Business Plan

2013/14

Financial Conduct Authority

Business Plan

2013/14

© Financial Conduct Authority 2013

25 The North Colonnade Canary Wharf London E14 5HS

Telephone: +44 (0)20 7066 1000

Website: www.fca.org.uk

All rights reserved

Business Plan / 2013/14

Financial Conduct Authority

3

Content s

Chairman/Chief Executive Introduction 4

1 Executive Summary 8

1.1 Our strategic priorities 9

1.2 Key European and international priorities 10

1.3 Measuring our performance 11

1.4 Using our resources effectively 12

2 Achieving our objectives 14

2.1 Conduct risks to our objectives 15

2.2 Consumer protection 22

2.3 Enhancing market integrity 25

2.4 Building competitive markets 30

2.5 Building a new regulator 33

3 Taking action against firms that do not 38

meet our standards

3.1 Market abuse 40

3.2 Transaction reporting and 40

market surveillance

3.3 Financial crime 41

3.4 Redress 42

4 Protecting the perimeter 44

4.1 How will we challenge businesses 45

and individuals?

4.2 Authorising dual-regulated rms 47

5 Delivering our operational platform 48

5.1 Our information systems 49

5.2 Our estate and shared services 49

5.3 Our people 50

6 Budget 2013/14 52

Appendices

1. Regulatory architecture, key stakeholders

and international regulation

2. Our accountability and transparency

3. Table of regulatory reform by market(s)

affected

4. Principal European legislation

5. FCA independent panels – strategy

for 2013/14

6. The Organisation charts

7. Corporate responsibility

8. Reference table of strategic priorities

9. 2013/14 Milestones

AppendicesChapter 6Chapter 5Chapter 4Chapter 3Chapter 2Chapter 1Introduction

Business Plan / 2013/14

Chairman/Chief Executive introduction

Business Plan / 2013/14

Financial Conduct Authority

5

The Financial Conduct Authority (FCA) is coming

into existence at a critical time in the history of

nancial services. As the global crisis appears

gradually to recede, we still nd ourselves

dealing with major conduct scandals from the

past. The scale of the mis-selling of Payment

Protection Insurance, the behaviour surrounding

the manipulation of LIBOR, and other instances

of material consumer detriment have convinced

everyone that things must change as far as

conduct in nancial services is concerned.

Our job is to require, through regulation, that such

a change takes place in the culture of financial firms

so they learn the lessons from the past to prevent

errors being repeated. We will do this by creating an

environment supportive of good conduct but where

the incentives and opportunities for bad behaviour are

low and the potential costs are high.

Our responsibilities extend to all consumers, whatever

their age or financial circumstances and whether an

individual, small company or a major participant in the

wholesale markets. The challenge for us in building the

FCA is to use the full range of our powers under the

new legislation to make financial markets work well, so

that everyone can use the UK’s financial services with

renewed confidence.

This is the FCA’s first Business Plan and our first

opportunity to set out our priorities for the year

ahead. At the same time we are publishing our FCA

Risk Outlook, which sets out the challenging economic

backdrop, plus the framework against which we will

assess the condition of the markets and will seek

to identify future risks to our objectives. Many of

these are complex and will require intervention over

several years. This document is not attempting to be

comprehensive in that regard but is designed to give

a clear indication of how we will operate for the next

twelve months.

New statutory objectives

Underpinning our work is our strategic objective of

making markets work well and our three operational

objectives which are:

• Delivering consumer protection − securing an

appropriate degree of protection for consumers.

• Enhancing market integrity − protecting and

enhancing the integrity of the UK nancial system.

• Building competitive markets − promoting effective

competition in the interests of consumers.

The FCA has a renewed focus on consumers. We

will work in a number of areas to ensure that our

objective of consumer protection is met, including

work to ensure that firms’ strategies are aligned

with producing good outcomes for consumers − for

example, through our work on product governance

and incentive structures in firms.

Our work on wholesale conduct will help us underpin

market integrity, as will our new approach to the

supervision of trading platforms. Clean markets are

key to ensuring the integrity of the UK financial system

and we continue to prioritise tackling market abuse to

address this.

Our new competition objective is a significant change

and we will make sure that we are equipped to

deliver it. This will involve building a new Competition

department; embedding competition analysis in the

FCA, assessing what is happening in the marketplace

and the impact on competition of any intervention

we may consider. We will work with, and learn from,

the Office of Fair Trading in particular.

Not all of our work is new. We carry forward many

tried and tested procedures from the Financial Services

Introduction

Business Plan / 2013/14

6 Financial Conduct Authority

“Our culture should reect

the world around us and

change in response to it”

Authority (FSA) as well as some major policy initiatives:

the Mortgage Market Review, the rules on retail

investment advice and extensive engagement with

Europe on important Directives. At the same time

we have a big task preparing ourselves to regulate

consumer credit from 2014.

New culture

Our culture should reflect the world around us and

change in response to it. A major risk for any regulator is a

natural tendency to become bound, often unconsciously,

to the conventional thinking and approaches of the day.

We need to build a new regulatory culture that stresses

openness − and therefore predictability − by learning

from our own experience and from others. We need to

make it natural to question ourselves so that we avoid

‘group think’ and are continually looking to explore

new approaches and perspectives, be it from our staff,

other regulators and the world at large.

We will be open and accountable. Our Discussion Paper

on transparency and accountability and our Policy

Statement on publishing regulatory failure reports are

only the start of a continual process of becoming more

open and holding ourselves to account.

New approach

Our first year as a new regulator will be an exciting

and challenging time but one for which we are well

prepared. We know that we will be scrutinised and

judged by how we perform against our new statutory

objectives. We are introducing new approaches and

techniques to the way we do much of our work. But

we cannot succeed wholly in isolation. Our outcomes

will be greatly enhanced by the conscious cooperation

of the firms we regulate and by the vigilance of their

customers. With both of these stakeholder groups we

want our relationships to be open, our messaging to

be clear and our interventions to be effective. While

there will be no room for the poor behaviour of the

past, there is every intention of combining financial

markets that work well with better outcomes for

consumers. All are essential for the long-term

sustainability of the industry.

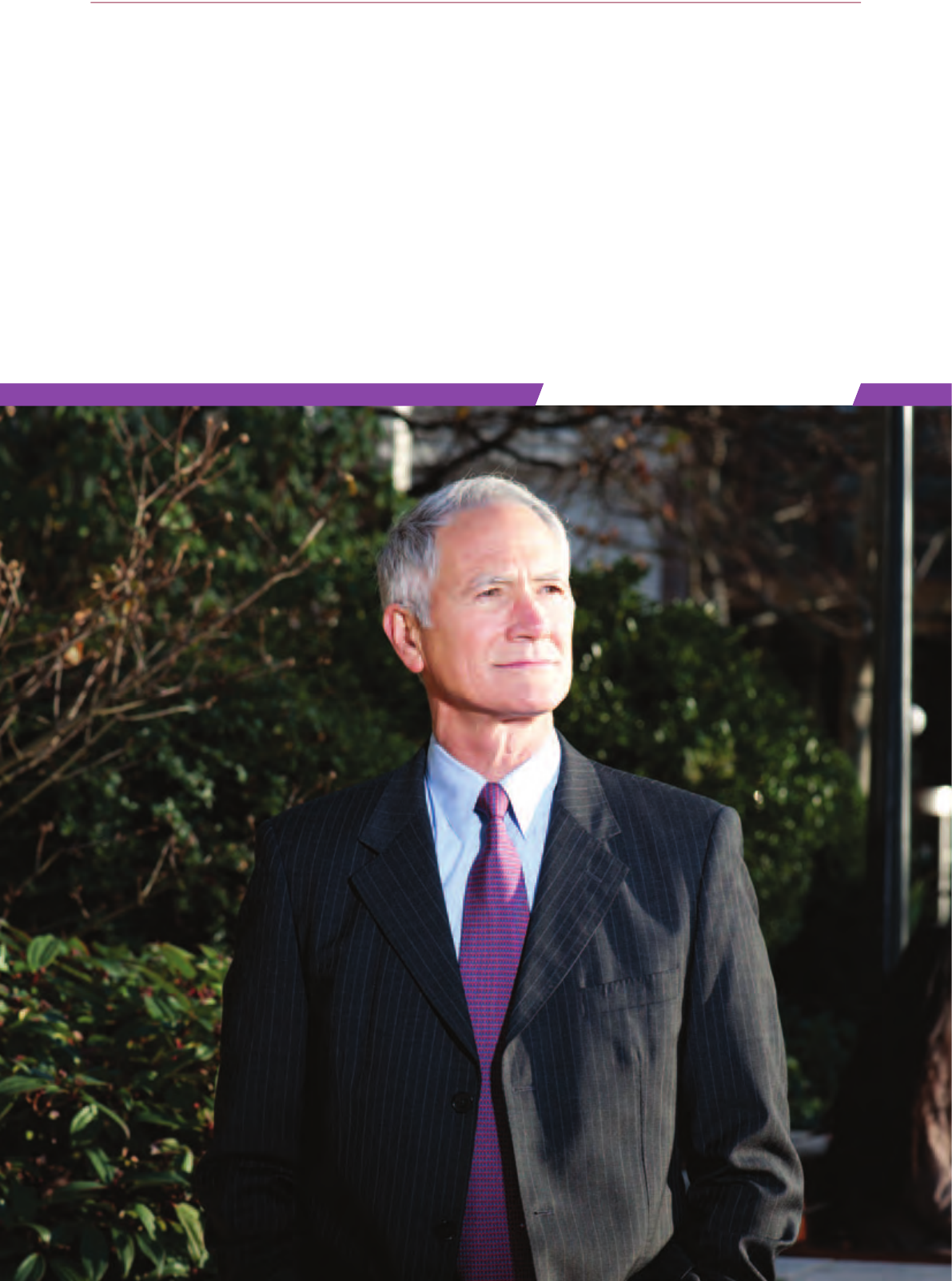

John Grifth-Jones, Chairman Designate Martin Wheatley, Chief Executive Designate

Introduction

Business Plan / 2013/14

1.

Executive Summary

Financial Conduct Authority 9

Business Plan / 2013/14

Our strategic priorities are driven by three

components:

• the key forward-looking risks in the FCA Risk

Outlook;

• our operational objectives; and

• addressing crystallised risk.

The Business Plan sets out how we will achieve this,

including the prudent use of our resources.

To achieve our priorities we have a broad range of

regulatory tools available, from supervisory actions and

policy responses to research initiatives and engaging

with consumer bodies.

These tools are available to us throughout the regulatory

lifecycle, from authorising a firm, overseeing its day-

to-day conduct and taking enforcement action when

conduct has fallen short of what is expected.

Below we have outlined the three components of

our strategic priorities, which are explained in detail

throughout this Business Plan. A reference table is in

Appendix 8.

1.1 – Our strategic priorities

Key forward-looking risks from the FCA Risk

Outlook (Section 2.1)

Major priorities will be to address the key forward-

looking risks outlined in the FCA Risk Outlook, and

strongly influence the conduct of financial services.

These risks are:

• Firms do not design products or services that respond

to real consumer needs or that are in consumers’

long-term interests.

• Distribution channels do not promote transparency

for consumers on nancial products and services.

• Over-reliance on, and inadequate oversight of,

payment and product technologies.

• Shift towards more innovative, complex or risky

funding strategies or structures that lack adequate

oversight, posing risks to market integrity and

consumer protection.

• Poor understanding of risk and return, combined

with the search for yield or income, leads consumers

to take on more risk than is appropriate.

We will also consider the three main causes of conduct

risk set out in the FCA Risk Outlook.

