POST-DISASTER

CLAIMS GUIDE

Illinois Department of Insurance

122 S. Michigan Ave, 19th Floor

Chicago, IL 60603

(312) 814-2420

320 W. Washington St.

Springfield, IL 62767

(217) 782-4515

THERE'S BEEN A DISASTER - WHAT SHOULD I DO NOW?

SAFE AND SOUND

After a disaster hits, make sure you and your family are safe. Then secure your

belongings. Do what you can to secure your home and property to prevent more

damage or theft. For example, if windows are broken, board them up. If the roof has

a few holes, cover it with a tarp to prevent water damage.

REPORT A CLAIM

Once you’ve determined your home is damaged and needs to be repaired or rebuilt,

report or file a claim as soon as possible. The easiest way to report a claim is to call

your insurance company or agent. You may be able to report or file a claim online or

from your cell phone. If you have trouble finding a phone number, try searching for

your insurance company online.

ESTIMATE DAMAGE

An insurance adjuster will figure out how much damage was done to your home

and property. The adjuster will ask you for a home inventory (a list of your personal

property) if your personal belongings were damaged or destroyed. The adjuster will

visit your home to inspect and estimate the damage done. In this section, you can

learn about the different types of adjusters who may work on your claim and what

you should do to prepare to meet the adjuster.

DETERMINE COVERAGE

Once the adjuster has figured out how much it will cost to rebuild, repair or replace

your home or property, the adjuster will review your policy to calculate how much the

insurance company will pay. If you’ve never filed a claim before, this process can

seem overwhelming. But you can read this section to learn how claim payments are

calculated and how your coverage will impact what your insurance company pays.

You can learn the meaning of some of the words insurance companies use.

REBUILD, REPAIR AND REPLACE

Your recovery from a disaster is not complete until you're living back in your home.

During the recovery phase, you’ll be replacing personal items (if damaged), choosing

building materials and working with contractors. Read this section to find tips about

working with contractors and how to avoid becoming a victim of fraud.

PREPARE

It may sound strange, but the recovery process is the best time to start preparing

for the next disaster or claim. Create a home inventory list as you’re replacing your

belongings. Also as you’re rebuilding, consider using building materials that will resist

damage – so if there’s another disaster, your home may have less damage. For

example, you could use impact-resistant shingles or impact-resistant siding.

Learn more in the sections described below.

1

PROPERTY INSURANCE CLAIMS GUIDE

Disasters happen everywhere and can happen at any time. Any of the following can

cause a significant amount of damage to homes and personal property:

This might be the first time you've had an insurance claim – or maybe a claim this big.

This Guide will help you understand what to do after a natural disaster damages your home. It also gives you

helpful tools and tips to navigate the insurance claims process, whether this is your first insurance claim or

not.

This Guide provides general information to help you in any type of disaster. But remember, most policies

won't cover damage from floods or earthquakes unless you bought that coverage separately.

Your state insurance department will help you and answer any questions – free of charge.

SAFE AND SOUND

A disaster has hit my area and my home

has been damaged. I’ve made sure my

family is safe. What should I do next?

Make sure there are no safety issues like downed

electrical lines or broken gas lines. If there are safety

issues, leave your home and wait for or listen to your

local authorities to learn when you can return.

When inspecting your home, avoid broken glass and

sharp objects or remove them. Watch out for things

that could cause you to trip or fall.

Take photos or videos of the damaged areas and

personal property. You also can jot down notes

about any significant damage you see.

My family and I were evacuated from our

home. When can we go home?

Wait to return to your home until your state or local

authorities tell you it’s safe. The authorities won’t let

you return to your home if there are hazards like

downed power lines or broken gas lines. This is for

your safety.

There's a lot of damage to my home. What

should I do about the damage?

Try to prevent further damage by making essential

repairs, like covering roofs, or windows with

plywood, tarp, canvas, or other waterproof

materials.

IMPORTANT: KEEP ALL RECEIPTS FOR

EMERGENCY REPAIRS TO GIVE TO YOUR

INSURANCE COMPANY. Because you have to

prevent more damage, you may want to hire a

contractor to make any emergency repairs.

Don’t make permanent repairs before talking with

your insurance agent or insurance company. Your

company may not pay for repairs it didn't authorize.

If you’re contacted by any contractors, review the

section on Avoiding Insurance Fraud to avoid being

taken advantage of.

TORNADOES

WILDFIRES

HURRICANES FLOODS

EARTHQUAKE

2

ADDITIONAL LIVING EXPENSE ALE

Most homeowners policies also will pay the additional expenses you have if you can’t stay in your home

because of damage from a covered disaster. For example, if you've to move into a hotel or apartment while

your home is repaired or rebuilt, the insurance company will pay your costs for temporary housing.

Just don’t expect the insurance company to pay for your stay at a 5-star spa and resort or to eat out every

night at the most expensive restaurant in town.

ALE is limited; see below for more information.

Do your best to secure your home and personal

belongings.

Gather important papers, including insurance

policies and a list of all damaged or destroyed

personal property (a home inventory list), if you have

one. Take those with you if you can’t stay in your

home.

If you can’t stay in your home, save any hotel

receipts. Your insurance company will need the

receipts to repay you.

Contact your doctor’s office, pharmacy, or health

plan if your prescription medicines were lost or if

you lost your glasses, contacts, hearing aids, walker,

wheelchair, or other medical equipment in the

disaster.

