Facebook Reports Third Quarter 2020 Results

MENLO PARK, Calif. € October•29, 2020 € Facebook, Inc. (Nasdaq: FB) today reported financial results for the

quarter ended September•30, 2020.

"We had a strong quarter as people and businesses continue to rely on our services to stay connected and create economic

opportunity during these tough times," said Mark Zuckerberg, Facebook founder and CEO. "We continue to make

significant investments in our products and hiring in order to deliver new and meaningful experiences for our community

around the world."

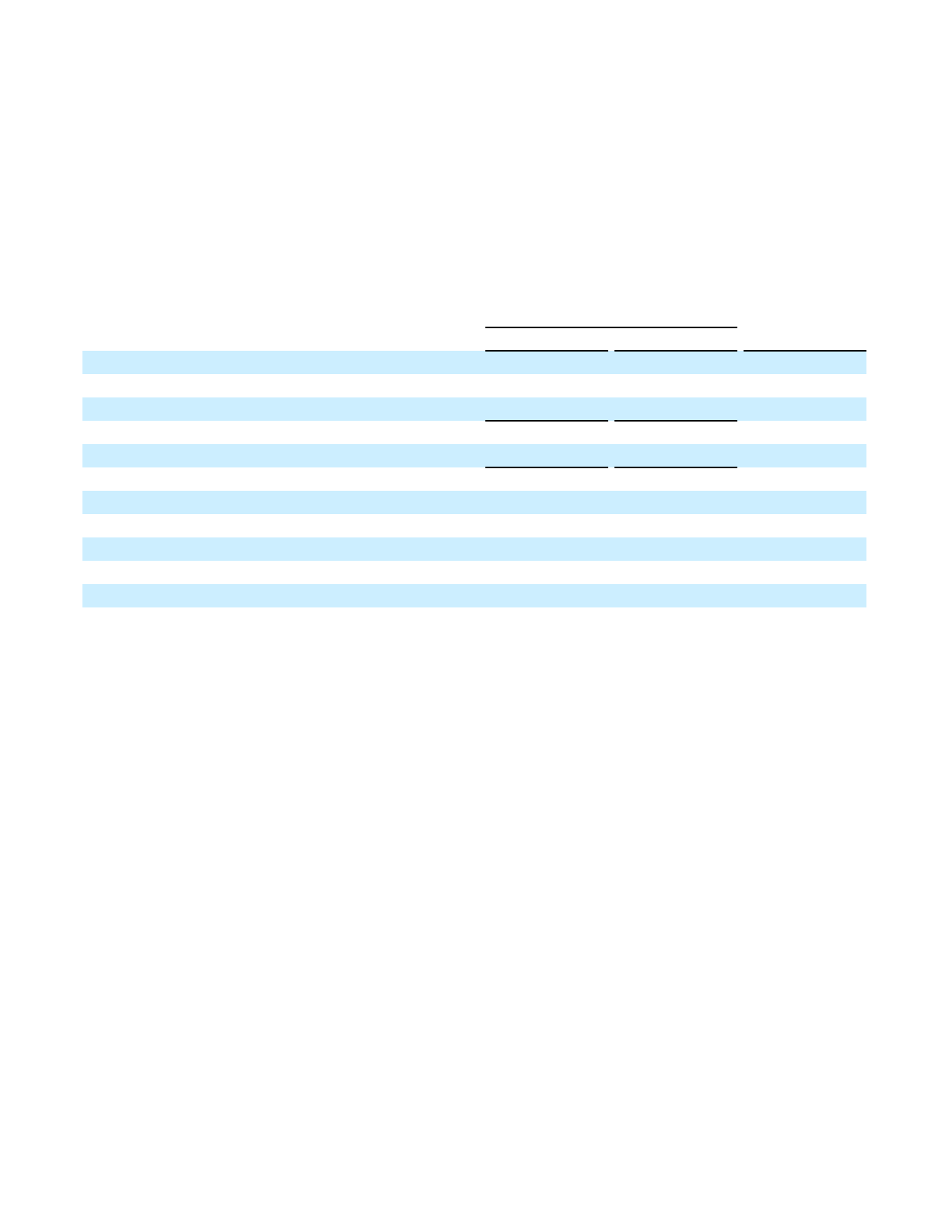

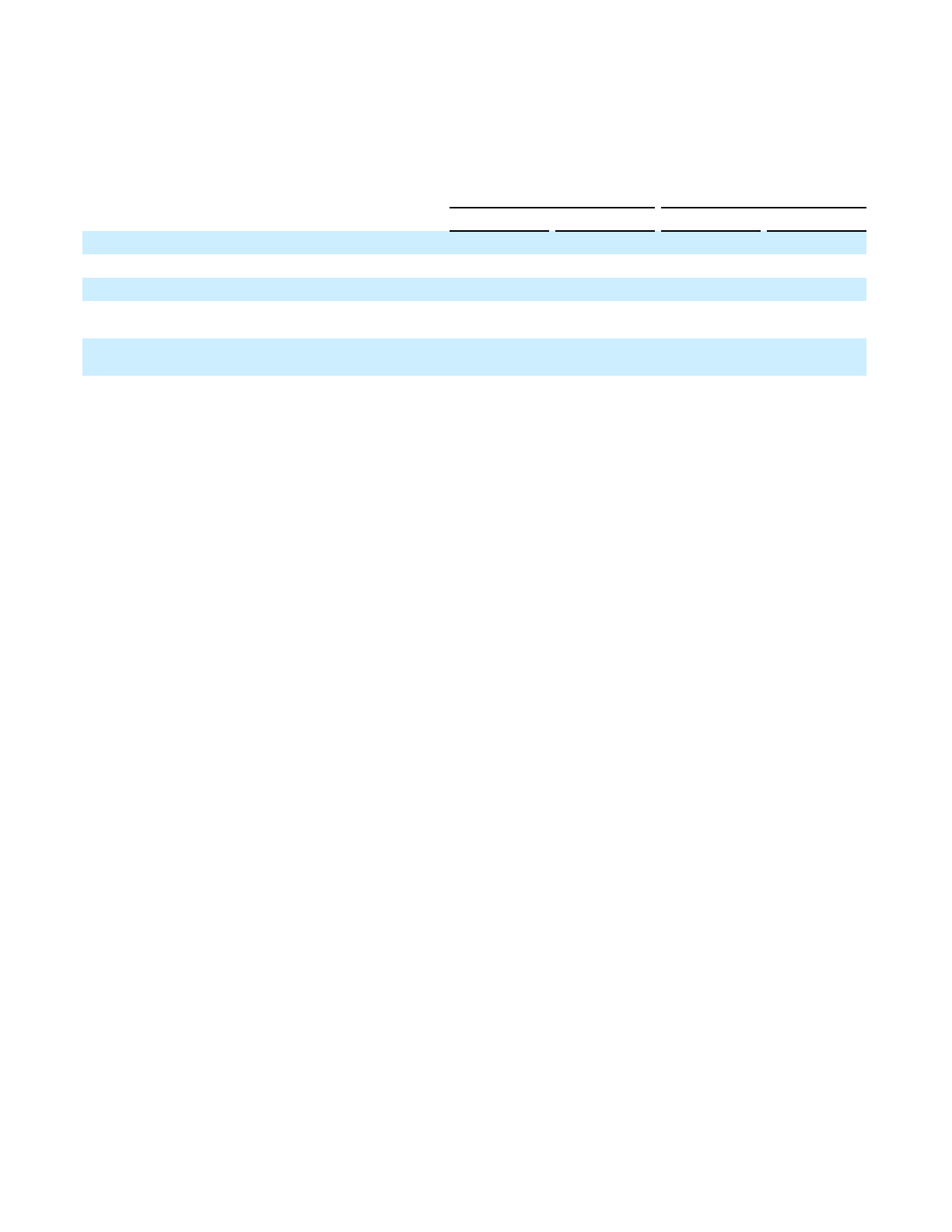

Third Quarter 2020 Financial Highlights

Three Months Ended September 30,

Year-over-Year %

Change

In millions, except percentages and per share amounts

2020

(1)

2019

Revenue:

Advertising

$

21,221

$

17,383 22%

Other 249 269 (7)%

Total revenue 21,470 17,652 22%

Total costs and expenses 13,430 10,467 28%

Income from operations

$

8,040

$

7,185 12%

Operating margin 37

%

41

%

Provision for income taxes

$

287

$

1,238 (77)%

Effective tax rate 4

%

17

%

Net income

$

7,846

$

6,091 29%

Diluted earnings per share (EPS)

$

2.71

$

2.12 28%

_________________________

(1)

Our third quarter 2020 effective tax rate was 4%, which reflects a one-time income tax benefit of $913 million related to the

effects of a tax election to capitalize and amortize certain research and development expenses for U.S. income tax purposes.

Excluding this tax benefit, our effective tax rate would have been•11•percentage points higher and our diluted EPS would have

been•$0.31•lower.

Third Quarter 2020 Operational and Other Financial Highlights

• Facebook daily active users (DAUs) € DAUs were 1.82 billion on average for September 2020, an increase

of 12% year-over-year.

‚ Facebook monthly active users (MAUs) € MAUs were 2.74 billion as of September•30, 2020, an increase

of 12% year-over-year.

‚ Family daily active people (DAP) € DAP was 2.54 billion on average for September 2020, an increase of

15% year-over-year.

‚ Family monthly active people (MAP) € MAP was 3.21 billion as of September 30, 2020, an increase of 14%

year-over-year.

• Capital expenditures € Capital expenditures, including principal payments on finance leases, were

$3.88•billion for the third quarter of 2020.

• Cash and cash equivalents and marketable securities € Cash and cash equivalents and marketable securities

were $55.62 billion as of September•30, 2020.