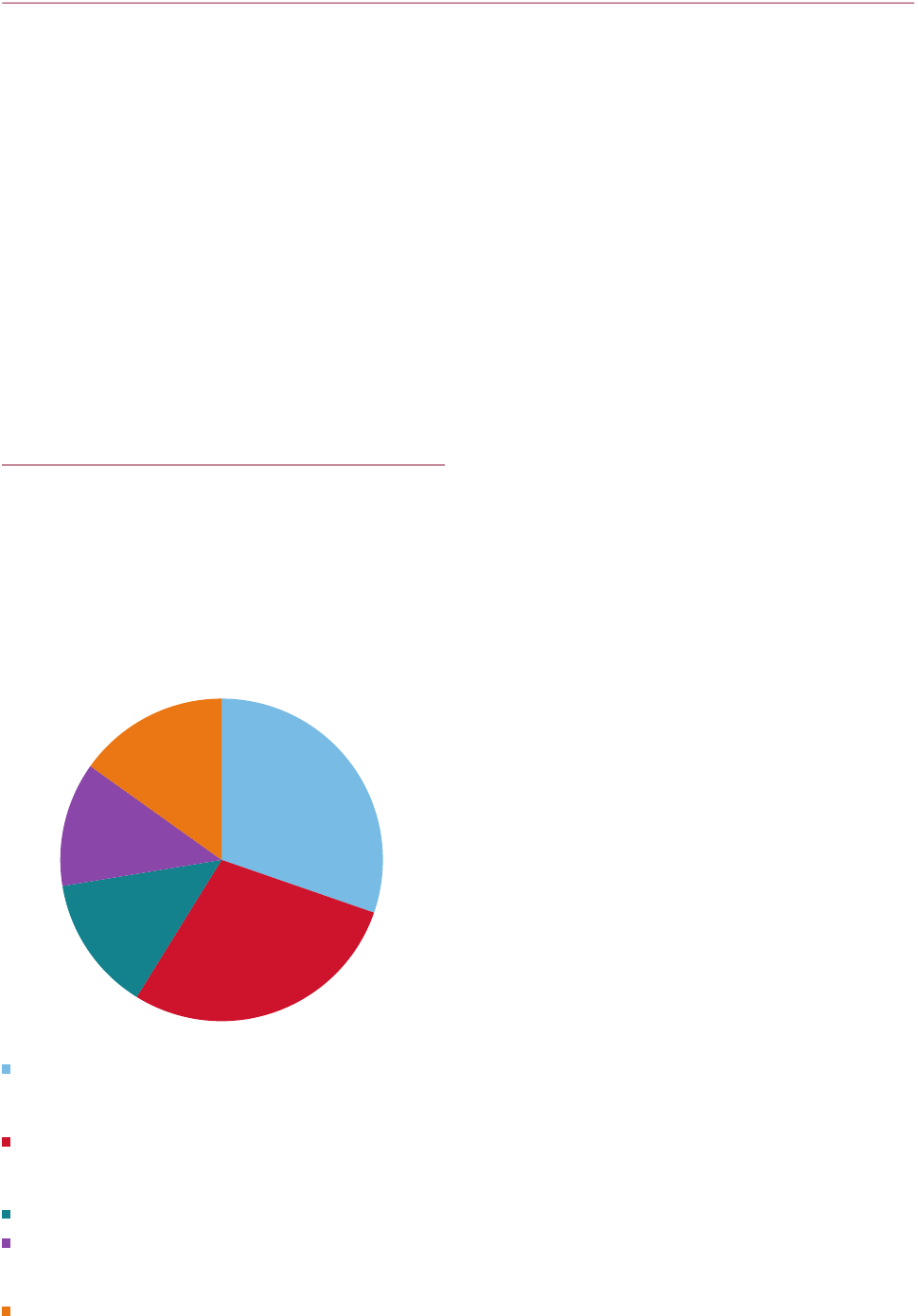

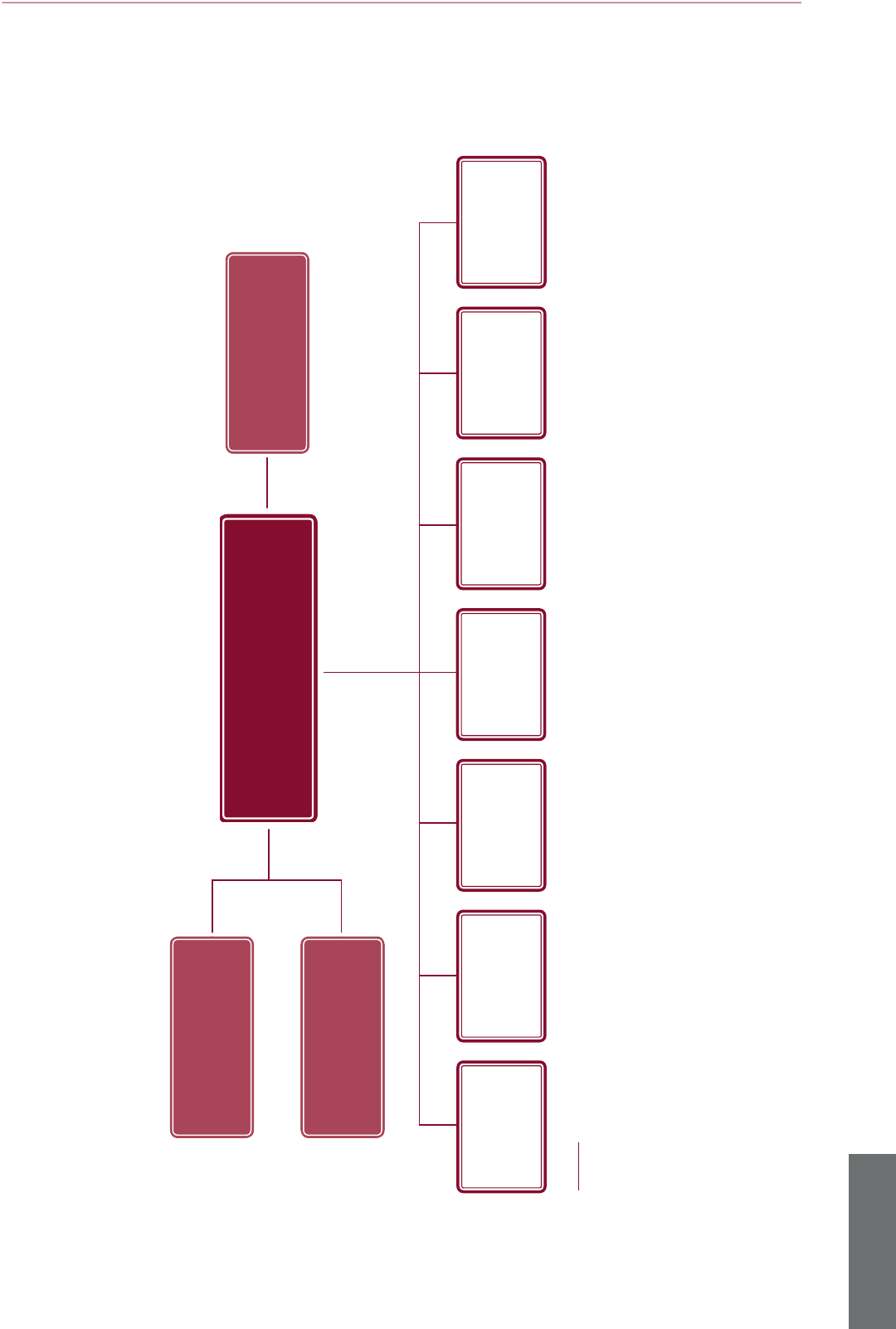

Figure 1

E

n

v

i

r

o

n

m

e

n

t

a

l

I

n

h

e

r

e

n

t

S

t

r

u

c

t

u

r

e

s

&

b

e

h

a

v

i

o

u

r

s

Biases &

heuristics

Inadequate

nancial

capability

Conicts

of interest

Culture &

incentives

Regulatory

& policy

changes

Technological

developments

Economic &

market trends

Ineffective

competition

Information

asymmetries

Chapter 1

Business Plan / 2013/14

10 Financial Conduct Authority

• Inherent factors − A range of inherent drivers of

conduct risk interact to produce poor choices and

outcomes in nancial markets. These drivers are

a combination of supply-side market failures (e.g.

information problems) and demand-side weaknesses

(e.g. inbuilt biases), which are often exacerbated by

low nancial capability among consumers.

• Structures and behaviours − Structures, processes

and management (including culture and incentives)

that have been designed into and become

embedded in the nancial sector, allowing rms to

prot from systematic consumer shortcomings and

from market failures.

• Environmental factors − Long-running and current

economic, regulatory and technological trends and

changes that affect the factors explored in Chapters

1 and 2 and are important drivers of rm and

consumer decisions.

Our operational objectives (Sections 2.2 to 2.4)

Our operational objectives are contained in the

Financial Services Act 2012 and are set within the

context of our strategic objective, which is to ensure

that relevant markets function well. They are:

• Delivering consumer protection − securing an

appropriate degree of protection for consumers.

• Enhancing market integrity − protecting and

enhancing the integrity of the UK nancial system.

• Building competitive markets − promoting

effective competition in the interests of consumers.

Addressing crystalised risk

• London Interbank Offered Rate (LIBOR) −

reforming the setting and governance of LIBOR,

plus pursuing other signicant cross-border

investigations in relation to LIBOR and other

benchmark rates (Section 2.3).

• Payment Protection Insurance − focusing on

ensuring that consumers who have been mis-sold

PPI promptly receive appropriate redress, plus

other work into examining complaints handling

(Section 3.4).

• Interest rate swaps − overseeing the review and

redress process to ensure that fair and reasonable

outcomes are being reached and that appropriate

redress is paid to small businesses where due

(Section 3.4).

1.2 – Key European and international priorities

The importance of the UK maintaining its influence

internationally is a high priority for 2013/14. We will work

at every level with other UK authorities, maintaining and

developing a strong, influential voice that promotes the

UK’s regulatory priorities and objectives. We will engage

in a positive manner, coordinating effectively and

working closely with the Prudential Regulation Authority

(PRA), Bank of England and the Treasury.

In the Journey to the FCA, which we published in

October 2012, we recognised that an increasing part

of our work will be to implement, supervise and

enforce EU and international standards. We committed

to engaging actively in international debates and

rulemaking, to ensure that standards set on consumer

protection and market integrity are consistent with our

objectives. The following international priorities are

discussed throughout this Business Plan:

• Provide leadership in the discussions on EU and

international issues and establish the FCA as a

credible and inuential member of the EU and

global community.

• Ensure that our EU and international engagement

is coordinated with the UK regulators.

Financial Conduct Authority 11

Business Plan / 2013/14

• Inuence global policy debates to promote a framework

that makes markets work well for consumers.

We are also influenced by our obligations to implement

already agreed EU requirements.