Make sure you notify utilities and your mortgage

company and make arrangements for mail deliveries.

There's so much damage to my home, there’s no way I can stay. What should I do?

What types of living expenses does ALE

pay for?

The insurance company will not pay ALL of your

living expenses. ALE is to help pay those expenses

that are beyond your normal expenses because

you can’t live in your home. For example, ALE

coverage will pay hotel lodging, but it won’t make

your mortgage payment.

ALE typically covers hotel bills, reasonable

restaurant meals (if you’re staying in a hotel room

with no kitchen), and other living costs above and

beyond your normal housing expenses while you

can’t live in your home because of damage.

You need to be sure you keep ALL receipts for any

additional costs you have. The insurance company

will need the receipts to reimburse you.

Is there a limit to how long or how much I

can use for my additional living

expenses?

Keep in mind that ALE coverage is limited. Some

policies have a dollar limit; some also may have a

time limitation.

The good news – these limits are separate from

any coverage you have to rebuild or repair your

home. They're also separate from any coverage

you have to replace your belongings.

Ask

your insurance company or adjuster what

your policy covers and any time or dollar limits

that apply.

3

REPORTING AN INSURANCE CLAIM

When should I report damage to

my home or personal property?

Before reporting the property damage to your home,

find out what your deductible is. If the damage

is minor, for example, just a few shingles were

damaged, you might decide you’re better off paying

for the repairs out of pocket instead of filing an

insurance claim. But, remember you might not be

able to see all the damage. You may want to have a

contractor inspect your home.

If you believe the damage will cost more than

your deductible to repair, or there's a lot of damage,

you may want to file a claim. It’s important to notify

your insurance company as soon as you know

there’s damage and you decide to file a claim.

The easiest way to report damage is to call your

insurance company or agent directly.

What should I do if I don’t have my

company or agent’s phone number?

If you have cell service, use your cell phone to

search for phone numbers or the insurance

company’s website. There may be a phone number

to report a claim.

If you can access social media, you can search for

information from your insurance company or state

department of insurance about how to file a claim.

If you have limited or no cell service, look for mobile

claims centers in your area. Local news outlets and

social media usually announce their locations.

What do I need to know when I call to make

a claim?

It will help if you have your policy number. But if you

don’t, your insurance company or agent can find your

policy with your name, address, and phone number.

You’ll need to briefly explain what happened and

describe the type and extent of the property

damage.

If you aren’t staying in your home, be prepared

to give your insurance company and agent your

new contact information—a phone number and an

address.

Let your insurance company and agent know when

you call if you’ve taken photos and videos of the

damage and have cost estimates.

What is a contractor?

An individual you hire to manage

the repair of your home. The

contractor is responsible

for supplying the necessary

equipment, material, labor and

services to complete repairs.

4

What do I need to ask when I file a claim?

You should ask:

• For the name and phone number for every

person you talk to.

• For your claim or reference number.

• How long you have to file a claim.

• If you need estimates to make repairs or

rebuild before you can file a claim.

• For a general idea of what your policy will

cover.

• If your insurance policy covers hotel costs. For

how much? For how long?

• For information about your deductible. Are

there separate deductibles for hail, hurricane,

or wind damage? What are those?

• If there are any special processes or

procedures you need to know about.

• When you can expect an adjuster to call.

• What other information the company will need

to process the claim.

What other information or paperwork could

the insurance company or agent ask for

during the claims process?

A list of all damaged or destroyed personal property

(a home inventory list) and receipts, if you have them,

showing when you bought the damaged or destroyed

items.

A list of damage to the home and other structures, like

a garage, tool shed, or in-ground swimming pool. You’ll

need this list when you meet with the adjuster.

What if I don’t have a completed home

inventory list?

Don’t worry; the adjuster will give you some time to

make a list. Ask the adjuster how much time you

have to submit this inventory list.

Work from memory if your property was destroyed

and you have no records.

Review photos, for example on your cell phone or

from family or friends, taken inside your home. That

may help you make the list.

Search online shopping websites or online

retailers to help estimate costs.

The National Association of Insurance

Commissioners (NAIC) has a printable inventory

listing that may help you as you’re making your list.

https://www.insureuonline.org/home_inventory_

checklist.pdf

5

What is a company adjuster?

• A company adjuster works only for that insurance company.

• The insurance company hires and pays a company adjuster. This adjuster will settle the

claim based on the insurance coverage you have and the amount of damage to your

home and property.

• You do

not

pay a company adjuster.

What is an independent adjuster?

• An independent adjuster works for several different insurance companies. An

insurance company uses independent adjusters when it doesn’t have its own adjusters

on staff or when it needs more adjusters than it has available; this often happens in a

large disaster.

• An independent adjuster does the same work as a company adjuster (see above).

• You do not pay an independent adjuster.

What is a public adjuster?

• A public adjuster is a professional you can hire to handle your insurance claim.

• Public adjusters have no ties to the insurance company.

• They estimate the damage to your home and property, review your insurance

coverage, and negotiate a settlement of the insurance claim for you.

• Many states require public adjusters to be licensed. Some states prohibit public

adjusters from negotiating insurance claims for you. In those states, only a licensed

attorney can represent you.

• You have to pay a public adjuster.

ESTIMATING THE DAMAGE

What is an adjuster and what does an adjuster do?