‚ Headcount € Headcount was 56,653 as of September•30, 2020, an increase of 32% year-over-year.

1

CFO Outlook Commentary

As expected, in the third quarter of 2020, we saw Facebook DAUs and MAUs in the US & Canada decline slightly

from the second quarter 2020 levels which were elevated due to the impact of the COVID-19 pandemic. In the fourth

quarter of 2020, we expect this trend to continue and that the number of DAUs and MAUs in the US & Canada will

be flat or slightly down compared to the third quarter of 2020.

We expect our fourth quarter 2020 year-over-year ad revenue growth rate to be higher than our reported third quarter

2020 rate, driven by continued strong advertiser demand during the holiday season. Additionally, Oculus Quest 2 orders

have been strong which should benefit Other Revenue.

Looking ahead to 2021, we continue to face a significant amount of uncertainty.

We believe the pandemic has contributed to an acceleration in the shift of commerce from offline to online, and we

experienced increasing demand for advertising as a result of this acceleration. Considering that online commerce is

our largest ad vertical, a change in this trend could serve as a headwind to our 2021 ad revenue growth.

In addition, we expect more significant targeting and measurement headwinds in 2021. This includes headwinds from

platform changes, notably on Apple iOS 14, as well as those from the evolving regulatory landscape.

There is also continuing uncertainty around the viability of transatlantic data transfers in light of recent European

regulatory developments, and like other companies in our industry, we are closely monitoring the potential impact on

our European operations as these developments progress.

We expect 2020 total expenses to be in the range of $53-54 billion, narrowed from our prior range of $52-55 billion.

We anticipate that our full-year 2021 total expenses will be in the range of $68-73 billion, driven by continued

investments in product development and technical talent, as well as a return to more normal levels of spend in areas

like office operations and travel. However, these are preliminary estimates as we have not yet finalized our 2021 budget.

We expect 2020 capital expenditures to be approximately $16 billion, unchanged from our prior outlook. For 2021,

we anticipate capital expenditures to be in the range of $21-23 billion, driven by investments in data centers, servers,

network infrastructure, and office facilities. Our outlook includes spend that was delayed from 2020 due to the impact

of the COVID-19 pandemic on our construction efforts.

We expect our fourth quarter 2020 effective tax rate to be in the mid-teens and our full-year 2021 tax rate to be in the

high-teens.

2

Webcast and Conference Call Information

Facebook will host a conference call to discuss the results at 3 p.m. PT / 6 p.m. ET today. The live webcast of Facebook's

earnings conference call can be accessed at investor.fb.com, along with the earnings press release, financial tables, and

slide presentation. Facebook uses the investor.fb.com and newsroom.fb.com websites as well as Mark Zuckerberg's

Facebook Page (https://www.facebook.com/zuck) as means of disclosing material non-public information and for

complying with its disclosure obligations under Regulation FD.

Following the call, a replay will be available at the same website. A telephonic replay will be available for one week

following the conference call at +1 (404) 537-3406 or +1 (855) 859-2056, conference ID 6245509.

Transcripts of conference calls with publishing equity research analysts held today will also be posted to

the•investor.fb.com•website.

About Facebook

Founded in 2004, Facebook's mission is to give people the power to build community and bring the world closer

together. People use Facebook's apps and technologies to connect with friends and family, find communities and grow

businesses.

Contacts

Investors:

Deborah Crawford

[email protected] / investor.fb.com

Press:

Ryan Moore

[email protected] / newsroom.fb.com

3

Forward-Looking Statements

This press release contains forward-looking statements regarding our future business expectations. These forward-

looking statements are only predictions and may differ materially from actual results due to a variety of factors including:

the impact of the COVID-19 pandemic on our business and financial results; our ability to retain or increase users and

engagement levels; our reliance on advertising revenue; our dependency on data signals and mobile operating systems,

networks, and standards that we do not control; risks associated with new products and changes to existing products

as well as other new business initiatives; our emphasis on community growth and engagement and the user experience

over short-term financial results; maintaining and enhancing our brand and reputation; our ongoing privacy, safety,

security, and content review efforts; competition; risks associated with government actions that could restrict access

to our products or impair our ability to sell advertising in certain countries; litigation and government inquiries; privacy

and regulatory concerns; risks associated with acquisitions; security breaches; and our ability to manage growth and

geographically-dispersed operations. These and other potential risks and uncertainties that could cause actual results

to differ from the results predicted are more fully detailed under the caption "Risk Factors" in our Quarterly Report

on Form 10-Q filed with the SEC on July 31, 2020, which is available on our Investor Relations website at

investor.fb.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly

Report on Form 10-Q for the quarter ended September•30, 2020. In addition, please note that the date of this press

release is October•29, 2020, and any forward-looking statements contained herein are based on assumptions that we

believe to be reasonable as of this date. We undertake no obligation to update these statements as a result of new

information or future events.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with

generally accepted accounting principles in the United States (GAAP), we use the following non-GAAP financial

measures: revenue excluding foreign exchange effect, advertising revenue excluding foreign exchange effect and free

cash flow. The presentation of these financial measures is not intended to be considered in isolation or as a substitute

for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned

that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In

addition, these measures may be different from non-GAAP financial measures used by other companies, limiting their

usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding

the GAAP amounts excluded from these non-GAAP financial measures.