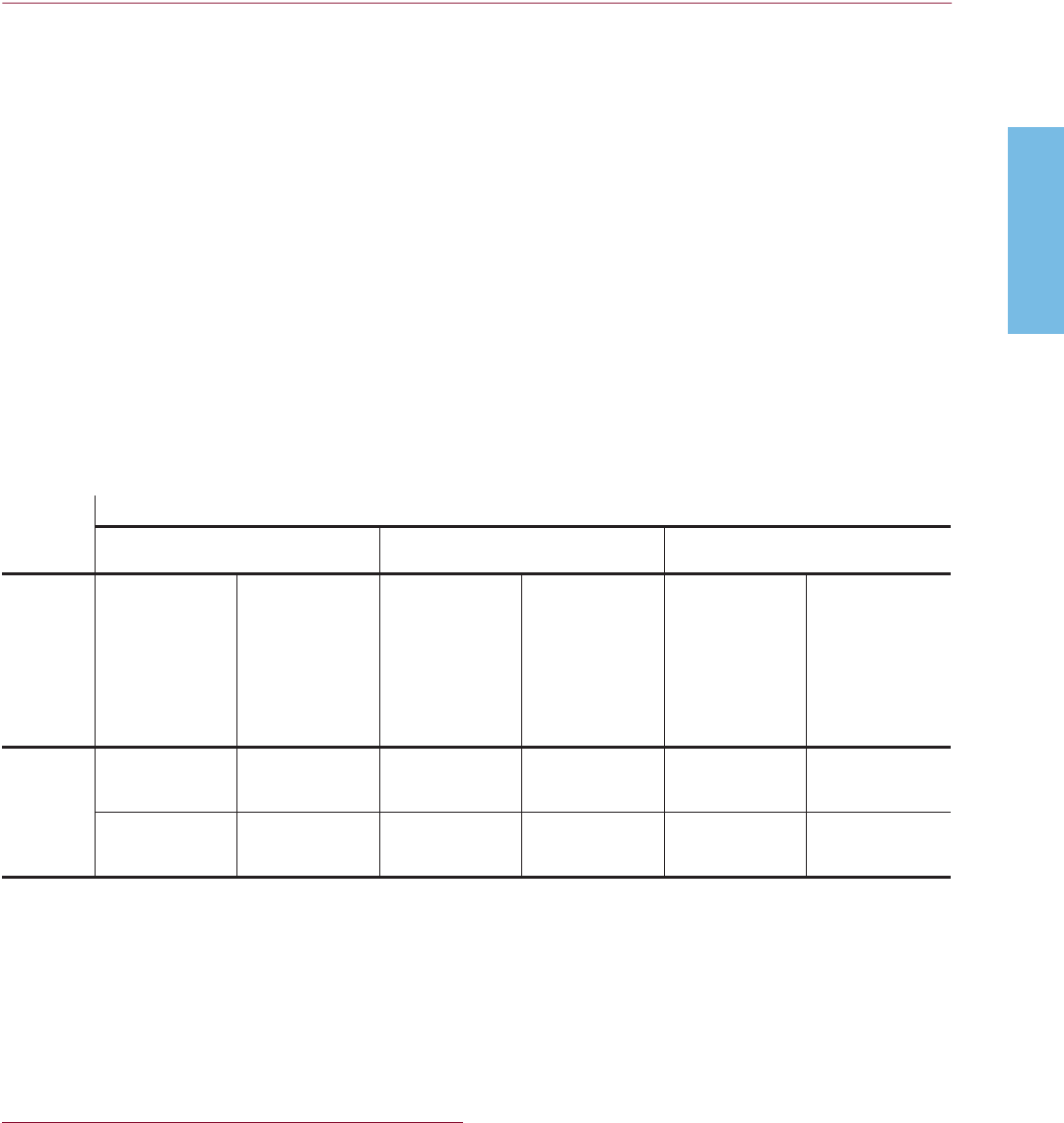

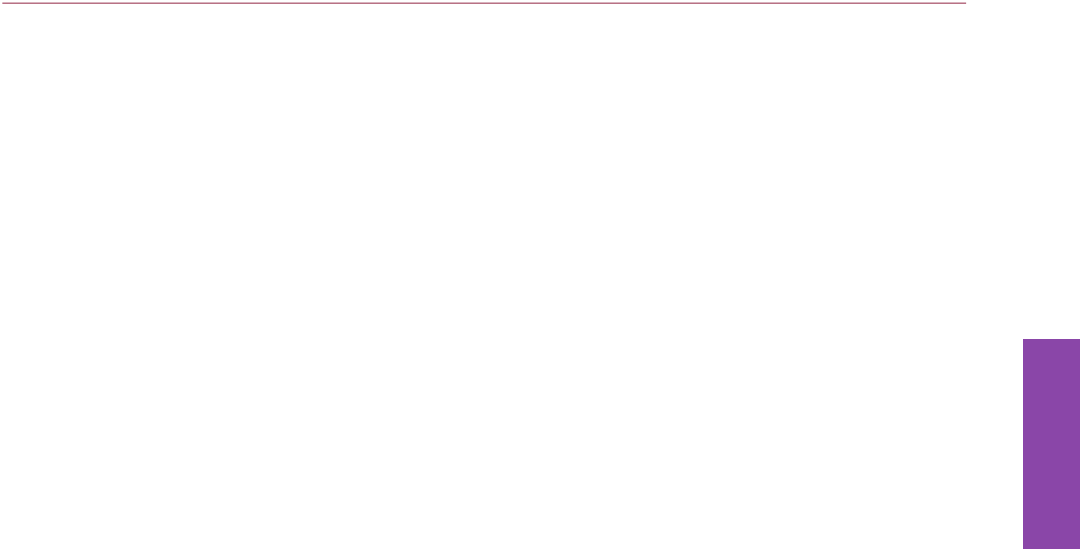

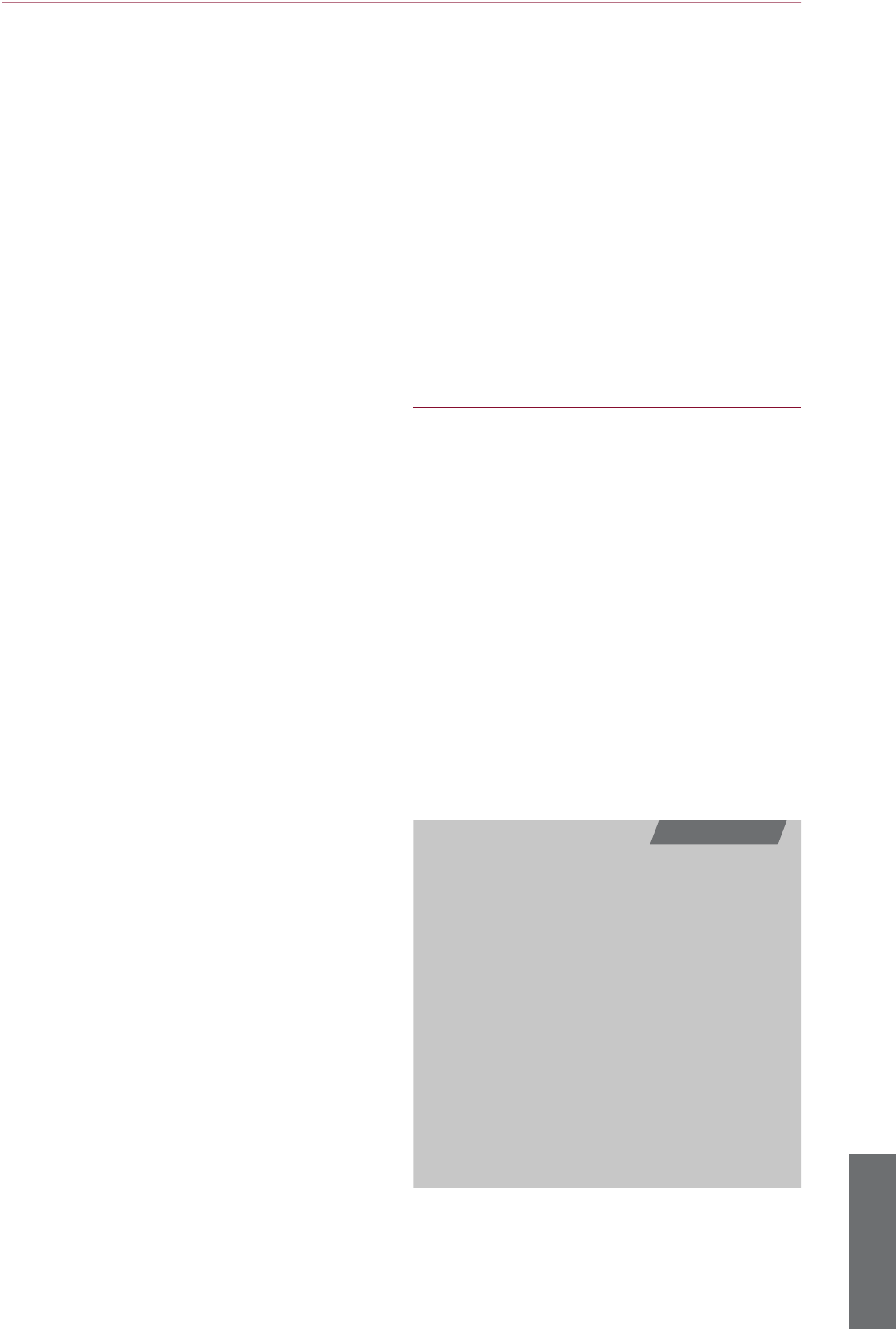

1.3 – Measuring our performance

To be an open, transparent regulator, we must

be held to account. Central to this is the need to

evaluate our performance. Last year the FSA consulted

representatives from firms, consumer groups and other

stakeholders on what they expect of the FCA and what

the FCA’s statutory objectives mean to them. We used

this to help develop outcomes against which we can

measure our performance. Later in 2013 the FCA will

publish its approach to evaluating its performance.