An adjuster is a person who determines the amount of damage to your home and property - what can be

repaired or replaced, and at what cost. An adjuster reviews your insurance policy to determine if the

damage is covered and if there are any dollar limits or deductibles that apply. They also should explain your

policy’s coverage for the claim.

ARE THERE DIFFERENT TYPES OF ADJUSTERS?

COMPANY INDEPENDENT PUBLIC

Remember in larger weather events or disasters, not all adjusters will live or work in your

state. Some adjusters may be sent from other states to help when there's a large number of

claims.

6

WORKING WITH THE INSURANCE ADJUSTER

How long after I file a claim will an adjuster come to inspect my home?

It depends – every disaster can be different. Ask your insurance company when you file the claim.

If you don’t hear from an adjuster in a reasonable amount of time, contact your agent or the company. A

reasonable amount of time could be 3 to 5 days for a minor claim. But, it may take longer for the adjuster to

reach you following a large disaster in your area. Be sure they know how to contact you.

What should I do to prepare to meet with the adjuster?

• Make a list of all damaged or destroyed

personal property. Make a list of damage to

the home and other structures, like a garage,

tool shed, or in-ground swimming pool. Work

from memory or from photos if you have no

records of your destroyed property.

• Gather any photos or videos of your home

and property before they were damaged or

destroyed.

• Include receipts from when you bought the

damaged or destroyed items, if you have

them. Search online shopping sites or online

retailers to help estimate costs.

• If you have time before the adjuster inspects

your home, try to get written bids from

contractors. You aren’t required to have

bids, but it can help. The bids should detail

the materials to be used, prices of those

materials, and labor on a line-by-line basis.

• Take notes when you meet with the adjuster.

Get the adjuster’s name and contact

information and ask when you

can expect to hear back. You can write this

information down in the Claims

Communication Section in the back of this

resource.

What will happen when the insurance adjuster comes to my home?

• You should be there when the adjuster

comes to your home. You can show the

adjuster where you believe there has been

structural damage and give the lists you’ve

prepared of property or structural damage,

photos or videos you’ve taken, and bids

from contractors.

• The adjuster will inspect your home and take

photographs and measurements. While the

adjuster is there, they may even do some

calculations of the damage and cost to

repair.

• Before the adjuster leaves, make sure you

have their contact information. Ask the

adjuster what the next steps will be and to

estimate when you'll hear back from them.

• Ask the adjuster if there's any other

information you should provide. After the

adjuster leaves, you may need to gather

more information or start a personal

property inventory list.

If I hire a public adjuster, will the insurance company still send its own adjuster?

The insurance company doesn’t have to accept your public adjuster's estimates.

The insurance company will typically send either a company adjuster or an independent adjuster to assess

and estimate damage to your home or property.

7

How is a public adjuster paid?

• If you hire a public adjuster, it’s your

responsibility to pay their fee.

• Depending on the laws of your state, public

adjusters can charge a flat fee or a fee that’s

based on a percentage of the settlement you

get from your insurer.

• In some states, the maximum a public

adjuster can charge is set by law. The

maximum also may vary depending on

whether a widespread catastrophe caused

your loss.

• A public adjuster should give you a contract.

The contract should explain what services

the adjuster will provide and how much you

will pay.

• If you hire a public adjuster after your insurer

has made an initial offer, ask about the fee.

The contract should say if the fee you'll pay

will be based on the total the insurance

company pays or on the amount the public

adjuster negotiates for you.

• You should ask your public adjuster to

routinely provide you updates on the status

of your claim.

DETERMINING COVERAGE

SETTLING A CLAIM

How do I get a settlement offer? Who gives me that?

The company adjuster or independent adjuster will calculate the amount of damage to your home and

property. They will review your policy and determine what deductibles may apply and if there are any limits

on what will be paid. Once they’ve made those calculations, they’ll contact you and your public adjuster or

lawyer (if you have one) and share their estimates and calculations with you. They also may contact your

contractor about their estimates and calculations.

Will I get a lump sum payment and when will I receive money?

The settlement process is not a single transaction. You’ll get a number of payments for different parts of your

claim to help you start the rebuilding and repairing process. You’ll likely receive a payment for your additional

living expenses mentioned above. Then you'll start to receive payments to replace your personal property,

followed by payments for the repairs and construction on your home.

Why did the insurance company make the check payable to me AND my mortgage

company?

If you have a mortgage on your home, your lender has an interest in making sure the home is rebuilt – or that

your loan is paid in full. Your mortgage lender required you to add them as an additional insured on your

homeowners policy. Because of this, the insurer is obligated to include them on the check it pays for major

repairs. You’ll need to work with your mortgage lender to get the claim money released for repairs. If you

have problems working with your mortgage lender, contact your state’s agency that regulates banks and

mortgage lenders or your state’s Attorney General’s Office for assistance. The federal government also has

a website where you can make a complaint against your bank or mortgage lender, if you aren’t getting the

help you need. That website is: https://www.usa.gov/complaints-lender. Your state department of

insurance also may have suggestions for you.

8

How long will it take for my insurance claim

to be settled?

Everyone wants the process to be done as fast as

possible so they can return to a normal life.

If there’s substantial damage involving your home and

property, an insurance claim is not going to be closed

with a single payment. There will be claims payments

for various parts of your claim as the rebuilding

process moves along. Most people find it takes at

least 18 to 24 months to repair/rebuild their home and

replace their possessions after a major disaster. Your

insurance claim will stay open until the insurer has

made all payments you’re entitled to under your policy.

