. It is the policy of the State of Nevada to limit and monitor costs associated with the hiring

of professional and expert services, including private attorneys who provide services to the State as

independent contractors. Accordingly, all such contracts including those entered into between the State,

its agencies, boards and commissions, must include the following contract terms. Further, no such

contract may extend beyond a two-year term without review and approval of the Board of Examiners.

1. Notification of Attorney General's Office - Contractor shall notify and consult with the Attorney

General's Office promptly regarding all significant developments in regard to any potential legal

matters or legal services provided under this contract. Should litigation involving potential

liability for the State commence or significantly change during the term of this contract, the

Attorney General's Office shall be immediately informed in writing. Contractor shall promptly

advise the Risk Management Division of the Department of Administration regarding changes in

the status of litigation that may have a fiscal impact on the State.

2. Copies of Work Products Provided to Attorney General's Office - Contractor shall promptly

provide the Attorney General's Office, 100 N. Carson Street, Carson City, NV 89701-4717, with

copies of final versions of the written work product relevant to any legal matter, including

correspondence and executed counterparts of any original pleadings or other matters of

importance. Contractor shall also provide to the Attorney General's Office written, quarterly

reports summarizing significant developments in regard to the subject matter of the contract and

significant services performed under the contract.

3. Work Product the Property of the State - All work products of the Contractor resulting from this

contract are the exclusive property of the State. If any work remains in progress at the

termination of this agreement, the Contractor shall surrender originals of all documents, objects

or other tangible items related to the work to the Attorney General's Office.

4. Conflicts of Interest - Contractor shall not accept other representation or work known to be in

direct conflict with the subject matter of the contract without prior written approval of the

Attorney General's Office and all attorneys will consult with the Attorney General's Office

regarding potential conflicts of interest, at all times acting in accordance with the Nevada Rules

of Professional Conduct, Supreme Court Rules 157 - 159

5. Copies of professional liability insurance will be attached to the contract with proof of policy of

professional liability insurance for errors and omissions that is issued by an admitted insurance

company authorized to transact insurance in the State of Nevada or by an insurance company

authorized to transact surplus lines in the State of Nevada in an amount not less than $1 million,

or as otherwise determined or waived by the Division of Risk Management, Department of

Administration, 201 S. Roop Street, Suite #201, Carson City, NV 89701.

6. Billing - In the absence of an agreed upon flat rate or per diem, contractor shall submit monthly

billings for work performed, billing only for actual time spent performing a task, and not for unit

charge (e.g., no automatic billing of one-third hour for a phone call that may take only five

minutes). In every case all billings shall describe all work performed with particularity and by

whom it was performed. Billings shall be attached to payment vouchers and processed, as are

27

other claims against the State. Such billings are subject to the following guidelines:

a. Unless otherwise agreed in advance, it is expected that only one professional from

contractor's organization will attend meetings, depositions and arguments and other

necessary events, although a second person may be needed for trials and major hearings

or meetings;

b. Charges for professional time during travel will not normally be reimbursable unless the

time is actually used performing professional services or as otherwise arranged in

advance.

In addition, the State will not pay:

c. Fees for the training of personnel incurred as a result of staffing changes or increases

during the term of the contract;

d. Fees for time spent educating junior professionals or associates;

e. Fees for more than ten hours of work per day for any individual, except during trial or

another extraordinary event.

7. Expense Statements - If the contract provides for specific reimbursement for expenses,

contractor shall submit monthly statements to the Contracting Agency itemizing all expenses for

which reimbursement is claimed. Certain disbursements will not be paid unless agreed to in

advance. These include:

a. Secretarial or word processing services (normal, temporary, or overtime);

b. Photocopy expenses of more than 15 cents per page;

c. Photocopy costs in excess of $2,000 for a single job;

d. Any other staff charges, such as meals, filing, proofreading, regardless of when incurred;

e. Computer time (other than computer legal research specificall y authorized in advance).

The State will not reimburse expenses for the following:

a. Local telephone expenses or office supply costs;

b. The costs of first-class travel (travel arrangements should be made in advance to take

advantage of cost-effective discounts or special rates).

8. Disputes - In the event that a civil action is instituted to collect any payment due under this

contract or to obtain performance under this contract, the State as a prevailing party shall

recover, as the court deems appropriate, reasonable attorneys' fees and all costs and

disbursements incurred in such action.

0326 Independent Contracts Not Requiring Board of Examiners’

Review

The following types of contracts need not be filed with or approved by the Board of Examiners:

1. Contracts executed by the Department of Transportation for any construction or reconstruction of

highways.

2. Contracts executed by the State Public Works Division or any other department or agency for

28

any construction or major repairs, which includes without limitation anticipatory repairs such as

remodeling or maintenance, of State buildings, or State improvements (i.e., dams, boat ramps,

camp grounds), including its leaseholds, if the contracting process was controlled by the rules of

open competitive bidding. (SAM 0338 and 1908)

3. Contracts executed by the Housing Division of the Department of Business & Industry.

4. Contracts executed with business entities for any work or maintenance or repair of office

machines and equipment. (Does not include computer hardware, computer hardware

maintenance and computer software, or items listed in SAM section 0330

5. Contracts entered into by the Nevada System of Higher Education.

6. Contracts for similar services provided by the same contractor within the same fiscal year which

if combined would not exceed $1,999.

7. Repair, replacement and installation of parts on automobiles and light trucks, including aircraft,

heating and air conditioning refer to SAM 1552

0328 Lease Contracts

State Offices - The Administrator of the State Public Works Division has the authority to lease and

equip office space outside of State buildings whenever sufficient office space cannot be provided within

State buildings. No such office space lease may extend beyond the term of one (1) year unless it is

reviewed and approved by the Board of Examiners regardless of the total cost. (NRS 331.110). The

exception is leased space used strictly for storage. In this instance, agencies may directly negotiate their own

leases and they are subject to the same approval thresholds as operating leases. The Attorney General shall

approve each lease entered into pursuant to this section as to form and compliance with law.

Land - The Division of State Lands acquires and holds all lands and interests in land owned or required

by the State except:

1. Lands or interests used or acquired for highway purposes;

2. Lands or interests the title to which is vested in the Board of Regents of the Nevada System of

Higher Education.

3. Office buildings leased by the Administrator of the State Public Works Division; or

4. Lands used or acquired for the Legislature or its staff.

Equipment - The Purchasing Administrator has sole authority to contract for equipment unless otherwise

specifically provided by law (NRS 333.150). Agencies requiring equipment lease contracts should

contact the Purchasing Division (SAM 1500).

NRS 353.500 to NRS 353.630 outline provisions of law related to the purchase of real or personal

property via installment purchase agreements or lease-purchase agreements. These agreements

contemplate the State taking ownership of the property at the end of the agreement term. Lease-

purchase agreements are also referred to as capital leases. NRS 353.580 exempts these types of

agreements from Board of Examiners approval.

29

Conversely, an operating lease agreement is an agreement where ownership of the property does not

transfer to the State at the end of the agreement term. Operating leases are not exempt from Board of

Examiners approval.

Lease contracts must be ratified by appropriate official action of the governing body of each party to the

contract as a condition precedent to its entry into force. Operating leases ranging in cost from zero to

$1,999 require approval of the agency head; operating leases ranging in cost from $2,000 to $99,999

require the approval of the Clerk of the Board of Examiners, or designee, on behalf of the Board of

Examiners; operating leases totaling $100,000 or more require the approval of the Board of Examiners.