Underpinning this will be a detailed performance

framework against our statutory objectives as detailed

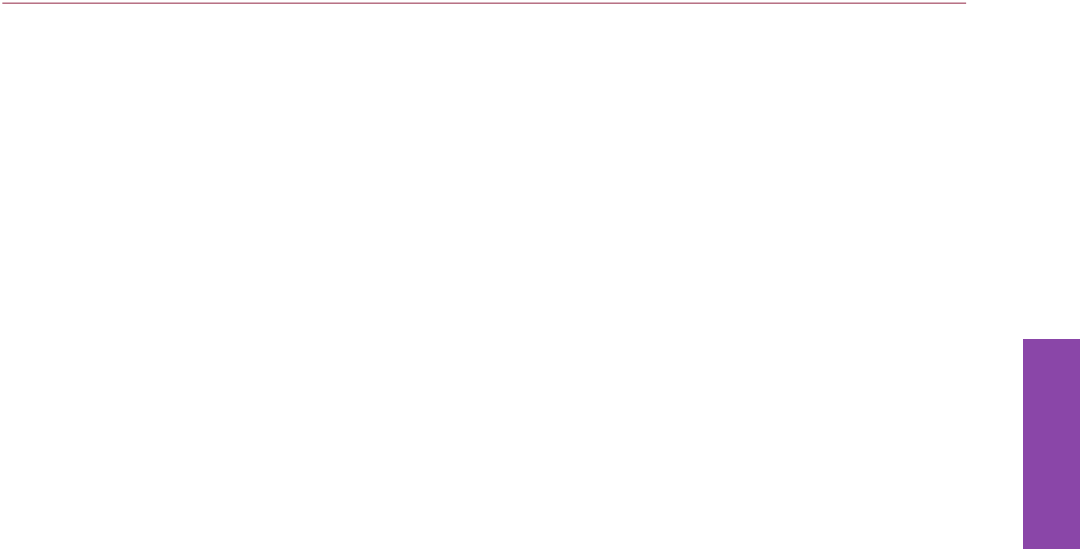

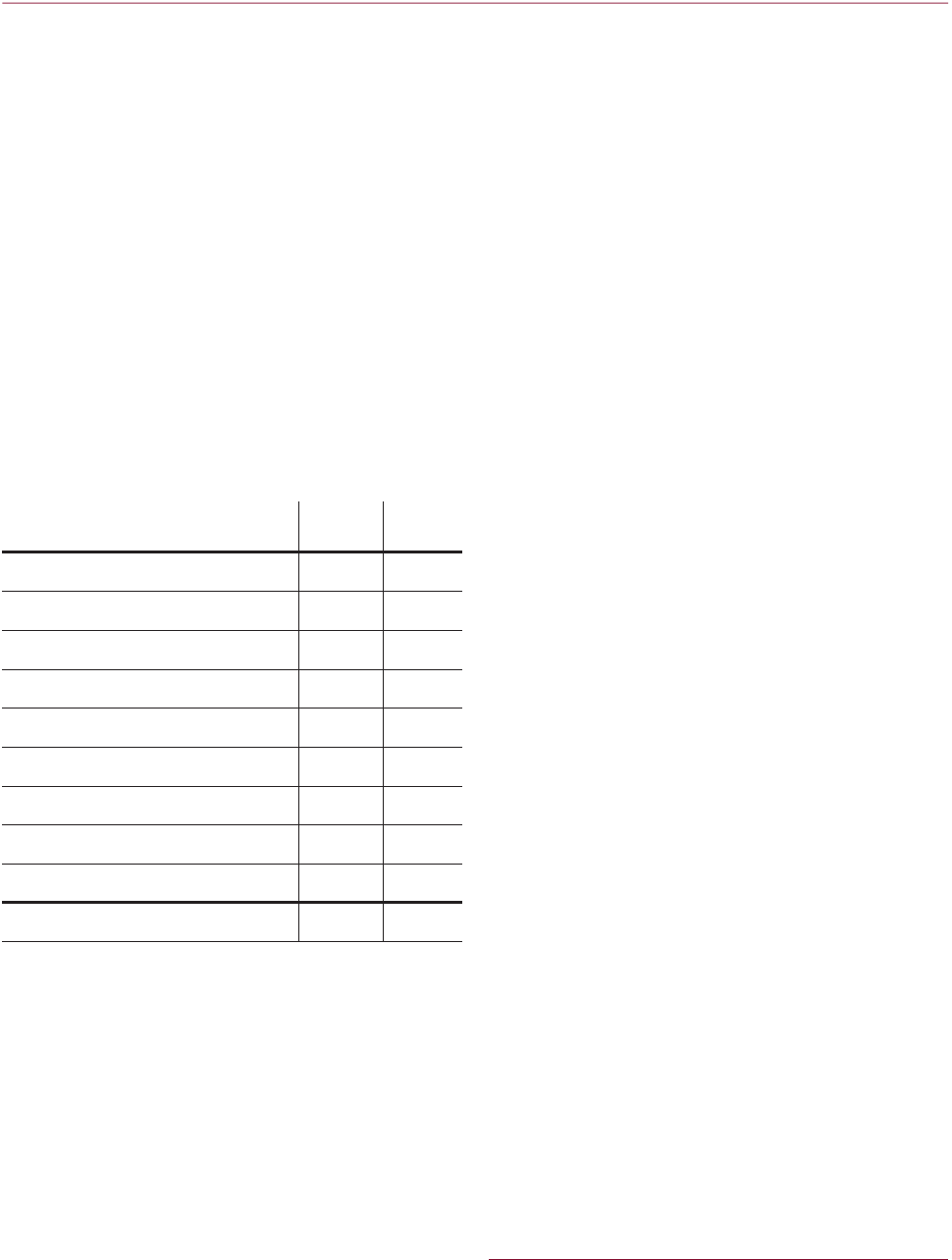

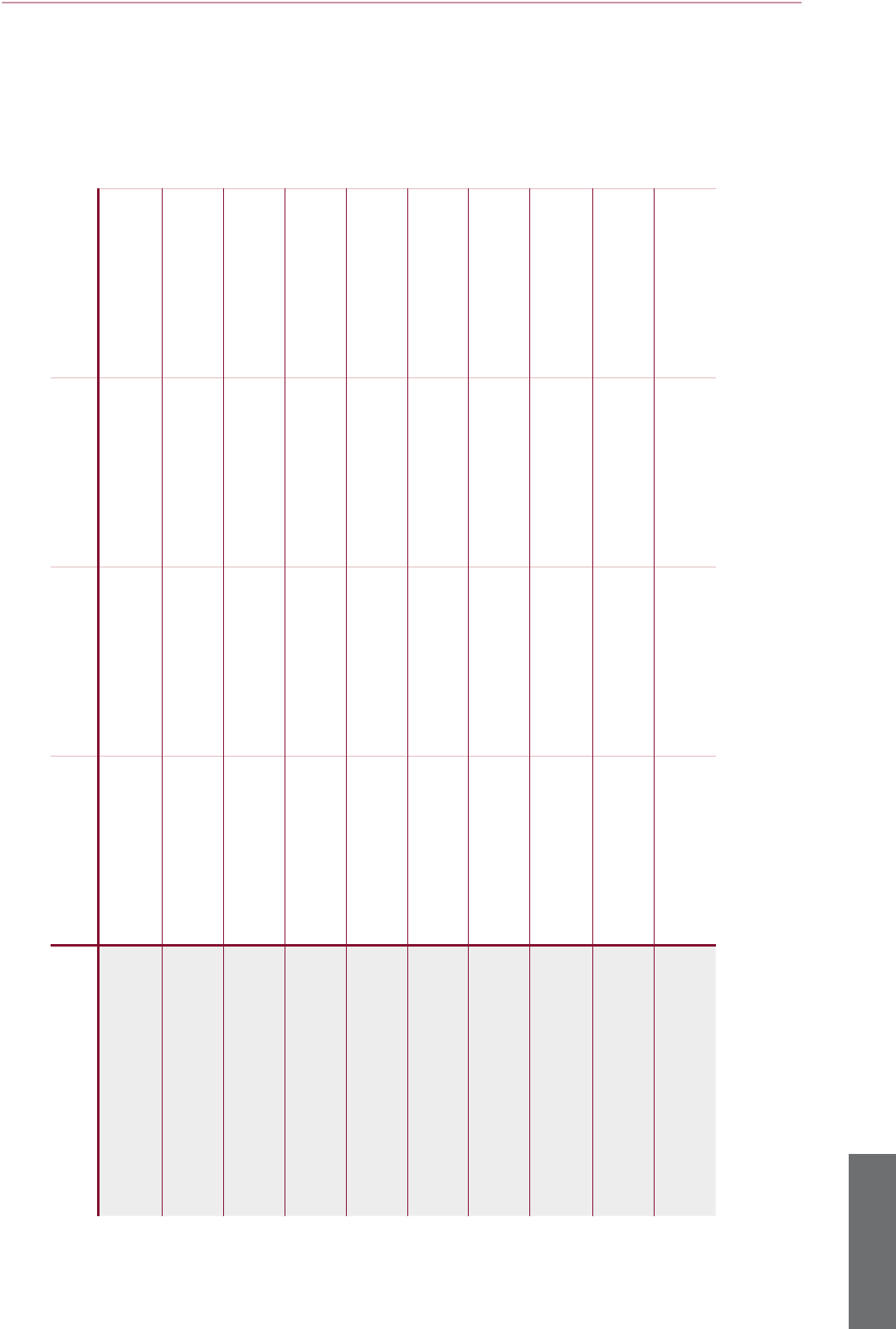

in Figure 2.

We are also considering eight key success measures

that represent some of the things we should achieve

in the next two or three years. They will measure

how we:

• successfully intervened earlier to the benet of

consumers;

• dealt quickly and efciently with crystallised risks;

• actively involved and engaged with our stakeholders

and put consumers at the heart of what we do;

• addressed competition issues to the benet of

consumers;

• successfully inuenced international policy;

• have been able to deliver judgement-based, early

intervention regulation;

• delivered business as usual; and

Chapter 1

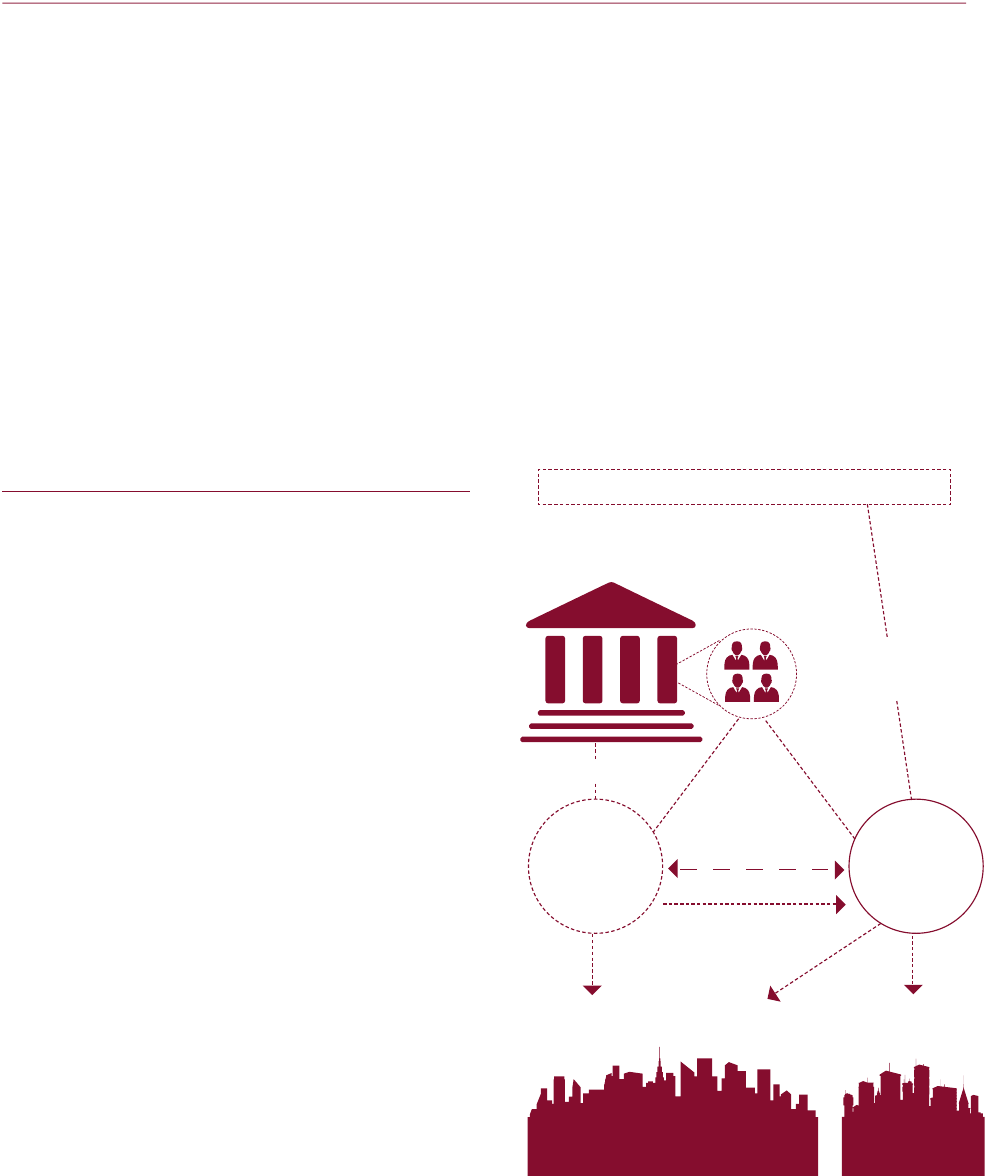

Statutory

objectives

Ensuring that relevant markets function well

Securing an appropriate degree of

protection for consumers

Promoting effective competition in the

interests of consumers

Protecting and enhancing the integrity

of the UK financial system

Outcomes Consumers have

access to fair

products and

services, which

deliver what they

promise

Consumers can

be confident that

firms will treat them

fairly, with problems

fixed promptly and

effectively

Competition

contributes to

better consumer

outcomes and

firms do not

exploit consumers’

behavioural bias

Firms compete on

clear costs and

quality of service

and consumers have

the information

they need

Consumers trust

authorised firms to

be fit and proper,

to keep their assets

secure and for

financial markets

to be clean and

protected from

abuse

FCA is part of a

respected regulatory

system that enables

firms to know

where they stand

and contributes to

the attractiveness of

financial markets

Indicators Fair products

and services

Building trust and

engagement

Value for money

products and

services

Competitive

markets

Clean regulated

markets

Attractiveness of

market

Improved consumer

experience

Effective remedies Getting better

service

Clear and useful

information

Low financial crime Respected,

joined-up

regulation

“To be an open,

transparent regulator,

we must be held

to account.”

Figure 2

Business Plan / 2013/14

12 Financial Conduct Authority

• encouraged positive cultural change in nancial

services rms.