You should feel free to contact your insurance

company or adjuster for a status on your claim at any

time during the claims process.

What if I’m not satisfied with the amount of

my insurance settlement?

• Your settlement won’t necessarily be the

same as your neighbor’s. Your coverages,

deductible, and policy limits may be different

even if the damage looks the same.

• If the insurance company denies any part of

the claim, ask for the denial in writing. Keep all

paperwork.

• If you don’t believe the offer is fair, call the

insurance company. Be prepared to explain

why you think the offer is unfair. If you’re not

satisfied with the response, contact your state

insurance department.

What if the insurance company doesn’t agree

with the public adjuster’s or my contractor’s

estimate of the damage?

Differences in construction estimates are common.

Ideally, you and the insurance company should reach

agreement on a “scope of loss”. This is a detailed list

of the quantities of construction materials, labor,

profit and overhead, building code compliance, and

every single item required to repair or rebuild your

home.

Once you’ve submitted all the information that your

insurance company needs, including written estimates

from contractors, the adjuster will calculate the total

cost.

If you disagree with the claim amount the adjuster

has calculated, there are different ways to settle that

disagreement without going to court. Two ways are

appraisal and arbitration.

Appraisal: If you can't agree with your insurance

company about how much it will cost to rebuild your

home and/or repair or replace your property, you can

use the appraisal process to resolve the differences.

This isn't the same as an appraisal you may have of

your home's value.

The appraisal process begins with two appraisers

comparing their estimates. The appraisal process

only determines costs, not if your policy covers these

costs. It isn't a court proceeding.

If you use the appraisal process, you'll have to pay

some of the costs. What you'll have to pay will

depend on your state's law.

If your policy has an appraisal clause, you must go

through the appraisal process before you can sue

your insurance company.

Arbitration: Arbitration is a legal process, but you

don't have to go to court. In an arbitration hearing, a

neutral third party (arbitrator) hears from both you

and your insurance company. Both parties agree to

accept the arbitrator's decision. Usually the decision

is binding so you can't go to court to appeal the

decision.

Some insurance policies require arbitration to settle

differences. Other policies will say how arbitration

will work if both you and your insurance company

agree to use it. If you use arbitration, you'll have to

split the cost with the insurance company. But,

some state laws may require you or your insurance

company to pay the full cost if you aren't successful.

What can I do if my claim was denied?

If you think the insurance company should have paid

your claim, you can use arbitration or file a lawsuit to

get the insurance company to reverse its decision.

But, before you do any of those, contact your state

insurance department for help.

Some states may have a mediation process that you

can use. Contact your state department of insurance

for more information.