We believe these non-GAAP financial measures provide investors with useful supplemental information about the

financial performance of our business, enable comparison of financial results between periods where certain items

may vary independent of business performance, and allow for greater transparency with respect to key metrics used

by management in operating our business.

We exclude the following items from our non-GAAP financial measures:

Foreign exchange effect on revenue. We translated revenue for the three and nine months ended September•30, 2020

using the prior year's monthly exchange rates for our settlement or billing currencies other than the U.S. dollar, which

we believe is a useful metric that facilitates comparison to our historical performance.

Purchases of property and equipment, net; Principal payments on finance leases. We subtract both net purchases of

property and equipment and principal payments on finance leases in our calculation of free cash flow because we

believe that these two items collectively represent the amount of property and equipment we need to procure to support

our business, regardless of whether we procure such property or equipment with a finance lease. We believe that this

methodology can provide useful supplemental information to help investors better understand underlying trends in our

business. Free cash flow is not intended to represent our residual cash flow available for discretionary expenditures.

For more information on our non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures,

please see the "Reconciliation of GAAP to Non-GAAP Results" table in this press release.

4

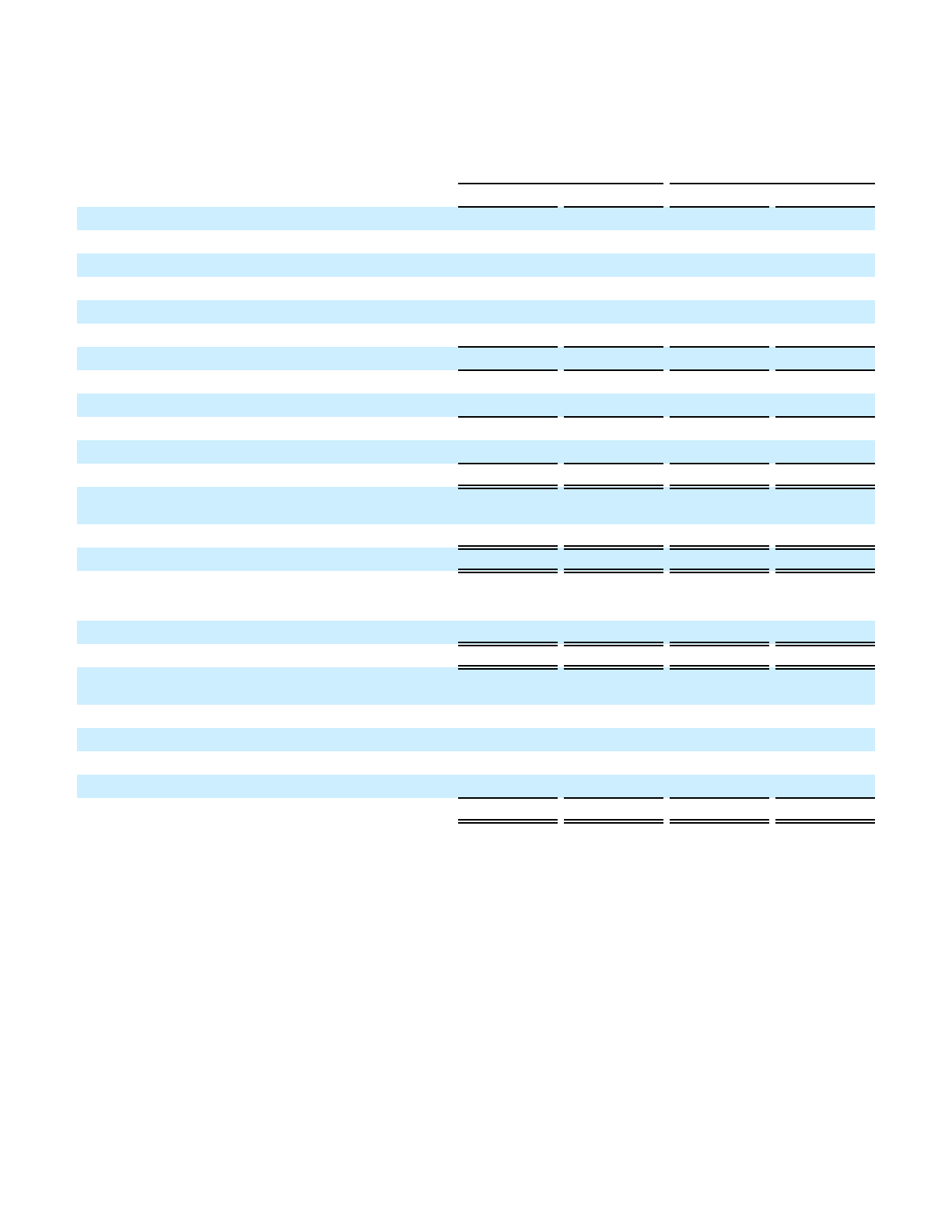

FACEBOOK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In millions, except for per share amounts)