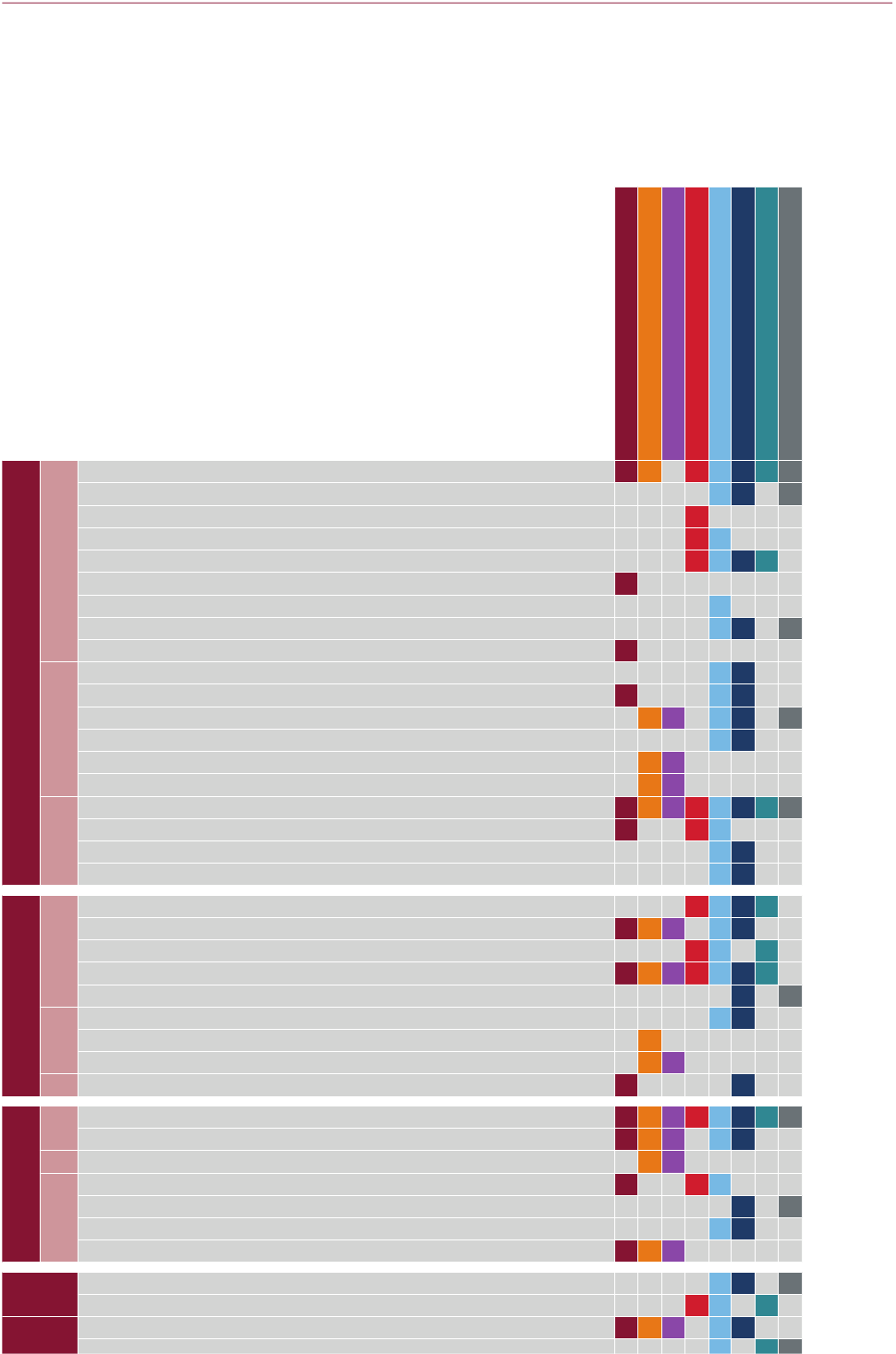

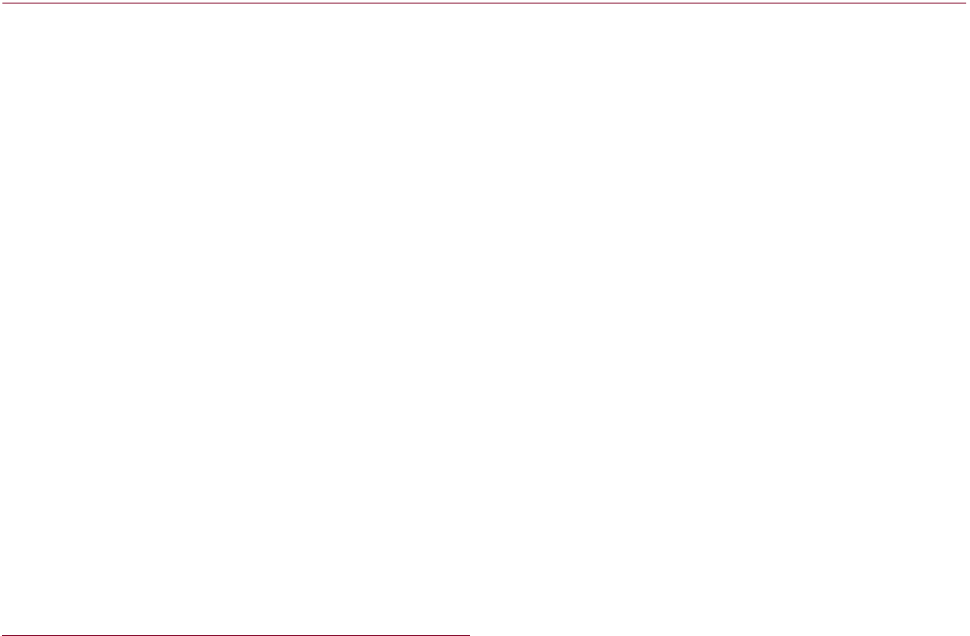

1.4 – Using our resources effectively

Using our resources effectively

Another key measure of our performance as a regulator

is the value we deliver to stakeholders. In line with the

National Audit Office (NAO) guidelines that we will

be audited on, we consider value for money (VfM)

(defined as the optimal use of resources to achieve

intended outcomes) in our decision-making. To

measure this we have developed a VfM framework,

which we use across our major supervisory and policy

initiatives.

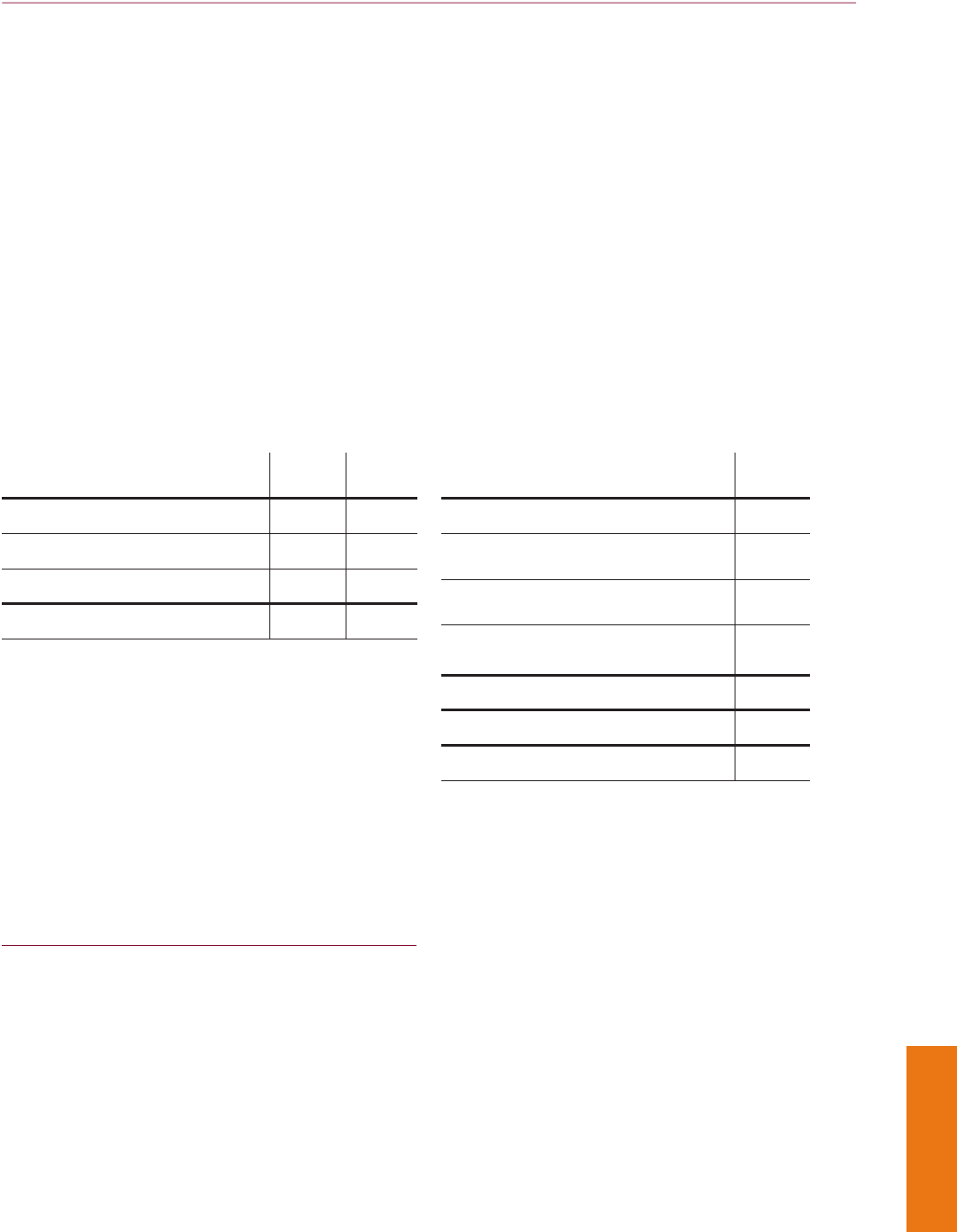

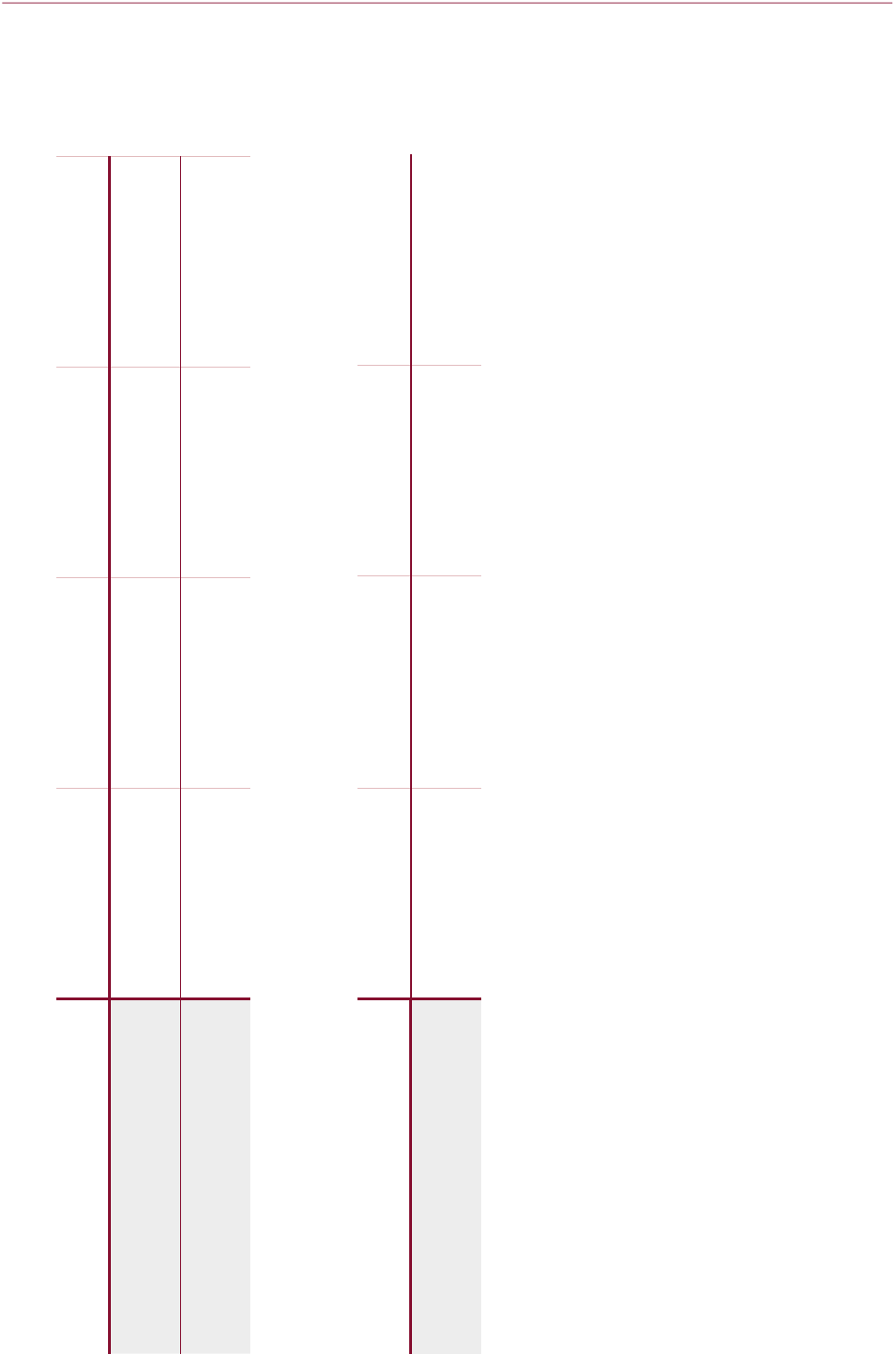

This will be coordinated as follows:

Value for

money

Economy

‘doing things

at a low price’

Effectiveness

‘doing the

right things’

Efciency

‘doing things in

the right way’

We will monitor

our costs to

identify where we

can be more

cost-effective

We will

allocate our

resources in a way

that reects what

is needed to

deliver our

objectives

We will

regularly

review how well

we use our

resources

We will review our

processes to see if

we can do things

quicker or cheaper

or do more for the

same resources

We will regularly

review how well we

are achieving our

objectives

We will assess the

impact of our work

Financial Conduct Authority 13

Business Plan / 2013/14

Chapter 1

Box 1: Executive Planning and Risk Committee (EPRC)

EPRC oversees the balance of FCA resources to policy, projects and risk. It is responsible for:

• Proposing the FCA Risk Outlook and Business Plan priorities.

• Risk management within the FCA, including external, firm and organisational risk, before its presentation

to the Risk Committee (external risks) and Audit Committee (internal risks).

• Providing direction on the use of FCA resources to deliver against risks.

• Approving resources for new policy projects.

• Providing direction on the resource requirements for new projects including policy, risk and operational

projects and significant thematic work.

Risk appetite framework

We need to take on a significant amount of risk if we are to meet our strategic and operational objectives.

Our risk appetite framework is a statement of our appetite, both absolute and relative, to take on risks of

different types and across our various activities. It will be reviewed and agreed by our Board annually.

In all cases, our over-riding principle will be to target our resources to best achieve our objectives. We also

recognise that, as well as risks to our objectives that have not yet caused harm, there are risks that are

already happening, and we have legal obligations that we have to fulfil under UK and EU law and under the

terms of international regulatory agreements. We will seek to balance our resources across these priorities

and within our risk appetite for each. To do this, we will classify our activities and assign our resources

through a single risk framework comprising four layers:

• Our mandatory activities (i.e those prescribed by UK and EU law, and by international agreements to

which we are a signatory).

• Forward-looking strategic priorities.

• Other major work areas (normally agreed at divisional level).

• Responses to crystallised events that threaten, or have exceeded, our risk appetite.

Business Plan / 2013/14

2.

Achieving our objectives

Financial Conduct Authority 15

Business Plan / 2013/14

We will supervise the conduct of approximately

26,000 rms across all nancial industry sectors

and the prudential standards of approximately

23,000 rms not regulated by the Prudential

Regulation Authority (PRA). We will use all of our

powers to ensure that rms continue to meet our

standards, that markets operate with integrity,

and that consumers are protected.

Our Supervision, Markets, Enforcement, Authorisations

and Policy, Risk and Research (PRR) divisions will work

together to ensure that we meet our objectives.

We will take a risk-based, proportionate approach to

supervision, recognising the diversity among firms and

markets, and allowing us to focus on the bigger issues,

either in individual firms or within and across sectors.

We will be a more proactive regulator, acting earlier

and decisively. Our PRR division will act as the FCA’s

radar, identifying risks and allowing us to address them

before they cause harm.

We will develop and use a range of policies to increase

consumer protection and market integrity. Many of

our rules are now made and influenced by what is

decided in Europe and internationally. We will work

closely with the Bank of England (BoE), the Treasury,

the European bodies and other relevant stakeholders

to ensure that these rules are appropriate and

proportionate, and that the UK’s interests are

represented in their development.