9

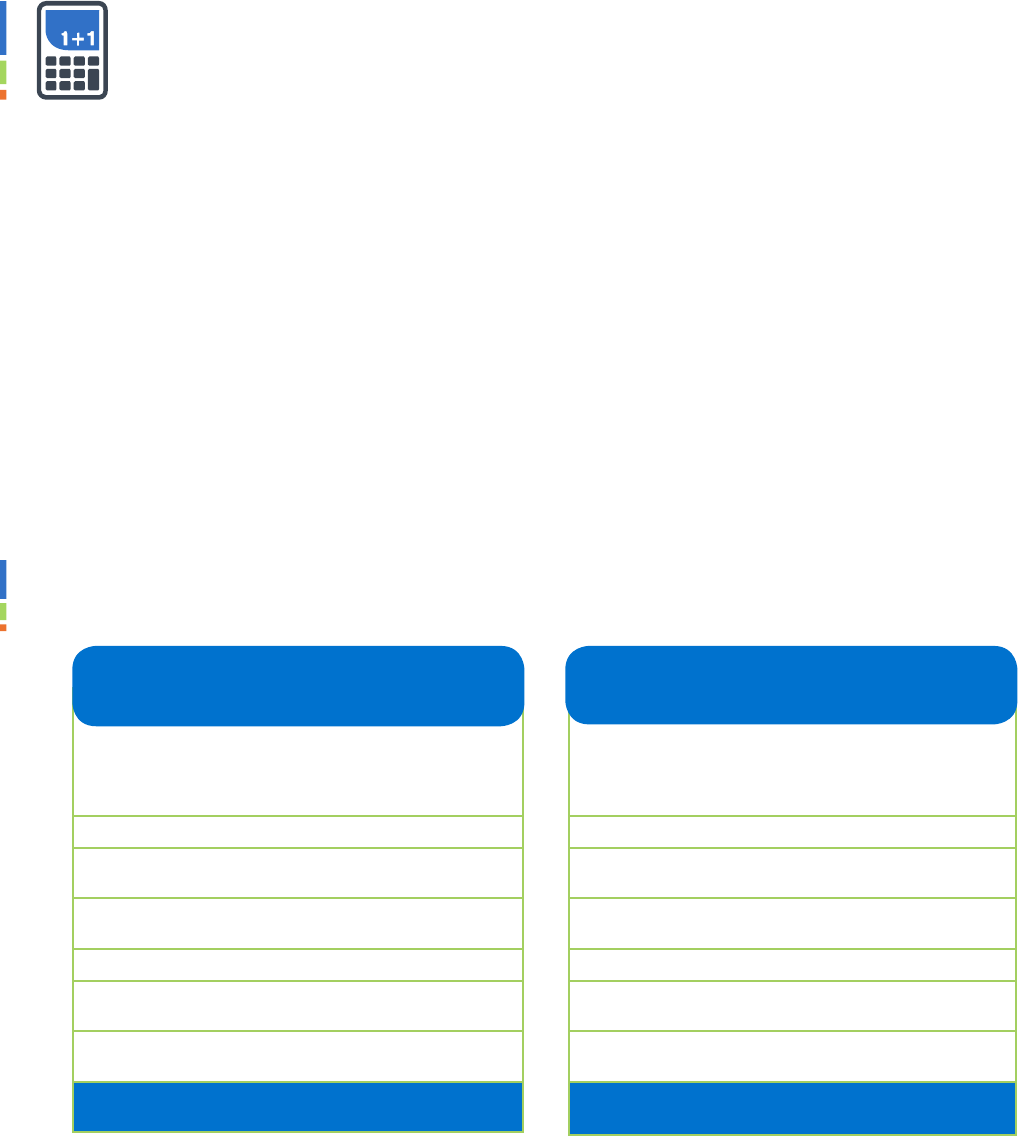

HOW IS A CLAIM PAYMENT AMOUNT CALCULATED?

A number of important insurance terms will help you understand how your insurance

claim will be paid. The following sections explain terms like deductible, depreciation,

Actual Cash Value, and Replacement Cost.

What is a deductible?

A deductible is the part (or amount

) of the claim you’re responsible for. Insurance companies will deduct this

amount from any claim settlements they pay to you or on your behalf. So if your insurance policy has a

$1,000 deductible, that means you've agreed to pay $1,000 out of your pocket for the damage to your home.

Are there different types of deductibles?

Yes. A deductible can be either a specific dollar amount or a percentage of the total amount of insurance.

There are special deductibles that apply to certain types of claims; some deductibles are applied to specific

parts of your home. Look at the declarations page or the front page of most homeowners insurance policies

to learn about your policy's deductible.

HOW ARE DEDUCTIBLES USED TO CALCULATE A CLAIM?

A disaster destroyed your home. Your home was

insured for $250K (structure only) and it will cost

$250K to rebuild it. You have a $500 deductible.

Damage and Cost to Rebuild: $250,000

Minus the Deductible:

- $500

Claim Settlement Amount: $249,500

A disaster destroyed your home. Your home was

insured for $250K (structure only) and it will cost

$250K to rebuild it. You have a 2% deductible.

Insured Value: $250,000

2% Deductible: $250,000 x 2% = $5,000

Damage and Cost to Rebuild: $250,000

Minus the Deductible:

- $5,000

Claim Settlement Amount: $245,000

FLAT DOLLAR DEDUCTIBLE

DEDUCTIBLE PER LOSS

PERCENTAGE DEDUCTIBLE

DEDUCTIBLE PER LOSS

Some insurance policies have a special deductible for losses caused by wind, hurricanes, or other types

of storms. The insurer applies this deductible when one of those types of disasters causes the

damage. If something else damages your home, then the “all peril” deductible would apply.

Some policies also may have a special deductible that applies to a specific part of your home, like your

roof. In these cases, the deductible could be either a flat dollar amount or a percentage.

10

REPLACEMENT COST VERSUS ACTUAL CASH VALUE

If you have Replacement Cost Value (RCV)

coverage, your policy will pay the cost to

repair or replace your damaged property

without deducting for depreciation.

If you have Actual Cash Value (ACV)

coverage, your policy will pay the

depreciated cost to repair or replace your

damaged property.

Check the declarations page of your homeowners policy to see whether the policy provides

replacement cost coverage. If it doesn't specify replacement cost, then your policy likely only covers actual

cash value. If it specifies replacement cost, then you have replacement cost coverage.

Under an RCV or ACV policy, your dwelling coverage pays for damage to the structure and will pay only up to the

policy limit.

Even if you bought an RCV policy, there may be other limits on what the policy will pay for damage to certain

surfaces, such as roofs. In some cases, the policy may pay ACV on your roof, but RCV on the rest of your home

and property. If you have questions, call the adjuster or your insurer and ask what type of coverage you have.

Example:

The Smiths and the Johnsons are next door neighbors. Their homes are exactly the same size, built in the same

year, and have the exact same floorplan. One night, a terrible storm tears through their town, destroying the

Smith’s and the Johnson’s roofs. Both roofs have the same damage. The Smiths and the Johnsons have a $1,000

deductible, and both roofs will cost $15,000 to replace. The Smiths have a replacement cost policy, while the

Johnsons have an actual cash value policy.

JOHNSON’S

ACTUAL CASH VALUE

SMITH’S

REPLACEMENT COST VALUE

Insurance valuation method: ACV

Cost of Johnson’s roof ten years ago: $15,000

Policy deductible: $1,000

Cost to replace roof: $15,000

Depreciation schedule: $1,000/year

Insurance payment:

$15,000 cost of new roof

– $10,000 depreciation ($1000/yr x 10 years)

– $1,000 deductible

= $4,000 insurance payment

Insurance valuation method: RCV

Cost of Smith’s roof ten years ago: $15,000

Policy deductible: $1,000

Cost to replace roof: $15,000

Depreciation not applicable for RCV

Insurance payment:

$15,000 cost of new roof

– $0 depreciation (no depreciation with RCV)

– $1,000 deductible

= $14,000 insurance payment

1

1

HOW DOES DEPRECIATION WORK?

IS ALL DEPRECIATION THE SAME?