(Unaudited)

Three Months Ended September 30, Nine Months Ended September 30,

2020 2019

2020 2019

Revenue

$

21,470

$

17,652

$

57,893

$

49,615

Costs and expenses:

Cost of revenue 4,194 3,155 11,482 9,279

Research and development 4,763 3,548 13,240 9,722

Marketing and sales 2,683 2,416 8,310 6,850

General and administrative 1,790 1,348 4,965 8,636

Total costs and expenses

13,430 10,467 37,997 34,487

Income from operations

8,040 7,185 19,896 15,128

Interest and other income, net 93 144 229 515

Income before provision for income taxes 8,133 7,329 20,125 15,643

Provision for income taxes 287 1,238 2,198 4,507

Net income

$

7,846

$

6,091

$

17,927

$

11,136

Earnings per share attributable to Class A and Class B

common stockholders:

Basic

$

2.75

$

2.13

$

6.29

$

3.90

Diluted

$

2.71

$

2.12

$

6.22

$

3.87

Weighted-average shares used to compute earnings per

share attributable to Class A and Class B common

stockholders:

Basic 2,850 2,854 2,850 2,855

Diluted 2,891 2,874 2,883 2,875

Share-based compensation expense included in costs

and expenses:

Cost of revenue

$

116

$

91

$

327

$

287

Research and development 1,297 907 3,557 2,557

Marketing and sales 180 148 516 421

General and administrative 129 103 352 297

Total share-based compensation expense

$

1,722

$

1,249

$

4,752

$

3,562

5

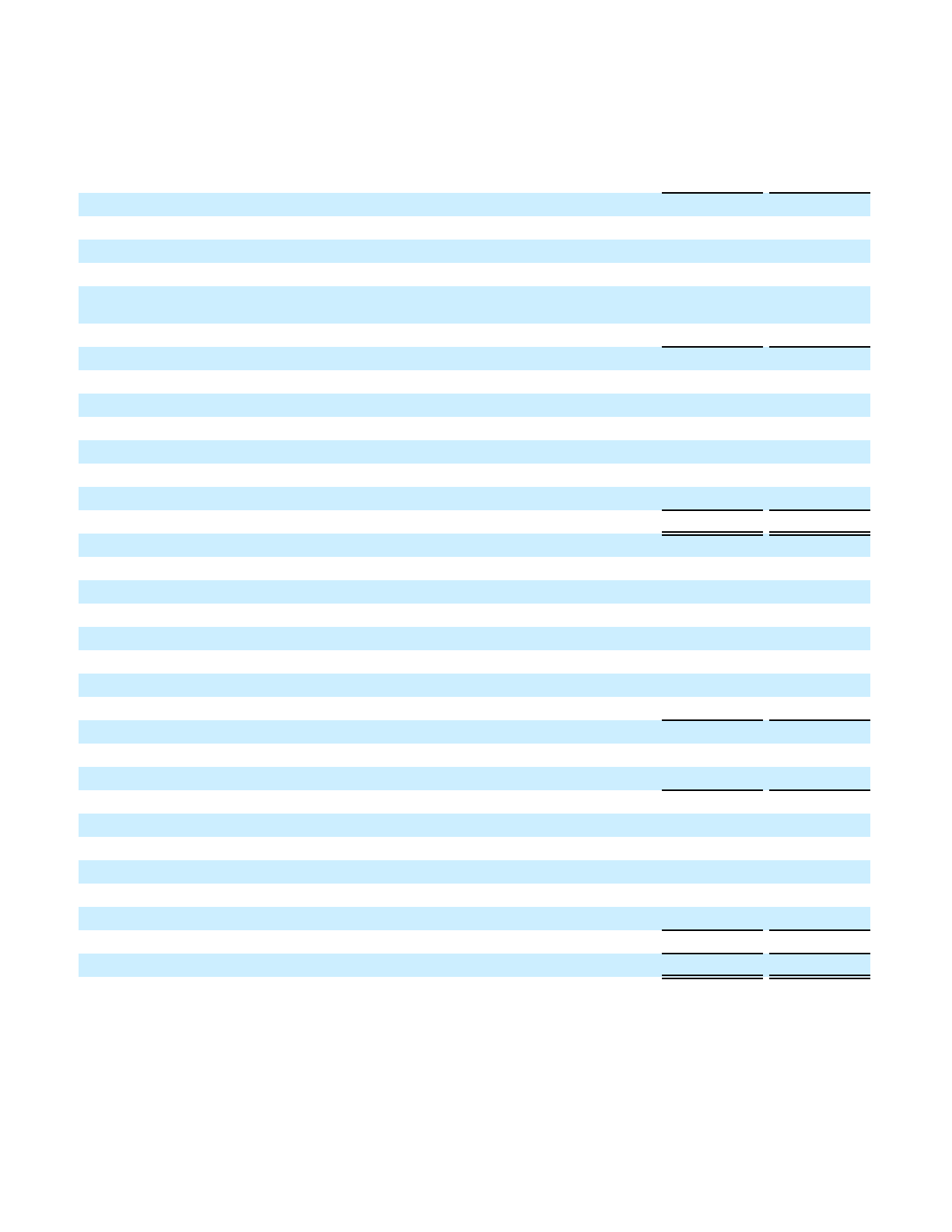

FACEBOOK, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

(Unaudited)

September 30,

2020

December 31,

2019

Assets

Current assets:

Cash and cash equivalents

$

11,617

$

19,079

Marketable securities 44,003 35,776

Accounts receivable, net of allowances of $311 and $206 as of September 30, 2020 and

December 31, 2019, respectively

8,024 9,518

Prepaid expenses and other current assets 2,155 1,852

Total current assets 65,799 66,225

Equity investments 6,164 86

Property and equipment, net 42,291 35,323

Operating lease right-of-use assets, net 9,439 9,460

Intangible assets, net 744 894

Goodwill 19,031 18,715

Other assets 2,969 2,673

Total assets

$

146,437

$

133,376

Liabilities and stockholders' equity

Current liabilities:

Accounts payable

$

1,106

$

1,363

Partners payable 800 886

Operating lease liabilities, current 975 800

Accrued expenses and other current liabilities 8,684 11,735

Deferred revenue and deposits 379 269

Total current liabilities 11,944 15,053

Operating lease liabilities, non-current

9,641 9,524

Other liabilities 7,121 7,745

Total liabilities 28,706 32,322

Commitments and contingencies

Stockholders' equity:

Common stock and additional paid-in capital 48,910 45,851

Accumulated other comprehensive income (loss) 308 (489

)