Market integrity benefits firms, individuals and society

as a whole, and our Markets division will work to

ensure markets operate in such a manner. We will

take a proportionate, risk-based approach and identify

the issues that have wider, longer-term effects on

consumers and market integrity.

We are committed to a credible deterrence strategy

through our enforcement actions. This means that we

will use our enforcement powers to take action against

firms and individuals who abuse the system and to

deter others from doing so.

We recognise that poor outcomes for consumers

may result from anti-competitive factors in markets,

including information problems, market structures

and consumer biases. We will work to ensure that

markets operate competitively to support positive

outcomes for consumers.

The rest of this chapter is set out as follows:

• In Section 2.1 we consider our FCA Risk Outlook,

which identies current and future risks to our

objectives.

• In Sections 2.2 to 2.4 we discuss how, in addition to our

FCA Risk Outlook work, we will achieve our objectives.

• In Section 2.5 we outline the framework we will use

to achieve our objectives.

2.1 – Conduct risks to our objectives

The conduct risks we have identified are based on what

the main risks are in firms’ behaviour that could stop us

achieving our objectives, and how much of this risk we

are willing to accept (our ‘risk appetite’). We set this out

in more detail in our FCA Risk Outlook. In this section

we set out the conduct risks we have identified and the

work that we are carrying out in 2013/14 to tackle them.

Risk: Firms do not design products or services

that respond to real consumer needs or are in

consumers’ long-term interests

Product governance

Poor product governance can cause conduct risk in

a number of ways. Unconscious consumer biases are

inherent and can be manipulated by product design

Chapter 2

Business Plan / 2013/14

16 Financial Conduct Authority

and sales processes. There may also be a lack of

oversight over a product’s lifecycle, which may lead to

complex or unclear products that are not in the best

interest of consumers.

We will be prepared to intervene earlier to prevent

or minimise harm to consumers before it becomes

widespread. We will be prepared to make judgements

on whether firms have identified an appropriate

target market, and if distribution strategies and

product oversight are likely to deliver fair outcomes

for consumers.

Where necessary we will intervene directly in the

design and distribution of products rather than

relying on information from firms to prevent harm

to consumers. We will use the range of product

interventions we developed in 2011, up to and

including banning products.

Product intervention

As well as supervisory work to address the risks related

to developing and distributing products, we will carry

out thematic reviews of firms’ product governance

processes across retail and wholesale markets to ensure

that the outcome is appropriate for consumers. We will

take tough action if standards are not adequate. We are

also looking into replacing the existing guidance with

rules to strengthen our requirements. More details on

our supervisory approach can be found in Section 2.5.

We will work together across the FCA to identify issues,

particularly on early intervention. Supervisors and

Enforcement will work to identify potential issues at an

early stage and will draw on the expertise across the

FCA to take appropriate action.

We will also discuss introducing product intervention

powers and developing high-level principles on product

governance with the European Commission (EC) and

the European Supervisory Authorities (ESAs).

Product Design and Oversight: Fund fee structure

In the asset management sector fund fees have

increased in the last decade, additional ‘hidden’ fees

have increased and overall charging structures have

become more complex as performance fees have

become more common. There is evidence that fee

structures exploit consumers’ behavioural bias, a key

cause of risk. For example, firms may:

• use complex fee structures that make price

comparisons difcult;

• apply more complex fee structures to retail customers

than institutional clients; and

• downplay the long-term impact of apparently small

increases in annual charges.

In 2013/14 we will undertake a project that will highlight

the behaviours and practices of asset management firms

in relation to charging structures that harm consumers.

Initial evidence suggests that fund fees are high in the

UK compared to comparable markets and charging

structures do not promote informed consumer choice.

Mortgage arrears and forbearance management

A key area of our focus in 2013 will be the fair treatment

of mortgage borrowers who have experienced

financial difficulty. We will conduct a thematic review

of firms’ arrears handling procedures and forbearance

management. This will consider the appropriateness

of firms’ strategies when dealing with long-term

arrears forbearance management, including recent

developments in arrears management practices, and

assess firms’ delivery of fair outcomes for consumers.

Following previous thematic reviews, which led to a

number of successful enforcement cases, we expect

firms to be able to clearly demonstrate how they comply

with our rules in this area, ensuring fair and appropriate

outcomes for borrowers in arrears.

“We will work together

across the FCA

to identify issues,

particularly on early

intervention.”

Financial Conduct Authority 17

Business Plan / 2013/14

Competition – General approach

This will involve detailed work from various teams within

the Policy, Risk and Research division, including our

Competition department. We will update stakeholders

regularly on the initial outcomes of this work.

We will address competition through our policy and

supervision work and by making sure we have the

right tools and engage with stakeholders to deal

with competition issues in pursuit of our competition

objective. In our work over 2013/13 we will develop

our competition expertise and focus on:

• how we identify risks;

• early intervention − using our range of regulatory

tools to prevent competition issues becoming

widespread;

• examining barriers to entry and exit; and

• undertaking market studies to help strengthen our

understanding of competition issues in markets

More detail on our competition work can be found

in Section 2.4

Risk: Distribution channels do not promote

transparency for consumers on nancial

products and services

Financial incentives

In 2012, the FSA published guidance on the risks to

customers from financial incentives after our thematic

work showed that most incentive schemes are likely

to cause mis-selling and firms are not managing this

properly. We welcome the significant changes that some

firms are now making to reduce the risks in their schemes.

In 2013/14 we will conduct a wider review to assess how

firms responded to this guidance and whether they have

established schemes and controls that avoid the risk of mis-

selling. We want firms to manage their incentive schemes

properly, so that consumers are less likely to suffer.

Depending on how firms react to our guidance, we

will consider more intrusive supervision, including

strengthening our rules. We will also take action against

individual firms that are not managing the risks from

their incentive schemes.

Financial promotions

Consumers are influenced by, and rely on, the information

they get from financial promotions when making their

purchasing decisions. We have a team dedicated to

reducing the potential risk of harm to consumers caused

by misleading promotions.

The team will review financial promotions across

all sectors to ensure firms provide consumers with

information that is fair, clear and not misleading and we

will take action where this is not achieved. We anticipate

reviewing a number of promotions and taking forward

cases as necessary.

The FCA has a new power to ban financial promotions

and publish the details relating to it. Using this power

will deliver a number of benefits. In particular and most

importantly, it allows us to take swift action to protect

consumers in a transparent and visible way. Publishing a

ban will inform and warn consumers of the misleading

promotion and encourage a broader understanding of

how promotions can be unfair, unclear and misleading.

For firms it will allow them to see real and varied

examples of where they fall short of our requirements

and allow them to proactively improve their own

financial promotions. We hope this power will deter

firms from misleading consumers. Where this is not the

case, we are ready to use this power.

We will also adopt a more streamlined and robust

approach to firms that consistently produce promotions

Chapter 2

Business Plan / 2013/14

18 Financial Conduct Authority

that can mislead, confuse or be unfair to consumers.

This may involve greater use of our supervisory and

enforcement powers.

Conicts of interest

Our Firm Systematic Framework (FSF) helps to address

some of the issues involved in conflicts of interest.

In 2013/14 we will also review the management of

conflicts of interest in the asset management sector.

Asset managers act as agents for their customers,

making investment decisions in financial markets

on their behalf. Confidence in the integrity of asset

managers is central to the trust between the industry

and its customers.

This means that when making investment decisions,

or buying products and services for customers, asset

managers must always act in customers’ best interests,

putting customers’ interests ahead of their own and

treating all their customers fairly.

Acting as an agent for customers may create conflicts

between the interests of a firm and its customers or

between the interests of different customers. Policies to

properly manage conflicts of interest mean customers

avoid unnecessary costs and have fair access to all

suitable investment opportunities. Properly managing

conflicts improves the returns earned by customers

and enhances general confidence in the UK asset

management industry.

In 2012/13 we carried out initial work on conflicts by

visiting firms and providing them with detailed feedback.

We communicated the findings from this first stage of

work to firms through a ‘Dear CEO’ letter in November

2012. We concluded that the seriousness of the issues

identified requires us to take action to ensure firms

comply with the rules. In 2013/14 we will carry out a

second stage of visits to firms.

Custody banks

Firms are facing considerable pressure on their business

models and strategies and consequential changes in

business models may lead to harm to consumers as

firms are pushed to exploit areas of profitability.

The custody bank business model is evolving and

the basic premise of providing safekeeping and

custody of client assets − which is high volume and

low margin − is facing strain in the ongoing low

interest-rate environment and because of changing

regulatory requirements.

Consequently, custody banks have become

increasingly reliant on revenues from secondary

services such as:

• securities lending;

• foreign exchange (‘custody FX sweep’ and ‘direct FX’);

• collateral and cash management;

• derivatives clearing; and

• data analytics, research services and transitions

management.

There is a risk that the pressure on firms to improve

profitability could lead to harm to consumers.

We want to investigate the transparency of secondary

services to establish whether investors are being

disadvantaged or charged excessively.

In 2013/14 will we will assess the secondary services

of custody banks to measure the impact of current

practices on their business models, on direct clients

and, where possible, on the indirect end-consumer. We

intend to identify the scale of any issues and develop a

strategy for reducing risk where we find issues.

Financial Conduct Authority 19

Business Plan / 2013/14

Transition management (TM)

TM allows improved performance through increased

portfolio returns and better risk management.

TM clients are usually pension funds, local authorities

or other institutional managers for whom transitions

occur infrequently. They are typically unadvised, so

information can be irregular when negotiating and

reviewing such transitions.

The use of affiliates by transition managers, unclear fee

structures and complex legal and pre/post-transition

documentation can result in poor customer outcomes.

This may have an immediate impact on pension

fund holders and cause a deterioration in market

confidence, with clients choosing not to use TM to

manage portfolio allocation risk.

There is evidence that the level of transparency and

market conduct among TM participants is not to the

standard we require.

In 2013/14 we will undertake a project to review

practices across the main TM industry participants to

assess whether customers are being treated fairly.

Product Design and Oversight – Fund fee structure

Our work in this area will also contribute towards

mitigation against this risk. Full details of our work can

be found on page 16.

Retail investment advice

We will continue to monitor developments and

changes in the retail investment market as firms adapt

to the new landscape. All firms in the distribution

chain for retail investment products will need to

consider the effects of the rules on retail investment

advice on their business models and propositions.

We will be monitoring these developments closely

by analysing individual sectors and the overall shape

of the market (‘macro’ analysis), and analysing how

individual firms adapt and their business models

manage the associated risks (‘micro’ analysis). Further

information on retail investment advice can be found

in Section 2.2.

Wholesale conduct strategy

Our wholesale conduct strategy will recognise that

even among wholesale counterparts, differences

in participant sophistication mean that some

participants should be given greater protection than

others. Our work on ‘payment for order flow’ reflects

this approach.

Payment for order flow is a practice that can influence

where orders are directed for executives, which can

take the form of brokers receiving payment from

market makers for every order sent to the market

maker. The risk is that the broker is incentivised to send

the client’s order to the market maker that pays the

most per order rather than the market maker offering

the best price for the consumer. Clients are unaware

of these payment arrangements, which are included

in the spreads they are offered, posing a risk to price

formation and market integrity.

Dealing commissions and stock-lending fees may

not be properly disclosed and poor management of

conflicts of interest may lead to excessive prices being

paid out of client funds for services received. Paying

for corporate access with dealing commission is not

transparent and creates a conflict of interest between

asset managers and their customers, making it

difficult for customers to judge how well their money

is being spent or whether the asset manager is acting

in their best interest. Overall fees may be presented in

a way that makes it difficult for the consumer to work

out what is being charged in total. Even in wholesale

markets, some participants have different degrees of

expertise and will need to be given higher protection

than others. We therefore place different regulatory

requirements on firms depending on the type of

participant they are conducting business with and the

type of service provided.

Chapter 2

Business Plan / 2013/14

20 Financial Conduct Authority

We will increasingly focus on the culture, systems and

controls that govern these relationships and be more

willing to intervene where we believe poor conduct could

have a negative impact on the integrity of the markets

or on the reputation of the UK as a place to do business.

LIBOR / Wheatley Review

The attempted manipulation of LIBOR highlighted

the weaknesses in some banks’ conflict of interest

management. The Wheatley Review will result in

LIBOR-related activity being brought into the regulatory

perimeter, which will raise the standards of governance

and systems and controls around the submission of

rates, and will create new Controlled Functions, which

will come into effect on 1 April 2013. Further detail on

our work on LIBOR is in Section 2.3.

Packaged Retail Investment Products (PRIPs)

The European Commission (EC) is concerned that the

existing disclosure requirements for PRIPs (which include

investment funds, structured products and insurance

contracts used for investment purposes) vary according

to the legal form a product takes, rather than its

economic nature or the risks it poses for retail investors.