No. Depreciation in an insurance claim is much different than depreciation on assets for taxes and is

different from an accountant's calculation of depreciation on property.

In an insurance claim, the deduction for depreciation may be significant, especially if the damaged property

was at or near the end of its useful life. For example, if a covered cause of loss destroys your 20 year old roof

and it must be replaced, a policy that pays RCV will cover the full cost to replace the roof. However, an ACV

policy may pay as little as 20% of the cost to replace the roof, since the useful life of a roof is usually about 25

years.

WHAT IS “DEPRECIATION” AND

HOW DOES THAT AFFECT MY CLAIM?

Everything covered under your homeowners policy is assigned a value. Your home, and

most of its contents and components, are likely to decline in value over time because of

age or wear and tear. This loss in value is known as depreciation.

Insurers usually calculate depreciation based on the condition of the property when it

was lost or damaged, what a new one would cost, and how long the item would

normally last.

For example, your two-year old laptop that was in good condition was destroyed in a

disaster. A similar new laptop would cost $750. Your laptop normally lasts four years,

so it had lost 50% of its value (25% a year). So, the value of your laptop at the time it

was destroyed was half of $750, or $375. Your insurance settlement would include

$375 to reimburse you for this laptop.

$750 $375

$375

Cost of new laptop

(Replacement cost value)

50% depreciation

(2 years x 25% per year)

Value of your laptop

(Actual cash value)

1

2

I have a replacement cost policy,

but my insurance company only

paid for part of the claim.

Can they do that?

When you have an RCV policy and turn in a

claim for a covered loss, the insurer at first

may pay only the ACV for the damage

to your home or personal property.

But, when you present evidence that the

damaged property has been repaired or

replaced, the insurer will pay the difference

(this is referred to as “recoverable

depreciation”) up to the replacement cost.

Recoverable depreciation is calculated

as the difference between an item's

replacement cost and ACV.

Is there a time limit on when I

can get paid for the recoverable

depreciation?

Yes, there’s usually a time limit. That time

limit can range from 6 months to up to

one year, depending on your state’s laws

and your policy.

In certain circumstances, like a very large-

scale disaster, insurance companies know

it will take longer to rebuild homes and

replace property. They'll give you more

time if you ask. Your state insurance

department may require the insurance

company to give you more time.

If you have questions about this time

frame, ask your adjuster. You also can

contact your state insurance department.

I was told I have to replace with “like kind and quality”. What does that mean?

Most insurance policies that are Replacement Cost cover repairs or replacements with property of

“like kind and quality”.

Your insurance policy isn’t intended to pay for expensive improvements or upgrades. For example, if

you had a 3-tab shingle roof before the loss, your insurance policy would cover the cost of another 3-

tab shingle roof, but not a more expensive slate roof. If you had ceramic bathroom sinks in your home,

your insurance policy won’t pay the extra cost to replace those with granite countertops.

What is “Functional Replacement”?

Another type of coverage becoming more common, particularly with older homes, is known as

“Functional Replacement Coverage” (FRC). FRC replaces the damaged property with a functional

replacement, which isn’t necessarily the same quality and craftsmanship as the original materials.

A simple example would be replacing plaster walls with drywall. Both provide solid walls and have the

same function, yet the cost varies greatly between the two. Another example would be a damaged

banister in a home. The repair could be made with wood carved in the same architectural style, but

using a less expensive wood – for instance, replacing an oak banister with a pine banister. Another

example would be replacing a tile roof with a shingle roof.

1

3

My adjuster mentioned that some

of my property has a special limit.

What is that?

A special limit caps how much money

you’ll be paid for certain types of

property. Don’t confuse this with the

contents or personal property limits.

A special limit will apply to specific

categories of property like jewelry, furs,

guns, antiques, collector items, and

coins.

My home and/or property were

destroyed and can’t be repaired.

Can I use the insurance settlement

to build or buy another home

somewhere else?

Check your insurance policy and talk with

your agent or company. You also can call

your state department of insurance.

You may not get the same settlement if you

don’t rebuild on the same location.

WHAT IS ORDINANCE AND LAW COVERAGE?

• In many instances, your local government may require your home to be repaired or rebuilt to meet

current local building codes. Unless you have Ordinance and Law coverage, a standard homeowners

policy doesn’t cover that added expense.

• Ordinance and Law coverage in your homeowners insurance policy covers part or all of the cost to

repair or rebuild your home to meet current local building codes. For example, electrical wiring,

plumbing, windows, and roofing materials are some things that may need to be updated.

• Standard homeowners policies don’t cover the added expense to meet current building codes

when you repair or replace your home. Look at the declarations page of your policy to see if you

have Ordinance and Law coverage.

1

4

THE THREE “R’S” OF RECOVERY

I’ve accepted the insurance company’s settlement and I’m ready to repair/rebuild. What do I

need to know?

• Use reputable contractors. Reputable contractors usually don’t ask for a large payment upfront.

• Contractors may be licensed or registered. The difference is important. A licensed contractor has

passed exams and met other requirements to show that he or she is competent. A registered

contractor has provided contact information to a government authority. You can learn more about

licensing and registration of contractors by calling your state Department of Insurance. They can

help you contact the state agency that licenses and regulates contractors.

• Ask your contractor to show you the building permits. Contractors most likely will need to apply and

pay for building permits before beginning work. And, don’t forget to check with your local officials

about any requirements for permits or inspections.