Retained earnings 68,513 55,692

Total stockholders' equity 117,731 101,054

Total liabilities and stockholders' equity

$

146,437

$

133,376

6

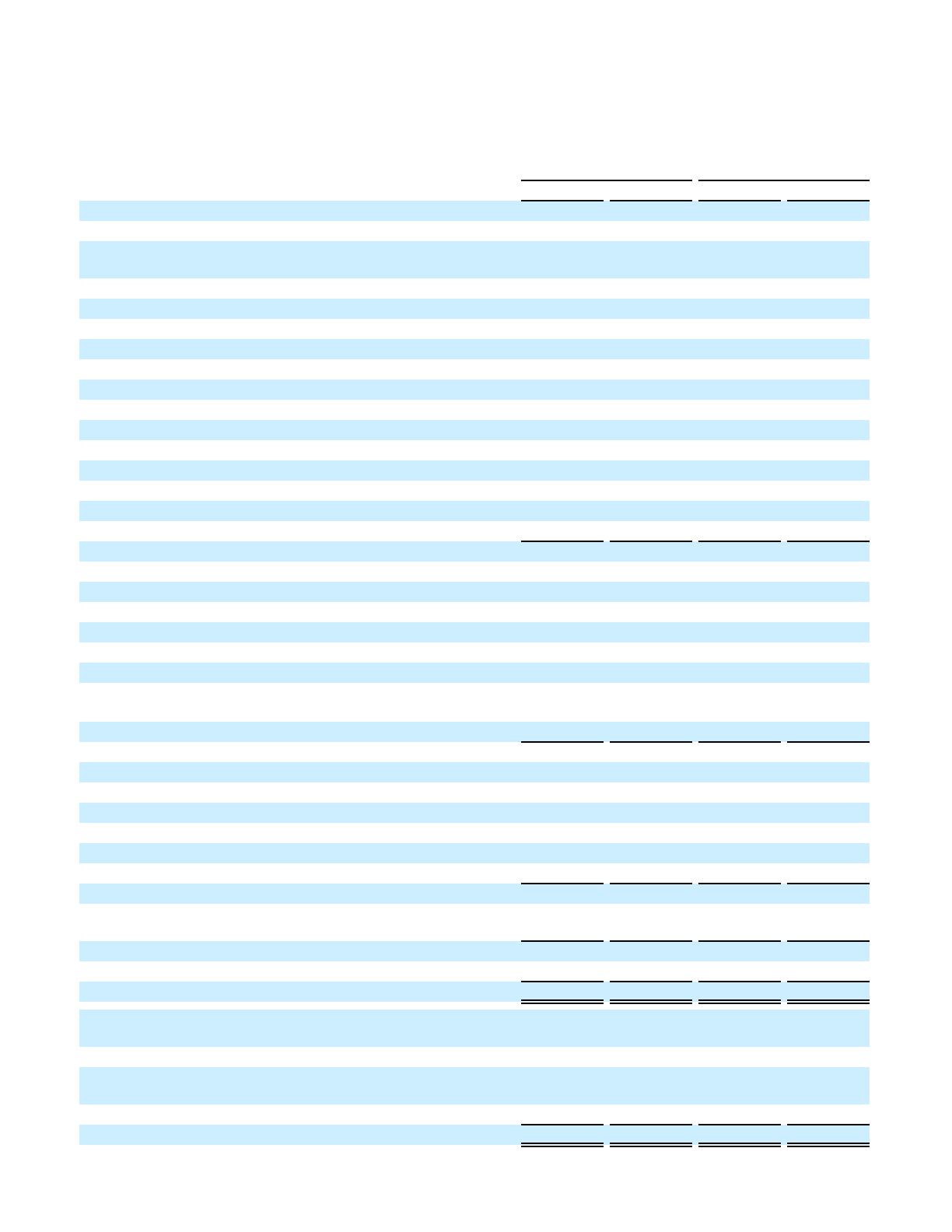

FACEBOOK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020 2019 2020 2019

Cash flows from operating activities

Net income $ 7,846 $ 6,091 $ 17,927 $ 11,136

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization 1,698 1,416 4,999 4,273

Share-based compensation 1,722 1,249 4,752 3,562

Deferred income taxes (1,506) 175 (816) 358

Other 7 30 56 44

Changes in assets and liabilities:

Accounts receivable (377) (328) 1,547 (264)

Prepaid expenses and other current assets 264 (360) (89) (527)

Other assets 6 ƒ (8) 66

Accounts payable 139 89 39 2

Partners payable 58 39 (100) 59

Accrued expenses and other current liabilities (258) 457 (3,273) 6,439

Deferred revenue and deposits 112 31 111 82

Other liabilities 117 418 (438) 2,001

Net cash provided by operating activities

9,828 9,307 24,707 27,231

Cash flows from investing activities

Purchases of property and equipment, net (3,689) (3,532) (10,502) (11,002)

Purchases of marketable securities (14,130) (7,397) (28,193) (19,152)

Sales of marketable securities 4,398 2,946 9,779 7,402

Maturities of marketable securities 2,857 2,943 10,725 7,048

Purchases of equity investments (6,020) ƒ (6,302) (61)

Acquisitions of businesses, net of cash acquired, and purchases of

intangible assets (12

)

(10

)

(384

)

(63

)

Other investing activities, net (3) ƒ (9) ƒ

Net cash used in investing activities