Providing good quality, consistent information will help

consumers make better informed decisions, offering

them better protection.

In 2013/14 we will work with the Treasury to influence

PRIPs regulation. We are keen to make sure that the

new documents will be genuinely useful for consumers,

as well as practical for firms to produce. Once the high-

level regulation is complete, we will work with all three

ESAs to develop detailed technical requirements.

Risk: Over-reliance on, and inadequate oversight

of, payment and product technologies

Insurance − Price comparison rms

Price comparison firms have been responsible for

major structural changes in the way the industry

manufactures, prices and distributes retail insurance

products, particularly motor and increasingly home

insurance products. We will review the risks that

price comparison websites present to consumers and

whether they comply with regulatory requirements.

New payment methods / Mobile banking

and payments

It is likely that new payment methods, particularly those

enabling consumers to make payments with their mobile

phones, will increase rapidly in popularity over the

next few years. Mobile banking and payments services

may have benefits for consumers, including greater

convenience. However, it is important that firms also

consider the potential risks to their customers when

launching these services.

Following initial work on mobile banking and payments

in 2012, we identified a number of potential risks to

consumers, including:

• consumers suffering fraud on their accounts;

• consumers being inadequately informed about how to

use the services or protect themselves from fraud; and

• rms failing to properly consider the needs of their

customers when developing and marketing mobile

banking and payment services.

During 2013/14, we will intervene to ensure that

firms offering such services are taking appropriate

steps to protect consumers. This may include

firms providing suitable information to consumers

on what the services do and how to use them,

ensuring customers’ funds are secure at all stages

of the payments chain and that any unauthorised

transactions are appropriately refunded.

Technological resilience/banking

We will address the risks to retail customers arising from

“We will review the risks that price

comparison websites present to

consumers and whether they comply

with regulatory requirements.”

Financial Conduct Authority 21

Business Plan / 2013/14

a major failure of core banking and payment systems.

This includes implementing the lessons learned from

the RBS Group systems failure in the summer of 2012,

including a better understanding of the root causes

of major events like this and the action required to

minimise the impact on banks’ customers.

Market infrastructure

Firms are placing new demands on market infrastructure

in the trading strategies they use, such as the increased

use of algorithmic and high-frequency trading. This

creates new risks to the operational resilience of market

infrastructure.

We will use our supervisory framework of regulated

investment exchanges and multi-lateral trading facilities

(MTFs) to assess whether the market infrastructure’s

operational risk management is sufficient to respond

to the risks these new demands place on operational

resilience. As well as this, we will maintain a full picture

of the risks around technology-dependent trading

strategies may pose to market integrity.

The Payment Services Directive (PSD)

The Payment Services Directive (PSD) is currently being

reviewed. The FCA and the Treasury will seek changes

to make it clearer and to promote competition and

innovation, which should make the new Directive more

able to embrace future technological change.

The EC has announced their intention to complete

the PSD review in 2013. The closely-related second

Electronic Money Directive (2EMD) will not be reviewed

until 2014 because it has not yet been implemented in

some Member States.

Risk: Shift towards more innovative, complex

or risky funding strategies or structures that

lack adequate oversight, posing risks to market

integrity and consumer protection

CRD IV

We are the prudential regulator for a large number

of investment firms currently covered by the Capital

Requirements Directive (CRD). They will therefore

need to implement the changes introduced in CRD IV.

CRD IV is the EU legislative response to the Basel

Committee on Banking Supervision’s ‘Basel III’

agreement for internationally active banks, and

represents a major strengthening of the prudential

regime. CRD IV represents a major change in

approach from the current CRD, because the majority

of the CRD IV text will be by way of a regulation,

which will be directly binding on the firms and/or

the regulators. As a result, large parts of the current

prudential rules for CRD firms in the FSA Handbook

(e.g. BIPRU) will disappear.

The FCA will need to consult on those parts of CRD IV

where it can still retain its own rules and guidance and,

within the tighter constraints of the new EU legislation,

seek to implement the changes in as proportionate

and risk-based manner as possible. There will be many

areas of detailed change, which could affect individual

investment firms differently, according to their own

individual circumstances, including current capital

structures and business models.

The EC proposed implementation date of 1 January

2013 was delayed. We will continue to undertake

all preparatory work that is possible in the absence

of finalised legislative text and expect all firms in

scope to do likewise. Timing for implementation now

depends on the implementation date agreed through

the EU legislative process. We will proceed with the

necessary preparations to be ready to begin collecting

data under Common Reporting for the period

beginning 1 January 2014, should the legislation and

related standards be in place by then. Transitional

periods and phasing in of various parts of the new

requirements will run through to 1 January 2019.

Chapter 2

Business Plan / 2013/14

22 Financial Conduct Authority

Risk: Poor understanding of risk and return,

combined with the search for yield or income,

leads consumers to take on more risk than is

appropriate.

General approach

We are currently establishing a detailed strategy to

deal with the complex issues underlying this risk and

decide how best to intervene. This will involve significant

scoping and research work across the FCA, coordinated

by our Policy, Risk and Research division. We will update

stakeholders regularly and as appropriate on the initial

outcomes of this work.

Interest-only mortgages

We have been looking into the maturity of interest-only

mortgages, considering the risk of existing interest-

only mortgage customers being unable to repay the

amount due at the end of their mortgage term.

We are working closely with relevant industry and

consumer bodies. We will be reporting on the findings

from our initial review shortly. We will also continue to

monitor product developments that aim to resolve the

issue and will intervene where we have concerns about

particular products.

2.2 – Consumer protection

Much of our work addressing the key forward-

looking risks in the FCA Risk Outlook also contributes

towards meeting our consumer protection objective.

In addition to the work highlighted in Section 2.1, we

will be carrying out work in other areas to ensure that

consumers are protected, which is outlined below.

Section 2.5 also expands on our consumer-focused

work through our supervision strategy.

Domestic supervision initiatives

The Mortgage Market Review (MMR)

The MMR will ensure that the mortgage market works

better for consumers by tackling responsible lending,

distribution and disclosure, arrears management

and prudential requirements for non-deposit-taking

mortgage lenders. We have already published our Policy

Statement (PS12/16) on the MMR and our final rules

come into effect on 26 April 2014.

In 2013 we will engage with firms covered by the MMR

in a number of ways. Building on the roadshows that we

held in early 2013, we will conduct online surveys and

workshops throughout the year. We will also publish the

results of our readiness tracking in Q3 2013 and Q1 2014.

To help effectively supervise the MMR, our Policy

division will:

• enhance our reporting requirements (the information

that we require rms to send us); and

• review our Perimeter Guidance (PERG) to see how

we can make the boundary between advice and

information clearer ahead of implementation of

the MMR.

We will continue to monitor how ready the industry is

to implement the new MMR rules when they come into

effect. We will support the industry through ongoing

communication including:

• early engagement and education with rms and

their relevant trade bodies;

• monitoring how ready rms are to implement the

MMR;

• feeding back to the industry on our ndings from

the readiness tracking, with further education given

where needed;

Financial Conduct Authority 23

Business Plan / 2013/14

• engagement with consumer groups to promote

consumer awareness of the MMR and how it affects

them; and

• taking appropriate action in response to any risks

we see emerging in the lead-up to implementing

the MMR.

Retail Investment advice

The way we supervise firms in the retail investment

market should help reduce the risks associated with

adviser firms failing to devise, disclose and consistently

deliver compliant charging and service advice models.

It will also look for individuals who are not suitably

qualified, and those that misrepresent advised sales as

non-advised sales.

The rule changes around retail investment advice, and in

particular the qualifications requirements, could lead to

a significant proportion of advisers leaving the market,

making investment advice more difficult to access. We

are monitoring the number of advisers in the market

to understand if this is happening. Our figures show

there were 31,132 retail investment advisers operating

in the market, as at 31 December 2012. We have also

published guidance on simplified advice to help tackle

the risk that the cost will deter consumers.

Apart from our assessment of adviser qualifications,

we will tackle other risks through thematic work

and by communicating with industry throughout

2013/14. For all firms, the rules on retail investment

advice represent a significant change to business

models; we recognise that this poses a risk to the

market and to consumers. We will produce good

and poor practice, speeches and workshops as

appropriate to guide firms through implementation.

Where we find that firms are not complying with the

rules on retail investment advice, we will consider

tightening or amending rules to ensure that firms

deliver the outcomes we expect. We are also making

changes to the way that platforms are paid. This will

require a change in firms’ business models and a

substantial amount of work. We will provide support

through this process.

Managing Client Assets (CASS)

Our supervisory work shows that a number of firms

have inadequate records and ineffective segregation of

client assets, heightening the risk that any departures

from the market could prove disorderly, causing

harm to clients, creditors and counterparties and

the market as a whole. Increasing firms’ compliance

and awareness of CASS rules is a key aim for us in

2013/14. We will:

• Increase the supervision of rms holding client

money and safe custody of assets through more

intrusive visits to rms, thematic projects and

desk-based reviews, actions initiated through

Client Asset and Money Return (CMAR) /audit

information and taking regulatory action where

rm failings are identied.

• Embed our risk assessment and prioritisation

method, using the information given to us by rms

through CMAR audits, and combining this with

rm intelligence.

Specific actions that we will be taking include:

• Implementing EMIR (Part 1) and consideration of

EMIR (Part 2 − binding technical standards) and the

possible implications for CASS.

• Strengthening our oversight of the rms holding

client money as insurance intermediaries through

the CASS 5 Policy Statement.

• Reviewing and re-drafting of Chapters 6 and 7

in CASS to achieve the wider objectives of the

distribution review.

Chapter2

Business Plan / 2013/14

24 Financial Conduct Authority

• Reviewing the CASS Handbook to re-evaluate issues

that have arisen over recent years (e.g. deposit

exemption, term deposits).

• Working to engage rms through more dened

engagement and wider participation with CF10a

individuals to address issues.

Where we find that firms do not have adequate

systems and controls in place to ensure the safe

segregation of client assets, we will consider taking

enforcement action. The FSA took enforcement

action against a number of firms for failures relating

to client asset obligations. We will take tough action

and impose fines on those firms that still do not have

adequate arrangements in place

Complaints data

A firm’s complaints handling process, including the

right of referral to the Financial Ombudsman Service

(FOS), is a significant ‘line of defence’ for consumers

suffering harm from poor advice and/or inappropriate

products and services.

Information on complaints can also provide an early

warning of emerging conduct risks in a firm. We will

focus on the effectiveness of complaints handling

in major banks through our supervision and we will

widen this to include firms from other sectors. The

supervisory approach will consider key stages of a

complaints lifecycle which, if ineffective, may act as a

barrier to fair treatment of the complainant. We will

also consider the effectiveness of the firm in identifying

emerging conduct risks through their complaints data

and the action they take as a result.

Domestic policy initiatives

Listing rules

To help protect consumers and deliver market

integrity, we will continue to ensure the listing rules

reflect and encourage high standards of market

practice and disclosure. Following the consultation

in October 2012 on enhancing the effectiveness

of the listing regime, we will finalise our proposals

for corporate governance within the listing regime,

quality of markets and listed funds.

The European Commission are due to publish their

proposals on EU standards for corporate governance

for listed issuers in 2013. We will exercise our influence

to ensure these appropriately cater for the UK market

and reflect the standards we promote

Wealth management

The FSA looked at the standards of suitability and

record-keeping in the wealth management industry.

One consequence of this work is that many wealth

management firms are improving their systems to

ensure their customers receive − and can be shown

to receive − portfolios that match their risk appetite

and meet their investment objectives. Often, firms

are updating the information they hold on their entire

client base to embed these improvements and, as

these efforts continue into 2013/14, we will continue

to work with firms to check that the outcomes are in

line with our requirements.

More generally, wealth management will remain a

major focus of ours over the coming year and firms

can expect to see more activity in this business

area, both thematically and as part of their regular

supervision arrangements.

International policy initiatives

Insurance Mediation Directive (IMD2)

The EC reviewed IMD2 with a number of key aims:

• extending the regime to include more insurance

mediation activity, bringing insurance undertakings

within scope;

“Where we nd that rms

do not have adequate

systems and controls in

place to ensure the safe

segregation of client

assets, we will consider

taking enforcement action.”

Financial Conduct Authority 25

Business Plan / 2013/14

• addressing what it sees as the inconsistent

application of IMD2 across Europe; and

• raising levels of consumer protection.

Negotiations will continue well into 2013. We are

working with the Treasury to influence the development

of IMD2 so that we can maintain the consumer

protection measures that apply to UK insurance

intermediaries.

Mortgage Credit Directive

The European Commission published a proposal in March

2011 that tackles a number of conduct issues, such as

responsible lending, advertising and disclosure, as well

as creating a passporting regime for mortgage credit

intermediaries. We will continue to help the Treasury

negotiate on the proposal, helping to formulate and press

the UK position. While the timetable for the proposal has

slipped, it may be agreed in 2013, and we would then

begin preparations to transpose the Directive (Member

States are likely to have two years to do this).