• Get an estimate from more than one contractor. An estimate from a contractor that's much lower

than any of the others doesn't mean it's the best deal. Make sure all the quotes include the same

things and check references.

• Contact your insurance company and adjuster any time you find damage that hasn’t already been

reported or inspected or if you learn something new about damage to your home or property.

What should I know about a contractor before hiring one?

Get the following information:

•

a copy of the contractor’s identification (the contractor’s name and the name of the business);

• a copy of the contractor’s business license (check the expiration date);

• a copy of the contractor’s proof of worker’s compensation insurance; and

• a copy of the contractor’s proof of liability insurance. A licensed insurance agent or company issues

this certificate. The proof of insurance should show the company’s name, phone number, and the

policy number. Call the insurance company to verify the coverage.

REBUILD

REPAIR

REPLACE

15

WHAT CAN I DO TO AVOID INSURANCE FRAUD?

After storms and other disasters, fraudsters and scam artists often arrive quickly. Watch for

contractors who offer to do your repairs with upgraded or free building materials. Here are a few tips to

help you avoid becoming a victim of a disaster fraudster or scam artist:

• If you’re working with contractors you don’t know, find out where they’re from. Many fraudsters will

travel from state to state.

• Before you sign any contracts or pay any money, ask for references.

• Never pay the full amount before the work is complete.

• Ask your local Better Business Bureau and state Attorney General’s Office about complaints.

• Check online for information about the contractor.

• Most importantly, report any suspected fraud to your insurance agent and your state’s department

of insurance as soon as possible.

Some states allow assignments of benefits (AOB) after a loss. This agreement transfers your rights under

your insurance policy and your claim to a third party, most often your contractor.

Be cautious if you’re asked to sign an AOB. Typically, there’s a promise from the contractor to handle all

matters with the insurance company for you, which may sound great. But you also may be giving up some,

most, or even all of your rights, including having a lawsuit filed without your approval or knowledge.

Take your time to review any AOB carefully. Talk to your claims adjuster or you can ask an attorney to

review and give you advice. You can also call your state department of insurance.

ASSIGNMENT OF BENEFITS

16

MOVING ON & LOOKING FORWARD

I’ve just gone through one disaster. What do I need to do to prepare for the next disaster?

There are two different parts of preparation – preparing your home and preparing yourself financially.

Preparing your home

While you're rebuilding, think about what you can do to minimize damage to your home during the next storm

or disaster. This is called mitigation.

WAYS YOU CAN LIMIT FUTURE DAMAGE:

You can make changes to your home to limit damage during a future tornado, wildfire,

hurricane, or high wind.

Brace your garage door. You can

buy bracing products that will

make your door stronger and more

wind resistant. If you’re expecting

bad weather and haven’t braced

your garage door, you can put

a vertical brace into the wall

framing and floor, much as you

would board up a window before a

hurricane.

Install wind-resistant roof

structures. Roofs are usually

installed with roofing nails. But

this type of roof can come off in

high winds. Using hurricane clips

to attach roofs creates a stronger

connection between the roof and

the house. Roofing clips come in a

range of protection; the one you

need depends on the weight of

your roof. The building codes in

hurricane-prone areas requires

roofing clips, but they’re a good

idea in tornado-prone areas too.

Secure entry doors.

Make sure

entry doors have a two-inch

deadbolt and three hinges with

screws long enough to secure the

door and frame to the wall. The

frame should be well anchored.

Install impact-resistant

windows. Local building codes in

some areas require this.

Leave the windows closed in a

storm. Opening the window

doesn’t equalize the pressure

between the inside and outside of

the house. Instead, it pressurizes

the inside of the house, like blowing

up a balloon until it pops. The air

pushes off the roof or a wall and the

house collapses.

Create a wildfire defense area.

Remove flammable materials from

around your home. Trim over

hanging branches. Remove dead

trees and bushes. Clean gutters

and clear them of leaves and pine

needles.

Install mesh screens over exterior

vents. This will prevent fire embers

from getting inside your home.

Store firewood and other

flammable materials away

from home, garage, or deck.

17

A number of great resources are available online can give you more ideas about ways you can reduce or

avoid damage to your home.

• Ready.gov (US Department of Homeland Security)

• FEMA Mitigation Resources (US Department of Homeland Security)

• Ready, Set Go! (Wildfire resiliency)

PREPARING YOURSELF FINANCIALLY

Once you've rebuilt or repaired your home, and you’re replacing damaged property, it’s time to prepare for

the future.

• You should make a list of all your stuff, called an inventory list. If you don’t want to write everything

down or type it into a spreadsheet, you can film a video to show your household items. As you film,

you can describe important items, including when you bought the item, its condition, and

how much you paid for it, if you know. There also are many mobile apps that will make it

easier to create an inventory list. The National Association of Insurance Commissioners

(NAIC) has a free app called the MyHOME Scr.APP.book that can be downloaded in

the Apple App Store or on Google Play.

• Make a copy of your inventory list and keep it with your insurance policy. You could put the copy

somewhere safe, such as a bank safety deposit box. You also could store a copy online.

• Put your insurance company name, policy number, and company contact information somewhere

you could find it in a disaster.

• Review your policy with your insurance agent each year to see if your needs have changed.