(16,599) (5,050) (24,886) (15,828)

Cash flows from financing activities

Taxes paid related to net share settlement of equity awards (1,000) (591) (2,444) (1,710)

Repurchases of Class A common stock (1,725) (1,148) (4,343) (2,906)

Principal payments on finance leases (189) (144) (398) (411)

Net change in overdraft in cash pooling entities (8) (141) (24) (260)

Other financing activities, net 10 5 124 14

Net cash used in financing activities

(2,912) (2,019) (7,085) (5,273)

Effect of exchange rate changes on cash, cash equivalents, and

restricted cash

93 (156

)

(36

)

(174

)

Net increase (decrease) in cash, cash equivalents, and restricted cash (9,590) 2,082 (7,300) 5,956

Cash, cash equivalents, and restricted cash at beginning of the period 21,569 13,998 19,279 10,124

Cash, cash equivalents, and restricted cash at end of the period

$ 11,979 $ 16,080 $ 11,979 $ 16,080

Reconciliation of cash, cash equivalents, and restricted cash to

the condensed consolidated balance sheets

Cash and cash equivalents $ 11,617 $ 15,979 $ 11,617 $ 15,979

Restricted cash, included in prepaid expenses and other current

assets

222 7 222 7

Restricted cash, included in other assets 140 94 140 94

Total cash, cash equivalents, and restricted cash

$ 11,979 $ 16,080 $ 11,979 $ 16,080

7

FACEBOOK, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

Three Months Ended September 30, Nine Months Ended September 30,

2020 2019 2020 2019

Supplemental cash flow data

Cash paid for income taxes, net

$

1,872

$

832

$

3,122

$

2,528

Non-cash investing activities:

Acquisition of businesses and other investments in

accrued expenses and other liabilities

$

118

$

ƒ

$

118

$

ƒ

Property and equipment in accounts payable and

accrued expenses and other liabilities

$

2,137

$

1,850

$

2,137

$

1,850

8

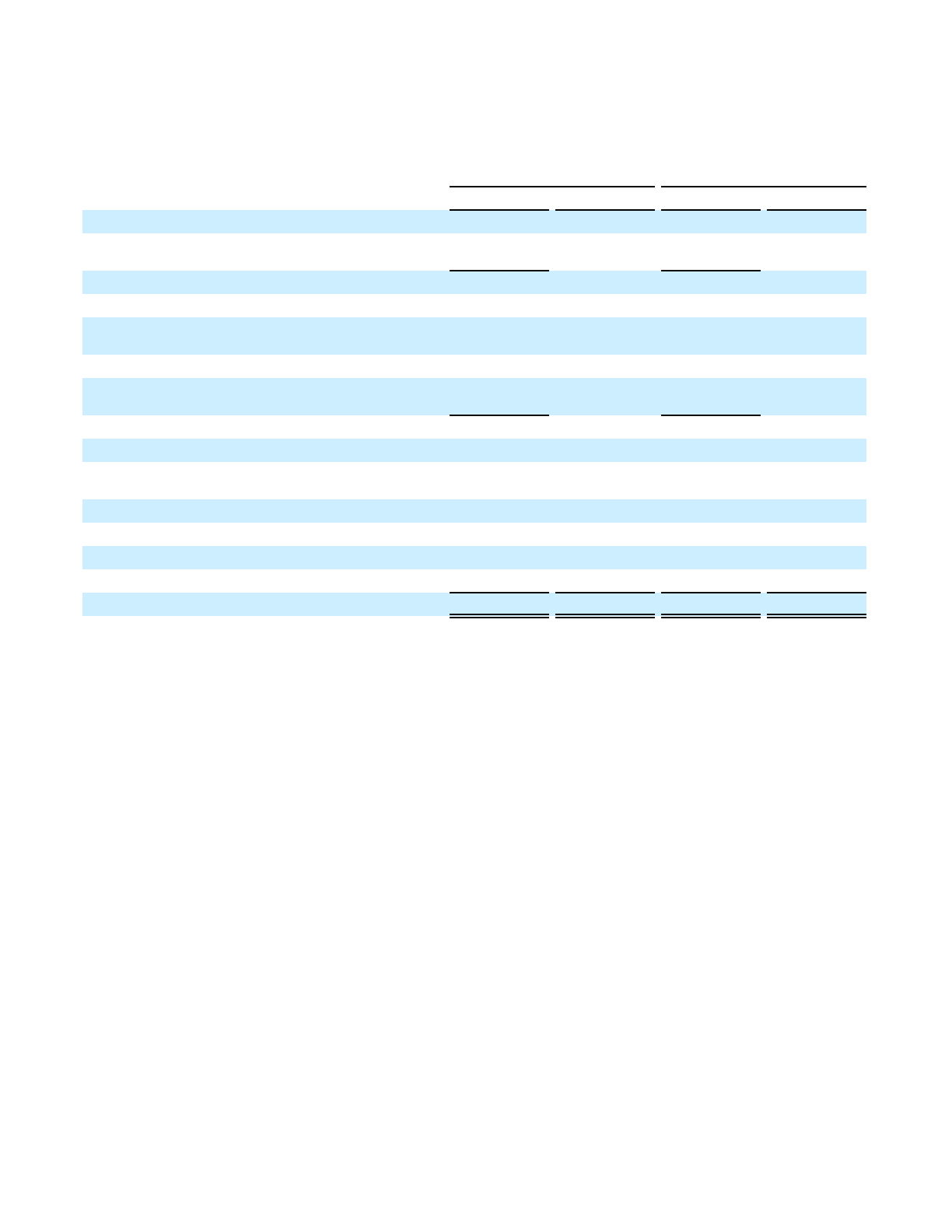

Reconciliation of GAAP to Non-GAAP Results

(In millions, except percentages)

(Unaudited)

Three Months Ended September 30, Nine Months Ended September 30,

2020 2019 2020 2019

GAAP revenue

$

21,470

$

17,652

$

57,893

$

49,615

Foreign exchange effect on 2020 revenue using 2019

rates

(114

)

459

Revenue excluding foreign exchange effect

$

21,356

$

58,352

GAAP revenue year-over-year change % 22

%

17

%

Revenue excluding foreign exchange effect year-over-

year change %

21

%

18

%

GAAP advertising revenue

$

21,221

$

17,383

$

56,981

$

48,919

Foreign exchange effect on 2020 advertising revenue

using 2019 rates

(109

)

462

Advertising revenue excluding foreign exchange effect

$

21,112

$

57,443

GAAP advertising revenue year-over-year change % 22

%

16

%

Advertising revenue excluding foreign exchange effect

year-over-year change %

21

%

17

%

Net cash provided by operating activities

$

9,828

$

9,307

$

24,707

$

27,231

Purchases of property and equipment, net (3,689

)

(3,532

)

(10,502

)

(11,002

)

Principal payments on finance leases (189

)

(144

)

(398

)

(411

)

Free cash flow

(1)

$

5,950

$

5,631

$

13,807

$

15,818

_________________________

(1)

Free cash flow in the nine months ended September 30, 2020 reflects the $5.0 billion FTC settlement that was paid in April

2020.

9