Box 2: Working with the ESAs on

consumer protection

We will actively participate in the work of the

three European Supervisory Authorities (ESAs) −

the European Securities and Markets Authority

(ESMA), the EBA (European Banking Authority)

and EIOPA (European Insurance and Occupational

Pensions Authority) − on conduct and consumer

protection issues. This includes through our

membership of the ESAs’ standing committees

on consumer protection and financial innovation,

and our involvement in various other ESMA

groups with an investor protection remit. We will

also continue to participate in the cross-sectoral

consumer protection committees established

under the Joint Committee of the three ESAs.

2.3 – Enhancing market integrity

We will address the drivers of market integrity in a

number of ways. This will include our continued focus

on wholesale conduct, ensuring that participants act

with integrity at the start of the investment chain. Details

of our wholesale conduct supervision approach are in

Section 2.5.

We have also refreshed our approach to the supervision

of trading platforms, recognising the increased role they

play in market integrity. Our work on LIBOR addresses

the weaknesses in governance, systems and controls in

the overall architecture of the regime and participants.

We will continue to prioritise tackling market abuse to

ensure that our markets are clean. Further details are

in Chapter 3.

Domestic supervision initiatives

Using new powers set out in the Financial Services Act

and through redeveloping our processes for authorising

and supervising markets, we will strengthen the way we

supervise markets for Recognised Investment Exchanges

(RIEs), sponsors and Primary Information Providers (PIPs)

so that they support our FCA objectives.

Supervising Recognised Investment Exchanges (RIEs)

Following the transfer of responsibility for the

supervision of clearing and settlement infrastructure

to the Bank of England, we will refocus our supervision

of market infrastructure to be targeted on the specific

risks to market integrity and consumer protection

posed by RIEs. As well as refining our supervisory

framework for RIEs, we will also incorporate new

powers for the FCA regarding holding companies

in a group context, information gathering and our

supervisory toolkit.

Primary Information Providers (PIPs)

Irregular information is a key cause of conduct risk.

In markets, PIPs have a key role in ensuring that

regulated information is communicated in a timely

Chapter 2

Business Plan / 2013/14

26 Financial Conduct Authority

manner. This is important to ensure a level playing

field in regulated markets and to enable consumers to

make informed decisions.

PIPs will be brought within our regulation through the

new statutory regime. In 2013/14 we will implement

processes to exercise our new powers for PIPs. This

will include new resource to supervise the enhanced

regime and reflect its importance in supporting the

listing regime.

Multilateral Trading Facilities (MTFs)

Since the implementation of MiFID, a significant

proportion of secondary trading of shares has moved

to MTFs. We will implement a new framework for

supervising MTFs, which will ensure a consistent and

proportionate approach to supervising these operators,

and that participants in MTFs are protected in a

consistent manner to those participating in regulated

markets. We will supervise MTF operators to an

equivalent standard to the regulated markets in which

they compete. We will ensure that our supervisory

approach is proportionate to the nature and scale of

an MTF’s activities. Where an MTF has a significant

market impact, or affects our statutory objectives, we

will supervise it more closely.

Sponsors

Sponsors are key for the capital raising of listed companies

and the integrity of the UK financial system. The FCA

has extended powers to impose financial penalties and

suspend sponsors. In 2013/14 we will increase the level of

resource dedicated to sponsor supervision, in line with the

number of firms supervised, to reflect the importance of

the sponsor role they perform. We will also exercise these

powers in a broader domestic and international context

where there is a concerted effort to improve sponsor

standards, to offer better protection for consumers of

their services. Following publication of CP02/12 we

will continue with our focus on sponsor standards and

tightening the requirements to which they are subject.

International policy initiatives

Though there is a significant domestic aspect to our

work on market integrity, the interconnectedness

of financial markets means that much of our market

integrity work also has an international focus or is

driven by international initiatives.

Markets in Financial Instruments Directive

(MiFID) and Markets in Financial Instruments

Regulation (MiFIR)

MiFID and MiFIR cover the buying, selling and trading

of financial instruments, including shares, funds, bonds

and derivatives. The rules are being revised to reflect

how financial markets have changed in recent years due

to new trading venues, products and technologies, and

to respond to the financial crisis by implementing G20

commitments regarding the trading of standardised

Over-The-Counter (OTC) derivatives.

The proposals aim to make financial markets more

efficient, resilient and transparent, and to strengthen

the amount of protection for investors. The revisions

to MiFID will have implications across client assets,

wholesale conduct, secondary trading and transaction

reporting. They will, among other things:

• introduce information requirements for dealings

with eligible counterparties;

• create a framework for pre/post-trade transparency

for the trading of non-equity instruments;

• introduce a new category of trading venues

(Organised Trading Facilities);

• require position limits be set for the trading of

commodity derivatives;

• expand and harmonise the scope of transaction

reporting; and

Financial Conduct Authority 27

Business Plan / 2013/14

• introduce a new authorisation regime for Approved

Reporting Mechanisms (ARMs).

Industry will be required to make major systems

changes. During 2013, we will continue to work

with other regulators in the European Securities and

Markets Authority (ESMA) in preparing detailed,

technical standards. We will consult on implementing

the new Directive once the standards are finalised.

An implementation date has yet to be finalised.

MiFID aims to improve investor protection in a

number of ways, most notably by introducing more

specific requirements to tackle both inducements

and remuneration practices that can cause bias,

as well as requirements on product governance

and intervention. As MiFID underpins many of

the conduct of business standards applying to the

investment market, it will be important to ensure

that it delivers appropriate and proportionate levels

of investor protection.

Alternative Investment Funds Managers

Directive (AIFMD)

The AIFMD aims to create a harmonised EU framework

for monitoring and supervising the risks that alternative

investment fund managers could pose to financial

stability and to investors. It applies to investment

companies and a wide range of firms that manage

funds, including hedge funds, private equity funds and

retail investment funds.

Member States are required to implement AIFMD by

July 2013. We intend to publish a Policy Statement in

2013 to implement the rules required by the Directive

and to put in place appropriate rules where we have

national discretion. We will also be working within

ESMA to finalise Level 3 guidelines on reporting

templates and supervisory cooperation arrangements

with non-EEA states.

UCITS (Directive on Undertakings for Collective

Investment in Transferable Securities)

UCITS V focuses on rules covering depositaries,

remuneration and sanctions, aiming to align UCITS with

the AIFMD. Discussions are on-going in the European

Parliament and in the Council. Along with the Treasury

we are actively participating in the negotiations taking

place. We expect the Level 1 text to be agreed in Q3/4

2013 and will consult on any necessary changes to our

rules shortly thereafter.

UCITS VI (as consulted on in July 2012) covers eligible

assets, use of derivatives, EPM, OTC derivatives,

liquidity management, depositary passport, money

market funds and long term investments. Additionally,

stakeholders’ comments were sought on whether

or not the rules concerning the UCITS management

company passport, master-feeder structures, fund

mergers and notification procedures might require

amendments. We submitted our joint response with

the Treasury in late-2012 and we will continue to feed

into the development and publication of Level 1.

We will consider the implications and any changes

necessary following the publication of ESMA guidelines

on ETFs and other UCITS issues, which were officially

published on 17 December 2012.

Financial Market Infrastructures (FMIs)

We expect legislation in this area to be proposed

by the Commission in 2013. FMIs play a critical role

in the global financial system and the disorderly

failure of an FMI or the closure of a critical service

provided by an FMI could lead to serious disruptions

to the financial markets. It is, therefore, important

for FMIs and authorities to have the necessary tools

and powers in place to help implement FMI recovery

and resolution. EU work will run in parallel to UK

developments in 2013.

Chapter 2

Business Plan / 2013/14

28 Financial Conduct Authority

Commodities market regulation

In all of our work on commodities market regulation,

we will factor in its impact on market efficiency

and liquidity. We will contribute to the following

international work on commodities markets in 2013/14:

• Chairmanship of the ESMA Commodities Task

Force, negotiating and implementing EU directives

and regulations wholly or partly affecting commodity

markets. Over the next year, the focus will be on

the Level 2 measures for MiFID, MiFIR and Market

Abuse Regulation (MAR) together with putting in

place the structure for cooperating with the Agency

for the Cooperation of Energy Regulators (ACER)

under the Regulation on Wholesale Energy Market

Integrity and Transparency (REMIT).

• Co-Chairmanship of the IOSCO Standing

Committee on Commodities, inuencing the

direction of global regulatory initiatives affecting

commodity markets. This group will particularly

focus on the implementation of the Principles for

Oil Price Reporting Agencies published by IOSCO

in October 2012 and input on the commodities-

related aspects of wider work on benchmarks.

Other key international proposals

Other key proposals on which we will continue to

support the Treasury in negotiations include:

• The Market Abuse Regulation and Criminal

Sanctions Market Abuse Directive, which

will improve the scope and operation of the

market abuse framework without imposing

disproportionate burdens on market participants.

• The Central Securities Depositaries Regulations

(CSDR), which aims to increase the level of safety of

securities settlement and improve the conditions of

cross-border provision of services. We will support

the Treasury in negotiations on CSDR, to improve

safety of CSD operations and operation of pan-

EU settlement services. We expect CSDR to be

implemented in 2014.

• The review of the Transparency Directive (TD),

which seeks to enhance the transparency of certain

types of information regarding issuers with shares

admitted to trading on regulated markets. This

includes information about the major shareholders

of the issuer, along with obligations that ensure the

maintenance of a timely and complete information

ow from the issuer to the market. We expect

the review of the TD to be nalised in 2013, with

implementation in the UK in 2014.

• Securities Law legislation proposals, which

we expect to be forthcoming in 2013 and aim to

provide legal certainty of securities holdings and

dispositions, ensuring investor condence and fair

and efcient markets.

• Anticipated proposals from the Commission

regarding a Close out netting Directive. Here

we will support EU negotiations to ensure that

cross-netting of exposures in default happens on a

reliable legal basis.

• The European Market Infrastructure Regulation

(EMIR), which came into force on 16 August 2012.

We will continue to play a leading role in ESMA on

nalising the technical standards under EMIR, which

we expect to come into force throughout 2013. The

FCA will assume a range of new responsibilities under

EMIR. Our work in 2013/14 will focus on preparations

on implementing the reporting, risk management

and clearing and collateral requirements of EMIR. We

will also help rms understand new obligations.

• Credit rating agencies were the subject of much

scrutiny in the aftermath of the nancial crisis, so it

is an important focus for regulation internationally.

“In all of our work on

commodities market

regulation, we will

factor in its impact

on market efciency

and liquidity.”

Financial Conduct Authority 29

Business Plan / 2013/14

The latest and third piece of EU legislation on

Credit Rating Agencies (CRAs) was nalised in

late 2012 and enhances the current regulatory

framework in this area. We will work within ESMA

on implementing the new regulation in 2013.

Box 3: Working with the ESAs on market integrity

In most cases, legislative initiatives will be supported by technical standards in the European Supervisory

Authorities (ESAs), notably ESMA from a markets perspective.

We will continue to play a leading role in ESMA on drafting technical standards on legislation that is still

under negotiation (such as CSDR, MAR and MiFID). We will also play a key role on finalised legislation, which

is being implemented to enable a smooth and efficient implementation in the UK. Recognising the significant

quantity of legislative initiative in the market integrity space, we will be strengthening our focus on policy

implementation to help ensure that those market participants affected are aware of their obligations and

the FCA is ready to implement legislation in an orderly and timely fashion.

Chapter 2

Box 4: Outcomes of the Wheatley Review

Benchmarks are used across a wide variety of financial markets as a reference in pricing contracts, calculating

payments in contracts or measuring the performance of a financial instrument. In light of concerns regarding

the integrity of the LIBOR rate, highlighted by investigations and enforcement action, a review of the LIBOR

was undertaken by FCA CEO-Designate Martin Wheatley at the request of the Chancellor of the Exchequer.

The Wheatley Review in September 2012 outlined a plan to comprehensively reform the setting and

governance of LIBOR. A key recommendation was bringing LIBOR-related activity within the regulatory

perimeter. As a result, the Government has amended the Financial Services Act and secondary legislation

to create two new regulated activities: ‘providing information in relation to a regulated benchmark’ and

‘administering a regulated benchmark’. In the first instance, the only regulated benchmark will be LIBOR.

It is our responsibility to create and supervise a regulatory regime for these activities. We published a

Consultation Paper with our proposals on 5 December 2012.

We will introduce two new significant influence controlled functions under our Approved Persons regime

that will create clear and unambiguous points of accountability within the LIBOR administrator and

submitter functions. Our Authorisations division will lead on assessing the administrator firm application

and applications from authorised firms for the new control functions, which are expected between April

and September 2013.

Business Plan / 2013/14

30 Financial Conduct Authority

2.4 – Building competitive markets