18

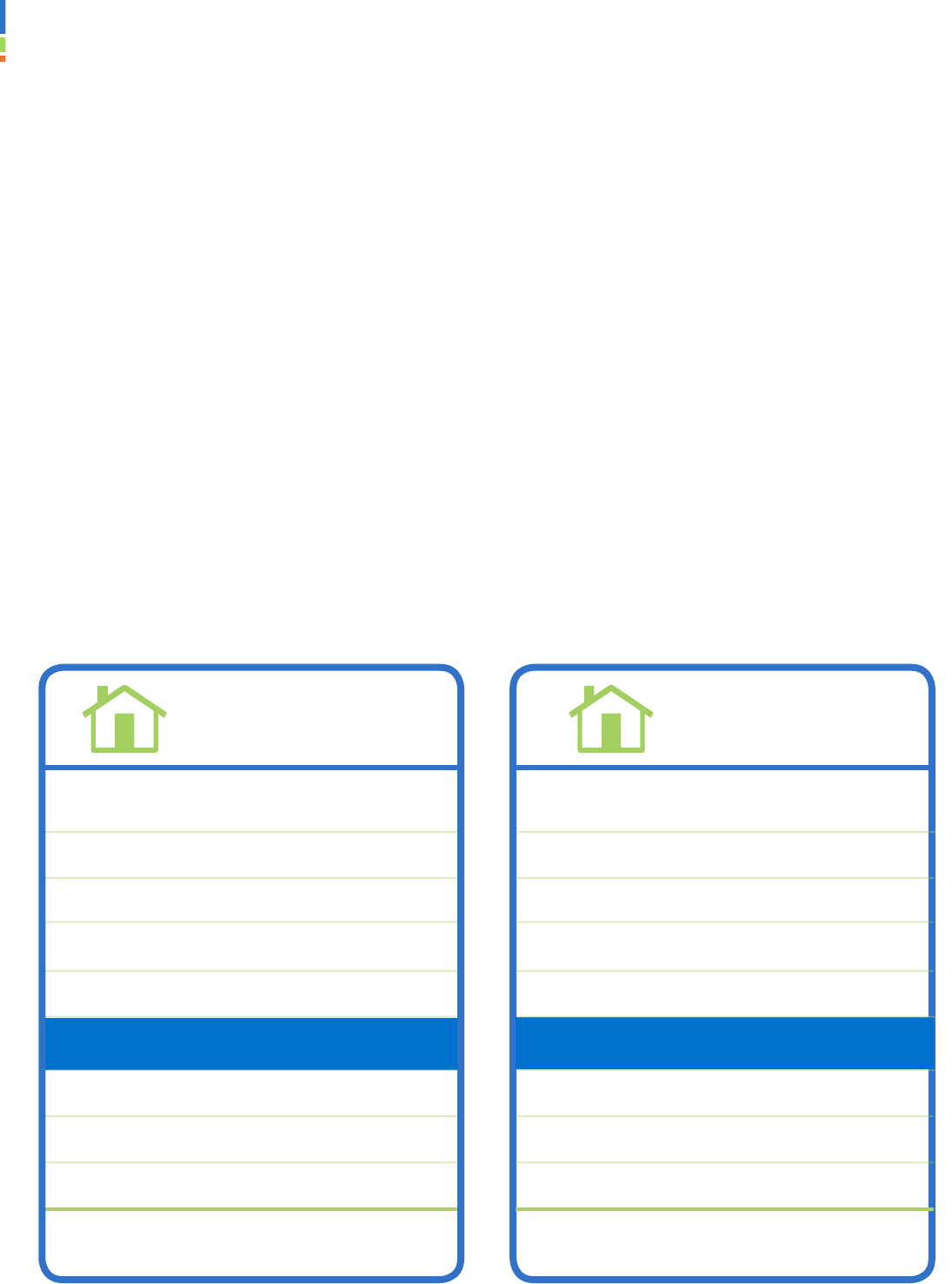

CLAIM INFORMATION

Name of Insurance Company:

Claim Number:

Phone Number:

INSURANCE ADJUSTER INFORMATION

Adjuster Name:

Adjuster Company:

Phone Number:

Adjuster License Number:

Website:

CONTRACTORS

Name of Company:

Representative:

Phone Number:

License Number:

I checked:

With my Insurance

Company

They have liability

Insurance

With the Better Business

Bureau

Online Search

Name of Company:

Representative:

Phone Number:

License Number:

I checked:

19

They have liability

Insurance

With my Ins

urance

Company

With the Better Business

B

ureau

Online Search

Who did I talk to:

Name of Company:

Date/Time:

What we talked about:

What is Next:

Who did I talk to:

Name of Company:

Date/Time:

What we talked about:

What is Next:

CLAIM COMMUNICATION LOG

20

Who did I talk to:

Name of Company:

Date/Time:

What we talked about:

What is Next:

Who did I talk to:

Name of Company:

Date/Time:

What we talked about:

What is Next:

CLAIM COMMUNICATION LOG

21

EMERGENCY REPAIR LOG

Repair:

Cost of Repair:

Date of Repair:

To help you keep track of any emergency repairs, here are some forms to help you.

Repair:

Cost of Repair:

Date of Repair:

Repair:

Cost of Repair:

Date of Repair:

Repair:

Cost of Repair:

Date of Repair:

22

Repair:

Cost of Repair:

Date of Repair:

Repair:

Cost of Repair:

Date of Repair:

Repair:

Cost of Repair:

Date of Repair:

Repair:

Cost of Repair:

Date of Repair:

23

EMERGENCY REPAIR LOG

To help you keep track of any emergency repairs, here are some forms to help you.